THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

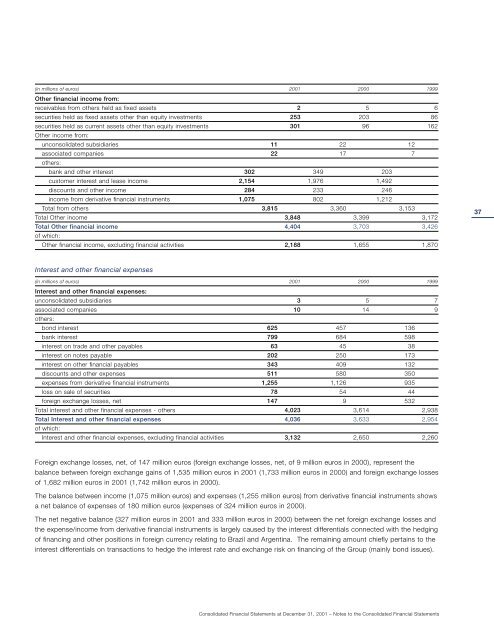

(in millions of euros) 2001 2000 1999<br />

Other financial income from:<br />

receivables from others held as fixed assets 2 5 6<br />

securities held as fixed assets other than equity investments 253 203 86<br />

securities held as current assets other than equity investments 301 96 162<br />

Other income from:<br />

unconsolidated subsidiaries 11 22 12<br />

associated companies 22 17 7<br />

others:<br />

bank and other interest 302 349 203<br />

customer interest and lease income 2,154 1,976 1,492<br />

discounts and other income 284 233 246<br />

income from derivative financial instruments 1,075 802 1,212<br />

Total from others 3,815 3,360 3,153<br />

Total Other income 3,848 3,399 3,172<br />

Total Other financial income 4,404 3,703 3,426<br />

of which:<br />

Other financial income, excluding financial activities 2,188 1,655 1,870<br />

Interest and other financial expenses<br />

(in millions of euros) 2001 2000 1999<br />

Interest and other financial expenses:<br />

unconsolidated subsidiaries 3 5 7<br />

associated companies 10 14 9<br />

others:<br />

bond interest 625 457 136<br />

bank interest 799 684 598<br />

interest on trade and other payables 63 45 38<br />

interest on notes payable 202 250 173<br />

interest on other financial payables 343 409 132<br />

discounts and other expenses 511 580 350<br />

expenses from derivative financial instruments 1,255 1,126 935<br />

loss on sale of securities 78 54 44<br />

foreign exchange losses, net 147 9 532<br />

Total interest and other financial expenses - others 4,023 3,614 2,938<br />

Total Interest and other financial expenses 4,036 3,633 2,954<br />

of which:<br />

Interest and other financial expenses, excluding financial activities 3,132 2,650 2,260<br />

Foreign exchange losses, net, of 147 million euros (foreign exchange losses, net, of 9 million euros in 2000), represent the<br />

balance between foreign exchange gains of 1,535 million euros in 2001 (1,733 million euros in 2000) and foreign exchange losses<br />

of 1,682 million euros in 2001 (1,742 million euros in 2000).<br />

The balance between income (1,075 million euros) and expenses (1,255 million euros) from derivative financial instruments shows<br />

a net balance of expenses of 180 million euros (expenses of 324 million euros in 2000).<br />

The net negative balance (327 million euros in 2001 and 333 million euros in 2000) between the net foreign exchange losses and<br />

the expense/income from derivative financial instruments is largely caused by the interest differentials connected with the hedging<br />

of financing and other positions in foreign currency relating to Brazil and Argentina. The remaining amount chiefly pertains to the<br />

interest differentials on transactions to hedge the interest rate and exchange risk on financing of the Group (mainly bond issues).<br />

Consolidated Financial Statements at December 31, 2001 – Notes to the Consolidated Financial Statements 37<br />

37