Download PDF - Hiscox

Download PDF - Hiscox

Download PDF - Hiscox

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

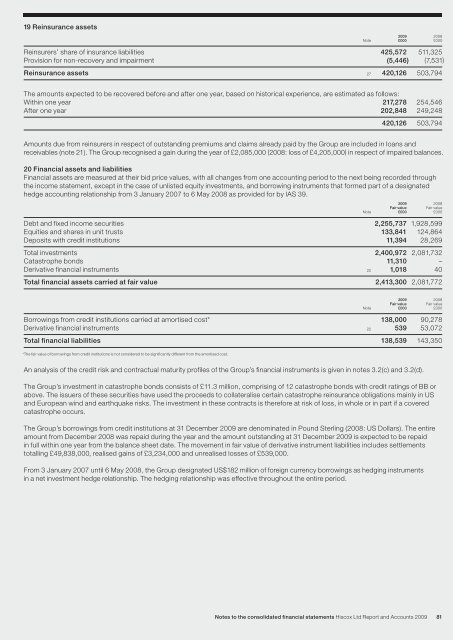

19 Reinsurance assets<br />

2009 2008<br />

Note £000 £000<br />

Reinsurers’ share of insurance liabilities 425,572 511,325<br />

Provision for non-recovery and impairment (5,446) (7,531)<br />

Reinsurance assets 27 420,126 503,794<br />

The amounts expected to be recovered before and after one year, based on historical experience, are estimated as follows:<br />

Within one year 217,278 254,546<br />

After one year 202,848 249,248<br />

420,126 503,794<br />

Amounts due from reinsurers in respect of outstanding premiums and claims already paid by the Group are included in loans and<br />

receivables (note 21). The Group recognised a gain during the year of £2,085,000 (2008: loss of £4,205,000) in respect of impaired balances.<br />

20 Financial assets and liabilities<br />

Financial assets are measured at their bid price values, with all changes from one accounting period to the next being recorded through<br />

the income statement, except in the case of unlisted equity investments, and borrowing instruments that formed part of a designated<br />

hedge accounting relationship from 3 January 2007 to 6 May 2008 as provided for by IAS 39.<br />

2009 2008<br />

Fair value Fair value<br />

Note £000 £000<br />

Debt and fixed income securities 2,255,737 1,928,599<br />

Equities and shares in unit trusts 133,841 124,864<br />

Deposits with credit institutions 11,394 28,269<br />

Total investments 2,400,972 2,081,732<br />

Catastrophe bonds 11,310 –<br />

Derivative financial instruments 22 1,018 40<br />

Total financial assets carried at fair value 2,413,300 2,081,772<br />

2009 2008<br />

Fair value Fair value<br />

Note £000 £000<br />

Borrowings from credit institutions carried at amortised cost* 138,000 90,278<br />

Derivative financial instruments 22 539 53,072<br />

Total financial liabilities 138,539 143,350<br />

*The fair value of borrowings from credit institutions is not considered to be significantly different from the amortised cost.<br />

An analysis of the credit risk and contractual maturity profiles of the Group’s financial instruments is given in notes 3.2(c) and 3.2(d).<br />

The Group’s investment in catastrophe bonds consists of £11.3 million, comprising of 12 catastrophe bonds with credit ratings of BB or<br />

above. The issuers of these securities have used the proceeds to collateralise certain catastrophe reinsurance obligations mainly in US<br />

and European wind and earthquake risks. The investment in these contracts is therefore at risk of loss, in whole or in part if a covered<br />

catastrophe occurs.<br />

The Group’s borrowings from credit institutions at 31 December 2009 are denominated in Pound Sterling (2008: US Dollars). The entire<br />

amount from December 2008 was repaid during the year and the amount outstanding at 31 December 2009 is expected to be repaid<br />

in full within one year from the balance sheet date. The movement in fair value of derivative instrument liabilities includes settlements<br />

totalling £49,838,000, realised gains of £3,234,000 and unrealised losses of £539,000.<br />

From 3 January 2007 until 6 May 2008, the Group designated US$182 million of foreign currency borrowings as hedging instruments<br />

in a net investment hedge relationship. The hedging relationship was effective throughout the entire period.<br />

Notes to the consolidated financial statements <strong>Hiscox</strong> Ltd Report and Accounts 2009<br />

81