THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

20<br />

20<br />

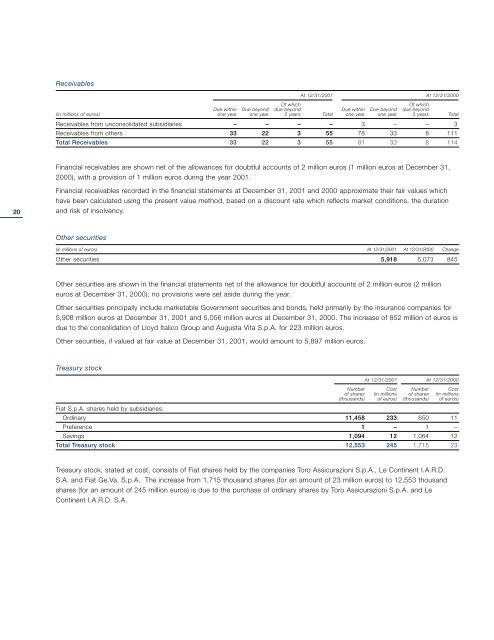

Receivables<br />

At 12/31/2001 At 12/31/2000<br />

Of which Of which<br />

(in millions of euros)<br />

Due within<br />

one year<br />

Due beyond<br />

one year<br />

due beyond<br />

5 years Total<br />

Due within<br />

one year<br />

Due beyond<br />

one year<br />

due beyond<br />

5 years Total<br />

Receivables from unconsolidated subsidiaries – – – – 3 – – 3<br />

Receivables from others 33 22 3 55 78 33 8 111<br />

Total Receivables 33 22 3 55 81 33 8 114<br />

Financial receivables are shown net of the allowances for doubtful accounts of 2 million euros (1 million euros at December 31,<br />

2000), with a provision of 1 million euros during the year 2001.<br />

Financial receivables recorded in the financial statements at December 31, 2001 and 2000 approximate their fair values which<br />

have been calculated using the present value method, based on a discount rate which reflects market conditions, the duration<br />

and risk of insolvency.<br />

Other securities<br />

(in millions of euros) At 12/31/2001 At 12/31/2000 Change<br />

Other securities 5,918 5,073 845<br />

Other securities are shown in the financial statements net of the allowance for doubtful accounts of 2 million euros (2 million<br />

euros at December 31, 2000); no provisions were set aside during the year.<br />

Other securities principally include marketable Government securities and bonds, held primarily by the insurance companies for<br />

5,908 million euros at December 31, 2001 and 5,056 million euros at December 31, 2000. The increase of 852 million of euros is<br />

due to the consolidation of Lloyd Italico Group and Augusta Vita S.p.A. for 223 million euros.<br />

Other securities, if valued at fair value at December 31, 2001, would amount to 5,897 million euros.<br />

Treasury stock<br />

At 12/31/2001 At 12/31/2000<br />

Number Cost Number Cost<br />

of shares<br />

(thousands)<br />

(in millions<br />

of euros)<br />

of shares<br />

(thousands)<br />

(in millions<br />

of euros)<br />

<strong>Fiat</strong> S.p.A. shares held by subsidiaries:<br />

Ordinary 11,458 233 650 11<br />

Preference 1 – 1 –<br />

Savings 1,094 12 1,064 12<br />

Total Treasury stock 12,553 245 1,715 23<br />

Treasury stock, stated at cost, consists of <strong>Fiat</strong> shares held by the companies Toro Assicurazioni S.p.A., Le Continent I.A.R.D.<br />

S.A. and <strong>Fiat</strong> Ge.Va. S.p.A. The increase from 1,715 thousand shares (for an amount of 23 million euros) to 12,553 thousand<br />

shares (for an amount of 245 million euros) is due to the purchase of ordinary shares by Toro Assicurazioni S.p.A. and Le<br />

Continent I.A.R.D. S.A.