Download PDF - Hiscox

Download PDF - Hiscox

Download PDF - Hiscox

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the consolidated<br />

financial statements<br />

continued<br />

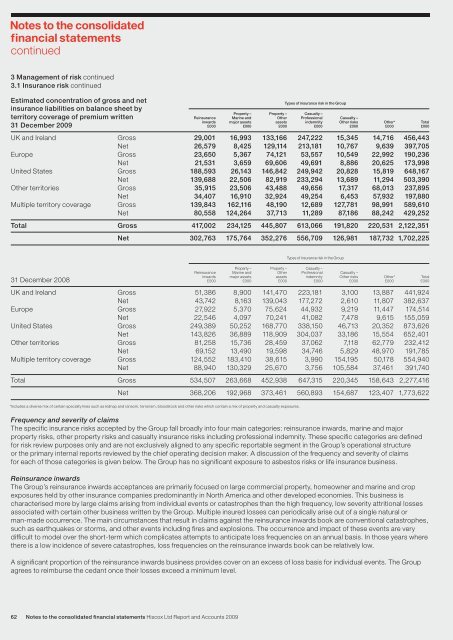

3 Management of risk continued<br />

3.1 Insurance risk continued<br />

Estimated concentration of gross and net<br />

insurance liabilities on balance sheet by<br />

Types of insurance risk in the Group<br />

territory coverage of premium written<br />

Reinsurance<br />

Property –<br />

Marine and<br />

Property –<br />

Other<br />

Casualty –<br />

Professional Casualty –<br />

31 December 2009<br />

inwards<br />

£000<br />

major assets<br />

£000<br />

assets<br />

£000<br />

indemnity<br />

£000<br />

Other risks<br />

£000<br />

Other*<br />

£000<br />

Total<br />

£000<br />

UK and Ireland Gross 29,001 16,993 133,166 247,222 15,345 14,716 456,443<br />

Net 26,579 8,425 129,114 213,181 10,767 9,639 397,705<br />

Europe Gross 23,650 5,367 74,121 53,557 10,549 22,992 190,236<br />

Net 21,531 3,659 69,606 49,691 8,886 20,625 173,998<br />

United States Gross 188,593 26,143 146,842 249,942 20,828 15,819 648,167<br />

Net 139,688 22,506 82,919 233,294 13,689 11,294 503,390<br />

Other territories Gross 35,915 23,506 43,488 49,656 17,317 68,013 237,895<br />

Net 34,407 16,910 32,924 49,254 6,453 57,932 197,880<br />

Multiple territory coverage Gross 139,843 162,116 48,190 12,689 127,781 98,991 589,610<br />

Net 80,558 124,264 37,713 11,289 87,186 88,242 429,252<br />

Total Gross 417,002 234,125 445,807 613,066 191,820 220,531 2,122,351<br />

Net 302,763 175,764 352,276 556,709 126,981 187,732 1,702,225<br />

Frequency and severity of claims<br />

The specific insurance risks accepted by the Group fall broadly into four main categories: reinsurance inwards, marine and major<br />

property risks, other property risks and casualty insurance risks including professional indemnity. These specific categories are defined<br />

for risk review purposes only and are not exclusively aligned to any specific reportable segment in the Group’s operational structure<br />

or the primary internal reports reviewed by the chief operating decision maker. A discussion of the frequency and severity of claims<br />

for each of those categories is given below. The Group has no significant exposure to asbestos risks or life insurance business.<br />

Reinsurance inwards<br />

The Group’s reinsurance inwards acceptances are primarily focused on large commercial property, homeowner and marine and crop<br />

exposures held by other insurance companies predominantly in North America and other developed economies. This business is<br />

characterised more by large claims arising from individual events or catastrophes than the high frequency, low severity attritional losses<br />

associated with certain other business written by the Group. Multiple insured losses can periodically arise out of a single natural or<br />

man-made occurrence. The main circumstances that result in claims against the reinsurance inwards book are conventional catastrophes,<br />

such as earthquakes or storms, and other events including fires and explosions. The occurrence and impact of these events are very<br />

difficult to model over the short-term which complicates attempts to anticipate loss frequencies on an annual basis. In those years where<br />

there is a low incidence of severe catastrophes, loss frequencies on the reinsurance inwards book can be relatively low.<br />

A significant proportion of the reinsurance inwards business provides cover on an excess of loss basis for individual events. The Group<br />

agrees to reimburse the cedant once their losses exceed a minimum level.<br />

62 Notes to the consolidated financial statements <strong>Hiscox</strong> Ltd Report and Accounts 2009<br />

Types of insurance risk in the Group<br />

Property – Property – Casualty –<br />

Reinsurance Marine and Other Professional Casualty –<br />

inwards major assets assets indemnity Other risks Other* Total<br />

31 December 2008 £000 £000 £000 £000 £000 £000 £000<br />

UK and Ireland Gross 51,386 8,900 141,470 223,181 3,100 13,887 441,924<br />

Net 43,742 8,163 139,043 177,272 2,610 11,807 382,637<br />

Europe Gross 27,922 5,370 75,624 44,932 9,219 11,447 174,514<br />

Net 22,546 4,097 70,241 41,082 7,478 9,615 155,059<br />

United States Gross 249,389 50,252 168,770 338,150 46,713 20,352 873,626<br />

Net 143,826 36,889 118,909 304,037 33,186 15,554 652,401<br />

Other territories Gross 81,258 15,736 28,459 37,062 7,118 62,779 232,412<br />

Net 69,152 13,490 19,598 34,746 5,829 48,970 191,785<br />

Multiple territory coverage Gross 124,552 183,410 38,615 3,990 154,195 50,178 554,940<br />

Net 88,940 130,329 25,670 3,756 105,584 37,461 391,740<br />

Total Gross 534,507 263,668 452,938 647,315 220,345 158,643 2,277,416<br />

Net 368,206 192,968 373,461 560,893 154,687 123,407 1,773,622<br />

*Includes a diverse mix of certain specialty lines such as kidnap and ransom, terrorism, bloodstock and other risks which contain a mix of property and casualty exposures.