Download PDF - Hiscox

Download PDF - Hiscox

Download PDF - Hiscox

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3 Management of risk continued<br />

3.2 Financial risk continued<br />

(d) Liquidity risk continued<br />

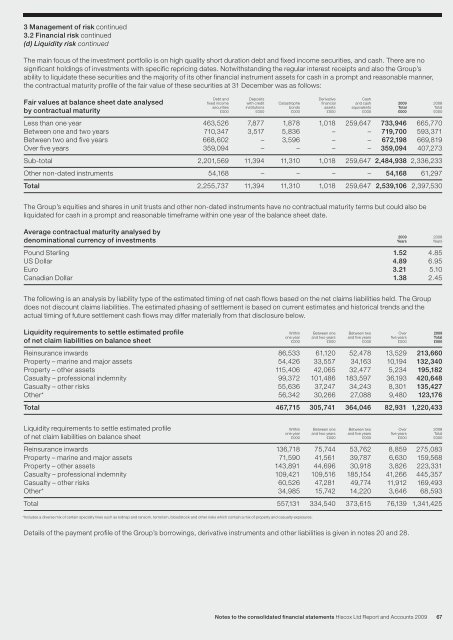

The main focus of the investment portfolio is on high quality short duration debt and fixed income securities, and cash. There are no<br />

significant holdings of investments with specific repricing dates. Notwithstanding the regular interest receipts and also the Group’s<br />

ability to liquidate these securities and the majority of its other financial instrument assets for cash in a prompt and reasonable manner,<br />

the contractual maturity profile of the fair value of these securities at 31 December was as follows:<br />

Fair values at balance sheet date analysed<br />

by contractual maturity<br />

Debt and Deposits Derivative Cash<br />

fixed income with credit Catastrophe financial and cash 2009 2008<br />

securities institutions bonds assets equivalents Total Total<br />

£000 £000 £000 £000 £000 £000 £000<br />

Less than one year 463,526 7,877 1,878 1,018 259,647 733,946 665,770<br />

Between one and two years 710,347 3,517 5,836 – – 719,700 593,371<br />

Between two and five years 668,602 – 3,596 – – 672,198 669,819<br />

Over five years 359,094 – – – – 359,094 407,273<br />

Sub-total 2,201,569 11,394 11,310 1,018 259,647 2,484,938 2,336,233<br />

Other non-dated instruments 54,168 – – – – 54,168 61,297<br />

Total 2,255,737 11,394 11,310 1,018 259,647 2,539,106 2,397,530<br />

The Group’s equities and shares in unit trusts and other non-dated instruments have no contractual maturity terms but could also be<br />

liquidated for cash in a prompt and reasonable timeframe within one year of the balance sheet date.<br />

Average contractual maturity analysed by<br />

denominational currency of investments<br />

2009 2008<br />

Years Years<br />

Pound Sterling 1.52 4.85<br />

US Dollar 4.89 6.95<br />

Euro 3.21 5.10<br />

Canadian Dollar 1.38 2.45<br />

The following is an analysis by liability type of the estimated timing of net cash flows based on the net claims liabilities held. The Group<br />

does not discount claims liabilities. The estimated phasing of settlement is based on current estimates and historical trends and the<br />

actual timing of future settlement cash flows may differ materially from that disclosure below.<br />

Liquidity requirements to settle estimated profile<br />

of net claim liabilities on balance sheet<br />

Within Between one Between two Over 2009<br />

one year and two years and five years five years Total<br />

£000 £000 £000 £000 £000<br />

Reinsurance inwards 86,533 61,120 52,478 13,529 213,660<br />

Property – marine and major assets 54,426 33,557 34,163 10,194 132,340<br />

Property – other assets 115,406 42,065 32,477 5,234 195,182<br />

Casualty – professional indemnity 99,372 101,486 183,597 36,193 420,648<br />

Casualty – other risks 55,636 37,247 34,243 8,301 135,427<br />

Other* 56,342 30,266 27,088 9,480 123,176<br />

Total 467,715 305,741 364,046 82,931 1,220,433<br />

Liquidity requirements to settle estimated profile<br />

of net claim liabilities on balance sheet<br />

Within Between one Between two Over 2008<br />

one year and two years and five years five years Total<br />

£000 £000 £000 £000 £000<br />

Reinsurance inwards 136,718 75,744 53,762 8,859 275,083<br />

Property – marine and major assets 71,590 41,561 39,787 6,630 159,568<br />

Property – other assets 143,891 44,696 30,918 3,826 223,331<br />

Casualty – professional indemnity 109,421 109,516 185,154 41,266 445,357<br />

Casualty – other risks 60,526 47,281 49,774 11,912 169,493<br />

Other* 34,985 15,742 14,220 3,646 68,593<br />

Total 557,131 334,540 373,615 76,139 1,341,425<br />

*Includes a diverse mix of certain specialty lines such as kidnap and ransom, terrorism, bloodstock and other risks which contain a mix of property and casualty exposures.<br />

Details of the payment profile of the Group’s borrowings, derivative instruments and other liabilities is given in notes 20 and 28.<br />

Notes to the consolidated financial statements <strong>Hiscox</strong> Ltd Report and Accounts 2009<br />

67