The Future of Animal Agriculture in North America - Farm Foundation

The Future of Animal Agriculture in North America - Farm Foundation

The Future of Animal Agriculture in North America - Farm Foundation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

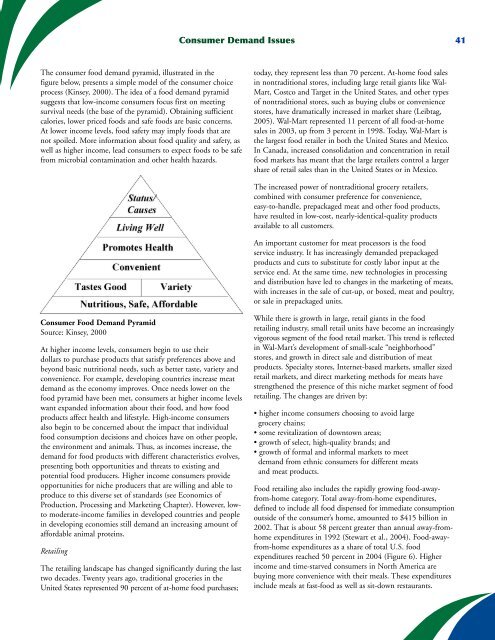

<strong>The</strong> consumer food demand pyramid, illustrated <strong>in</strong> the<br />

figure below, presents a simple model <strong>of</strong> the consumer choice<br />

process (K<strong>in</strong>sey, 2000). <strong>The</strong> idea <strong>of</strong> a food demand pyramid<br />

suggests that low-<strong>in</strong>come consumers focus first on meet<strong>in</strong>g<br />

survival needs (the base <strong>of</strong> the pyramid). Obta<strong>in</strong><strong>in</strong>g sufficient<br />

calories, lower priced foods and safe foods are basic concerns.<br />

At lower <strong>in</strong>come levels, food safety may imply foods that are<br />

not spoiled. More <strong>in</strong>formation about food quality and safety, as<br />

well as higher <strong>in</strong>come, lead consumers to expect foods to be safe<br />

from microbial contam<strong>in</strong>ation and other health hazards.<br />

Consumer Food Demand Pyramid<br />

Source: K<strong>in</strong>sey, 2000<br />

At higher <strong>in</strong>come levels, consumers beg<strong>in</strong> to use their<br />

dollars to purchase products that satisfy preferences above and<br />

beyond basic nutritional needs, such as better taste, variety and<br />

convenience. For example, develop<strong>in</strong>g countries <strong>in</strong>crease meat<br />

demand as the economy improves. Once needs lower on the<br />

food pyramid have been met, consumers at higher <strong>in</strong>come levels<br />

want expanded <strong>in</strong>formation about their food, and how food<br />

products affect health and lifestyle. High-<strong>in</strong>come consumers<br />

also beg<strong>in</strong> to be concerned about the impact that <strong>in</strong>dividual<br />

food consumption decisions and choices have on other people,<br />

the environment and animals. Thus, as <strong>in</strong>comes <strong>in</strong>crease, the<br />

demand for food products with different characteristics evolves,<br />

present<strong>in</strong>g both opportunities and threats to exist<strong>in</strong>g and<br />

potential food producers. Higher <strong>in</strong>come consumers provide<br />

opportunities for niche producers that are will<strong>in</strong>g and able to<br />

produce to this diverse set <strong>of</strong> standards (see Economics <strong>of</strong><br />

Production, Process<strong>in</strong>g and Market<strong>in</strong>g Chapter). However, lowto<br />

moderate-<strong>in</strong>come families <strong>in</strong> developed countries and people<br />

<strong>in</strong> develop<strong>in</strong>g economies still demand an <strong>in</strong>creas<strong>in</strong>g amount <strong>of</strong><br />

affordable animal prote<strong>in</strong>s.<br />

Retail<strong>in</strong>g<br />

<strong>The</strong> retail<strong>in</strong>g landscape has changed significantly dur<strong>in</strong>g the last<br />

two decades. Twenty years ago, traditional groceries <strong>in</strong> the<br />

United States represented 90 percent <strong>of</strong> at-home food purchases;<br />

Consumer Demand Issues 41<br />

today, they represent less than 70 percent. At-home food sales<br />

<strong>in</strong> nontraditional stores, <strong>in</strong>clud<strong>in</strong>g large retail giants like Wal-<br />

Mart, Costco and Target <strong>in</strong> the United States, and other types<br />

<strong>of</strong> nontraditional stores, such as buy<strong>in</strong>g clubs or convenience<br />

stores, have dramatically <strong>in</strong>creased <strong>in</strong> market share (Leibtag,<br />

2005). Wal-Mart represented 11 percent <strong>of</strong> all food-at-home<br />

sales <strong>in</strong> 2003, up from 3 percent <strong>in</strong> 1998. Today, Wal-Mart is<br />

the largest food retailer <strong>in</strong> both the United States and Mexico.<br />

In Canada, <strong>in</strong>creased consolidation and concentration <strong>in</strong> retail<br />

food markets has meant that the large retailers control a larger<br />

share <strong>of</strong> retail sales than <strong>in</strong> the United States or <strong>in</strong> Mexico.<br />

<strong>The</strong> <strong>in</strong>creased power <strong>of</strong> nontraditional grocery retailers,<br />

comb<strong>in</strong>ed with consumer preference for convenience,<br />

easy-to-handle, prepackaged meat and other food products,<br />

have resulted <strong>in</strong> low-cost, nearly-identical-quality products<br />

available to all customers.<br />

An important customer for meat processors is the food<br />

service <strong>in</strong>dustry. It has <strong>in</strong>creas<strong>in</strong>gly demanded prepackaged<br />

products and cuts to substitute for costly labor <strong>in</strong>put at the<br />

service end. At the same time, new technologies <strong>in</strong> process<strong>in</strong>g<br />

and distribution have led to changes <strong>in</strong> the market<strong>in</strong>g <strong>of</strong> meats,<br />

with <strong>in</strong>creases <strong>in</strong> the sale <strong>of</strong> cut-up, or boxed, meat and poultry,<br />

or sale <strong>in</strong> prepackaged units.<br />

While there is growth <strong>in</strong> large, retail giants <strong>in</strong> the food<br />

retail<strong>in</strong>g <strong>in</strong>dustry, small retail units have become an <strong>in</strong>creas<strong>in</strong>gly<br />

vigorous segment <strong>of</strong> the food retail market. This trend is reflected<br />

<strong>in</strong> Wal-Mart’s development <strong>of</strong> small-scale “neighborhood”<br />

stores, and growth <strong>in</strong> direct sale and distribution <strong>of</strong> meat<br />

products. Specialty stores, Internet-based markets, smaller sized<br />

retail markets, and direct market<strong>in</strong>g methods for meats have<br />

strengthened the presence <strong>of</strong> this niche market segment <strong>of</strong> food<br />

retail<strong>in</strong>g. <strong>The</strong> changes are driven by:<br />

• higher <strong>in</strong>come consumers choos<strong>in</strong>g to avoid large<br />

grocery cha<strong>in</strong>s;<br />

• some revitalization <strong>of</strong> downtown areas;<br />

• growth <strong>of</strong> select, high-quality brands; and<br />

• growth <strong>of</strong> formal and <strong>in</strong>formal markets to meet<br />

demand from ethnic consumers for different meats<br />

and meat products.<br />

Food retail<strong>in</strong>g also <strong>in</strong>cludes the rapidly grow<strong>in</strong>g food-awayfrom-home<br />

category. Total away-from-home expenditures,<br />

def<strong>in</strong>ed to <strong>in</strong>clude all food dispensed for immediate consumption<br />

outside <strong>of</strong> the consumer’s home, amounted to $415 billion <strong>in</strong><br />

2002. That is about 58 percent greater than annual away-fromhome<br />

expenditures <strong>in</strong> 1992 (Stewart et al., 2004). Food-awayfrom-home<br />

expenditures as a share <strong>of</strong> total U.S. food<br />

expenditures reached 50 percent <strong>in</strong> 2004 (Figure 6). Higher<br />

<strong>in</strong>come and time-starved consumers <strong>in</strong> <strong>North</strong> <strong>America</strong> are<br />

buy<strong>in</strong>g more convenience with their meals. <strong>The</strong>se expenditures<br />

<strong>in</strong>clude meals at fast-food as well as sit-down restaurants.