Download PDF - Hiscox

Download PDF - Hiscox

Download PDF - Hiscox

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the consolidated<br />

financial statements<br />

continued<br />

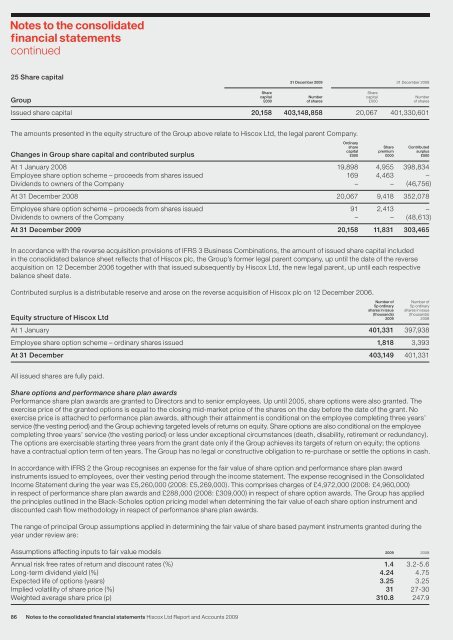

25 Share capital<br />

86 Notes to the consolidated financial statements <strong>Hiscox</strong> Ltd Report and Accounts 2009<br />

31 December 2009 31 December 2008<br />

Share Share<br />

capital Number capital Number<br />

Group £000 of shares £000 of shares<br />

Issued share capital 20,158 403,148,858 20,067 401,330,601<br />

The amounts presented in the equity structure of the Group above relate to <strong>Hiscox</strong> Ltd, the legal parent Company.<br />

Ordinary<br />

share Share Contributed<br />

capital premium surplus<br />

Changes in Group share capital and contributed surplus £000 £000 £000<br />

At 1 January 2008 19,898 4,955 398,834<br />

Employee share option scheme – proceeds from shares issued 169 4,463 –<br />

Dividends to owners of the Company – – (46,756)<br />

At 31 December 2008 20,067 9,418 352,078<br />

Employee share option scheme – proceeds from shares issued 91 2,413 –<br />

Dividends to owners of the Company – – (48,613)<br />

At 31 December 2009 20,158 11,831 303,465<br />

In accordance with the reverse acquisition provisions of IFRS 3 Business Combinations, the amount of issued share capital included<br />

in the consolidated balance sheet reflects that of <strong>Hiscox</strong> plc, the Group’s former legal parent company, up until the date of the reverse<br />

acquisition on 12 December 2006 together with that issued subsequently by <strong>Hiscox</strong> Ltd, the new legal parent, up until each respective<br />

balance sheet date.<br />

Contributed surplus is a distributable reserve and arose on the reverse acquisition of <strong>Hiscox</strong> plc on 12 December 2006.<br />

Number of Number of<br />

5p ordinary 5p ordinary<br />

shares in issue shares in issue<br />

(thousands) (thousands)<br />

Equity structure of <strong>Hiscox</strong> Ltd 2009 2008<br />

At 1 January 401,331 397,938<br />

Employee share option scheme – ordinary shares issued 1,818 3,393<br />

At 31 December 403,149 401,331<br />

All issued shares are fully paid.<br />

Share options and performance share plan awards<br />

Performance share plan awards are granted to Directors and to senior employees. Up until 2005, share options were also granted. The<br />

exercise price of the granted options is equal to the closing mid-market price of the shares on the day before the date of the grant. No<br />

exercise price is attached to performance plan awards, although their attainment is conditional on the employee completing three years’<br />

service (the vesting period) and the Group achieving targeted levels of returns on equity. Share options are also conditional on the employee<br />

completing three years’ service (the vesting period) or less under exceptional circumstances (death, disability, retirement or redundancy).<br />

The options are exercisable starting three years from the grant date only if the Group achieves its targets of return on equity; the options<br />

have a contractual option term of ten years. The Group has no legal or constructive obligation to re-purchase or settle the options in cash.<br />

In accordance with IFRS 2 the Group recognises an expense for the fair value of share option and performance share plan award<br />

instruments issued to employees, over their vesting period through the income statement. The expense recognised in the Consolidated<br />

Income Statement during the year was £5,260,000 (2008: £5,269,000). This comprises charges of £4,972,000 (2008: £4,960,000)<br />

in respect of performance share plan awards and £288,000 (2008: £309,000) in respect of share option awards. The Group has applied<br />

the principles outlined in the Black-Scholes option pricing model when determining the fair value of each share option instrument and<br />

discounted cash flow methodology in respect of performance share plan awards.<br />

The range of principal Group assumptions applied in determining the fair value of share based payment instruments granted during the<br />

year under review are:<br />

Assumptions affecting inputs to fair value models 2009 2008<br />

Annual risk free rates of return and discount rates (%) 1.4 3.2-5.6<br />

Long-term dividend yield (%) 4.24 4.75<br />

Expected life of options (years) 3.25 3.25<br />

Implied volatility of share price (%) 31 27-30<br />

Weighted average share price (p) 310.8 247.9