THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

16<br />

16<br />

In particular, with respect to the aforementioned net goodwill relating to the CNH Group (3,230 million euros), specific reviews<br />

were conducted, also to conform to the United States accounting standard SFAS 121 (the accounting standard applied by CNH<br />

Global NV in its consolidated financial statements which are prepared in accordance with US GAAP). These reviews revealed that<br />

the values are recoverable at the Sector level expressed in the financial statements. Moreover, CNH Global is also conducting<br />

new more detailed reviews at the level of each single business unit under the new United States accounting standard SFAS 142,<br />

which is applicable from January 1, 2002. At this time, it is not possible to anticipate the conclusions of such reviews, nor if<br />

these reviews will have a significant impact on the valuation of such goodwill also in relation to Italian accounting principles.<br />

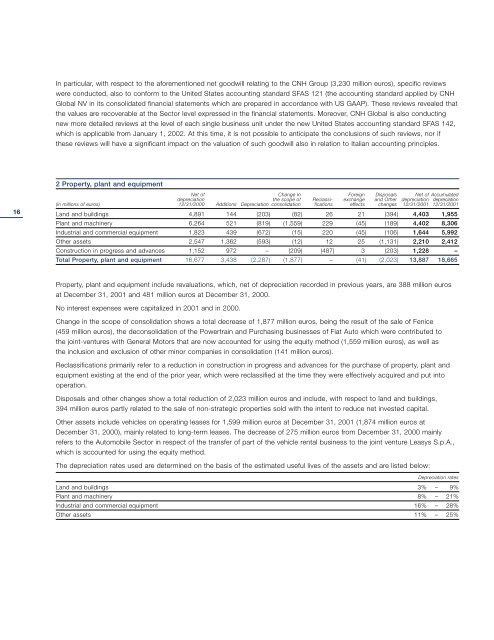

2 Property, plant and equipment<br />

Net of Change in Foreign Disposals Net of Accumulated<br />

depreciation the scope of Reclassi- exchange and Other depreciation depreciation<br />

(in millions of euros) 12/31/2000 Additions Depreciation consolidation fications effects changes 12/31/2001 12/31/2001<br />

Land and buildings 4,891 144 (203) (82) 26 21 (394) 4,403 1,955<br />

Plant and machinery 6,264 521 (819) (1,559) 229 (45) (189) 4,402 8,306<br />

Industrial and commercial equipment 1,823 439 (672) (15) 220 (45) (106) 1,644 5,992<br />

Other assets 2,547 1,362 (593) (12) 12 25 (1,131) 2,210 2,412<br />

Construction in progress and advances 1,152 972 – (209) (487) 3 (203) 1,228 –<br />

Total Property, plant and equipment 16,677 3,438 (2,287) (1,877) – (41) (2,023) 13,887 18,665<br />

Property, plant and equipment include revaluations, which, net of depreciation recorded in previous years, are 388 million euros<br />

at December 31, 2001 and 481 million euros at December 31, 2000.<br />

No interest expenses were capitalized in 2001 and in 2000.<br />

Change in the scope of consolidation shows a total decrease of 1,877 million euros, being the result of the sale of Fenice<br />

(459 million euros), the deconsolidation of the Powertrain and Purchasing businesses of <strong>Fiat</strong> Auto which were contributed to<br />

the joint-ventures with General Motors that are now accounted for using the equity method (1,559 million euros), as well as<br />

the inclusion and exclusion of other minor companies in consolidation (141 million euros).<br />

Reclassifications primarily refer to a reduction in construction in progress and advances for the purchase of property, plant and<br />

equipment existing at the end of the prior year, which were reclassified at the time they were effectively acquired and put into<br />

operation.<br />

Disposals and other changes show a total reduction of 2,023 million euros and include, with respect to land and buildings,<br />

394 million euros partly related to the sale of non-strategic properties sold with the intent to reduce net invested capital.<br />

Other assets include vehicles on operating leases for 1,599 million euros at December 31, 2001 (1,874 million euros at<br />

December 31, 2000), mainly related to long-term leases. The decrease of 275 million euros from December 31, 2000 mainly<br />

refers to the Automobile Sector in respect of the transfer of part of the vehicle rental business to the joint venture Leasys S.p.A.,<br />

which is accounted for using the equity method.<br />

The depreciation rates used are determined on the basis of the estimated useful lives of the assets and are listed below:<br />

Depreciation rates<br />

Land and buildings 3% – 9%<br />

Plant and machinery 8% – 21%<br />

Industrial and commercial equipment 16% – 28%<br />

Other assets 11% – 25%