ANNUAL REPORT - Dc Msme

ANNUAL REPORT - Dc Msme

ANNUAL REPORT - Dc Msme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annual Report<br />

2010-11<br />

Chapter IV - DC (MSME)<br />

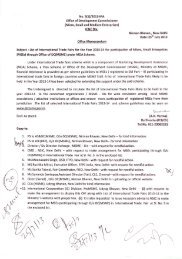

collateral/third party guarantees. The<br />

Scheme is being operated through the<br />

Credit Guarantee Fund Trust for Micro<br />

and Small Enterprises (CGTMSE) set<br />

up jointly by the Government of India<br />

and Small Industries Development<br />

Bank of India (SIDBI).<br />

4.9.2 The Scheme covers collateral free<br />

credit facility (term loan and/ or working<br />

capital) extended by eligible member<br />

lending institutions (MLIs) to new and<br />

existing micro and small enterprises up<br />

to Rs. 100 lakh per borrowing unit. The<br />

guarantee cover provided is up to<br />

75% of the credit facility up to Rs.50<br />

lakh with an incremental guarantee<br />

of 50% of the credit facility above<br />

Rs.50 lakh and up to Rs.100 lakh (85%<br />

for loans up to Rs. 5 lakh provided<br />

to micro enterprises, 80% for MSEs<br />

owned/ operated by women and all<br />

loans to NER). One time guarantee<br />

fee of 1.5% of the credit facility<br />

sanctioned (0.75% for NER including<br />

Sikkim) and Annual Service Fee of<br />

0.75% is collected from the MLIs.<br />

4.9.3 As on 31st December 2010,<br />

there were 115 eligible lending<br />

institutions registered as MLIs of<br />

the Trust comprising of 27 Public<br />

82<br />

Sector Banks, 17 Private Sector<br />

Banks, 61 Regional Rural Banks<br />

(RRBs), 2 foreign banks and 8 other<br />

Institutions viz., National Small<br />

Industries Corporation (NSIC),<br />

North Eastern Development<br />

Finance Corporation Ltd. (NEDFi),<br />

Delhi Financial Corporation, Kerala<br />

Financial Corporation, Tamilnadu<br />

Industrial Investment Corporation<br />

Ltd., Jammu & Kashmir Development<br />

Finance Corporation Ltd. (JKDFC),<br />

Export Import Bank of India<br />

(EXIM Bank) and Small Industries<br />

Development Bank of India (SIDBI).<br />

Cumulatively 4,76,452 proposals<br />

have been approved for guarantee<br />

cover for a total sanctioned loan<br />

amount of Rs. 20,109.36 crore.<br />

4.10 MICRO FINANCE<br />

PROGRAMME<br />

4.10.1 The Ministry has been<br />

operating a Scheme of Micro Finance<br />

Programme since 2003-04, which<br />

has been tied up with the existing<br />

Micro Credit Scheme of SIDBI. Under<br />

the Scheme, the Government of<br />

MSME