The Economic Impact of the UK Film Industry - BFI - British Film ...

The Economic Impact of the UK Film Industry - BFI - British Film ...

The Economic Impact of the UK Film Industry - BFI - British Film ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

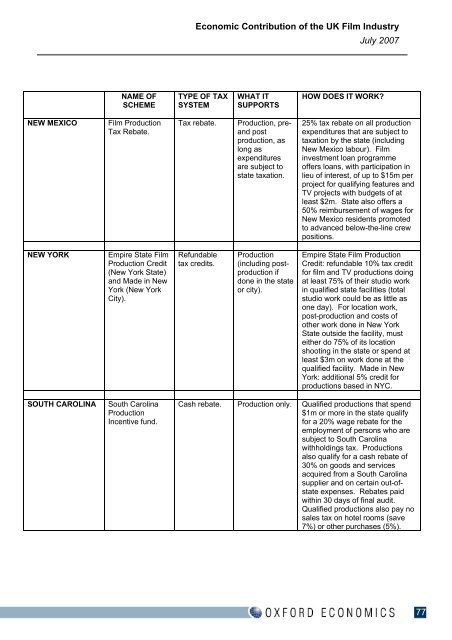

NAME OF<br />

SCHEME<br />

NEW MEXICO <strong>Film</strong> Production<br />

Tax Rebate.<br />

NEW YORK Empire State <strong>Film</strong><br />

Production Credit<br />

(New York State)<br />

and Made in New<br />

York (New York<br />

City).<br />

SOUTH CAROLINA South Carolina<br />

Production<br />

Incentive fund.<br />

<strong>Economic</strong> Contribution <strong>of</strong> <strong>the</strong> <strong>UK</strong> <strong>Film</strong> <strong>Industry</strong><br />

TYPE OF TAX<br />

SYSTEM<br />

WHAT IT<br />

SUPPORTS<br />

Tax rebate. Production, preand<br />

post<br />

production, as<br />

long as<br />

expenditures<br />

are subject to<br />

state taxation.<br />

Refundable<br />

tax credits.<br />

Production<br />

(including postproduction<br />

if<br />

done in <strong>the</strong> state<br />

or city).<br />

July 2007<br />

HOW DOES IT WORK?<br />

25% tax rebate on all production<br />

expenditures that are subject to<br />

taxation by <strong>the</strong> state (including<br />

New Mexico labour). <strong>Film</strong><br />

investment loan programme<br />

<strong>of</strong>fers loans, with participation in<br />

lieu <strong>of</strong> interest, <strong>of</strong> up to $15m per<br />

project for qualifying features and<br />

TV projects with budgets <strong>of</strong> at<br />

least $2m. State also <strong>of</strong>fers a<br />

50% reimbursement <strong>of</strong> wages for<br />

New Mexico residents promoted<br />

to advanced below-<strong>the</strong>-line crew<br />

positions.<br />

Empire State <strong>Film</strong> Production<br />

Credit: refundable 10% tax credit<br />

for film and TV productions doing<br />

at least 75% <strong>of</strong> <strong>the</strong>ir studio work<br />

in qualified state facilities (total<br />

studio work could be as little as<br />

one day). For location work,<br />

post-production and costs <strong>of</strong><br />

o<strong>the</strong>r work done in New York<br />

State outside <strong>the</strong> facility, must<br />

ei<strong>the</strong>r do 75% <strong>of</strong> its location<br />

shooting in <strong>the</strong> state or spend at<br />

least $3m on work done at <strong>the</strong><br />

qualified facility. Made in New<br />

York: additional 5% credit for<br />

productions based in NYC.<br />

Cash rebate. Production only. Qualified productions that spend<br />

$1m or more in <strong>the</strong> state qualify<br />

for a 20% wage rebate for <strong>the</strong><br />

employment <strong>of</strong> persons who are<br />

subject to South Carolina<br />

withholdings tax. Productions<br />

also qualify for a cash rebate <strong>of</strong><br />

30% on goods and services<br />

acquired from a South Carolina<br />

supplier and on certain out-<strong>of</strong>state<br />

expenses. Rebates paid<br />

within 30 days <strong>of</strong> final audit.<br />

Qualified productions also pay no<br />

sales tax on hotel rooms (save<br />

7%) or o<strong>the</strong>r purchases (5%).<br />

77