THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

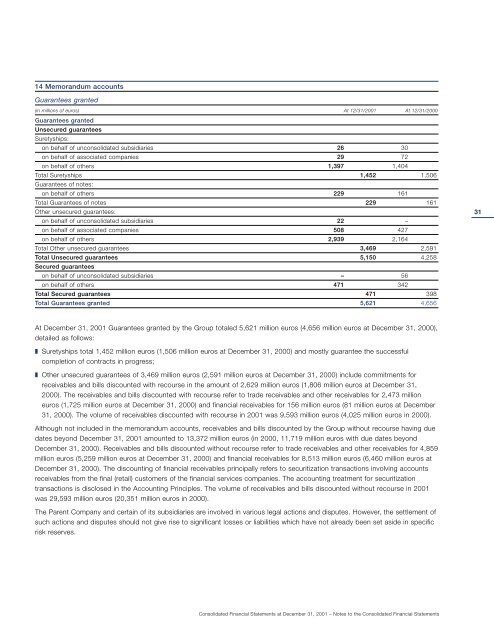

14 Memorandum accounts<br />

Guarantees granted<br />

(in millions of euros) At 12/31/2001 At 12/31/2000<br />

Guarantees granted<br />

Unsecured guarantees<br />

Suretyships:<br />

on behalf of unconsolidated subsidiaries 26 30<br />

on behalf of associated companies 29 72<br />

on behalf of others 1,397 1,404<br />

Total Suretyships 1,452 1,506<br />

Guarantees of notes:<br />

on behalf of others 229 161<br />

Total Guarantees of notes 229 161<br />

Other unsecured guarantees:<br />

on behalf of unconsolidated subsidiaries 22 –<br />

on behalf of associated companies 508 427<br />

on behalf of others 2,939 2,164<br />

Total Other unsecured guarantees 3,469 2,591<br />

Total Unsecured guarantees 5,150 4,258<br />

Secured guarantees<br />

on behalf of unconsolidated subsidiaries – 56<br />

on behalf of others 471 342<br />

Total Secured guarantees 471 398<br />

Total Guarantees granted 5,621 4,656<br />

At December 31, 2001 Guarantees granted by the Group totaled 5,621 million euros (4,656 million euros at December 31, 2000),<br />

detailed as follows:<br />

❚ Suretyships total 1,452 million euros (1,506 million euros at December 31, 2000) and mostly guarantee the successful<br />

completion of contracts in progress;<br />

❚ Other unsecured guarantees of 3,469 million euros (2,591 million euros at December 31, 2000) include commitments for<br />

receivables and bills discounted with recourse in the amount of 2,629 million euros (1,806 million euros at December 31,<br />

2000). The receivables and bills discounted with recourse refer to trade receivables and other receivables for 2,473 million<br />

euros (1,725 million euros at December 31, 2000) and financial receivables for 156 million euros (81 million euros at December<br />

31, 2000). The volume of receivables discounted with recourse in 2001 was 9,593 million euros (4,025 million euros in 2000).<br />

Although not included in the memorandum accounts, receivables and bills discounted by the Group without recourse having due<br />

dates beyond December 31, 2001 amounted to 13,372 million euros (in 2000, 11,719 million euros with due dates beyond<br />

December 31, 2000). Receivables and bills discounted without recourse refer to trade receivables and other receivables for 4,859<br />

million euros (5,259 million euros at December 31, 2000) and financial receivables for 8,513 million euros (6,460 million euros at<br />

December 31, 2000). The discounting of financial receivables principally refers to securitization transactions involving accounts<br />

receivables from the final (retail) customers of the financial services companies. The accounting treatment for securitization<br />

transactions is disclosed in the Accounting Principles. The volume of receivables and bills discounted without recourse in 2001<br />

was 29,593 million euros (20,351 million euros in 2000).<br />

The Parent Company and certain of its subsidiaries are involved in various legal actions and disputes. However, the settlement of<br />

such actions and disputes should not give rise to significant losses or liabilities which have not already been set aside in specific<br />

risk reserves.<br />

Consolidated Financial Statements at December 31, 2001 – Notes to the Consolidated Financial Statements 31<br />

31