MANUAL II POWERS AND DUTIES OF OFFICERS AND ...

MANUAL II POWERS AND DUTIES OF OFFICERS AND ...

MANUAL II POWERS AND DUTIES OF OFFICERS AND ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

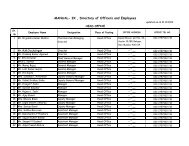

<strong>MANUAL</strong> <strong>II</strong> <strong>POWERS</strong> <strong>AND</strong> <strong>DUTIES</strong> <strong>OF</strong> <strong>OF</strong>FICERS <strong>AND</strong> EMPLOYEES<br />

(ix) To get the accounts of the Export section audited from<br />

Statutory Auditors and Government Auditors.<br />

(x) To attend the queries of Statutory Auditors as well as Govt.<br />

Auditors.<br />

(3) Accounts Officer -<strong>II</strong>I<br />

(i) Maintenance & Administration of Contributory Provident Fund ,<br />

Superannuation and Gratuity Trustees Accounts.<br />

(ii) Timely settlement of claim of superannuation/Provident Fund<br />

and Gratuity.<br />

(iii) Processing application for Non refundable Advance from PF.<br />

(iv) Payment of monthly Contributory Provident Fund and<br />

Superannuation dues of Trustees and RPFC<br />

(v) Examination & Sanction of House Building Advance Loans<br />

(vi) Maintenance of individual Provident Fund Account.<br />

(vii) Timely preparation and finalization of Annual Account of<br />

Provident Fund /Superannuation and Gratuity.<br />

(viii) All Insurance matters relating to Head Office & Branches.<br />

(ix) Coordinating with Branches for settlement of claim.<br />

(x) To get the accounts of Insurance Section audited from<br />

Statutory Auditors as well as Govt. Auditors.<br />

(xi) To attend the queries of Statutory Auditors as well as Govt.<br />

Auditors.<br />

(5) Accounts Officer - IV<br />

(i) Matters relating to Return & Assessment of Income Tax, Sales<br />

Tax, Service Tax, NMMC (Cess) of Head Office.<br />

(ii) Coordinating Taxation issue of Branches relating to Sales Tax,<br />

Collection of Con-I\Cessional forms, Service Tax, and TAX<br />

DEDUCTED AT SOURCE etc.<br />

(iii) Updating the Branches of amendments various taxation loss<br />

affecting HO and Branches by issuing circulars, notices etc.<br />

(iv) Appearing before various taxation authorities in Taxation<br />

matters representing the corporation.<br />

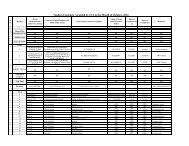

The Section-wise and employee-wise duties of Finance and Accounts Section are<br />

as under:-<br />

Office Manager-I<br />

1. Cash & Banking Section<br />

(i) To monitor inward remittances of branches .<br />

PAGE/68