THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

62<br />

62<br />

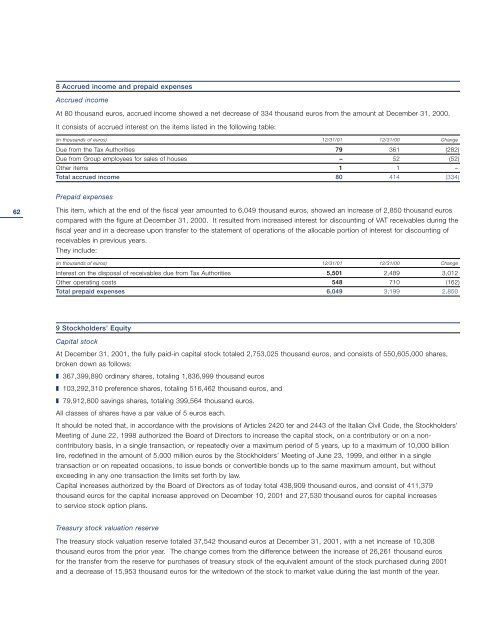

8 Accrued income and prepaid expenses<br />

Accrued income<br />

At 80 thousand euros, accrued income showed a net decrease of 334 thousand euros from the amount at December 31, 2000.<br />

It consists of accrued interest on the items listed in the following table:<br />

(in thousands of euros) 12/31/01 12/31/00 Change<br />

Due from the Tax Authorities 79 361 (282)<br />

Due from Group employees for sales of houses – 52 (52)<br />

Other items 1 1 –<br />

Total accrued income 80 414 (334)<br />

Prepaid expenses<br />

This item, which at the end of the fiscal year amounted to 6,049 thousand euros, showed an increase of 2,850 thousand euros<br />

compared with the figure at December 31, 2000. It resulted from increased interest for discounting of VAT receivables during the<br />

fiscal year and in a decrease upon transfer to the statement of operations of the allocable portion of interest for discounting of<br />

receivables in previous years.<br />

They include:<br />

(in thousands of euros) 12/31/01 12/31/00 Change<br />

Interest on the disposal of receivables due from Tax Authorities 5,501 2,489 3,012<br />

Other operating costs 548 710 (162)<br />

Total prepaid expenses 6,049 3,199 2,850<br />

9 Stockholders’ Equity<br />

Capital stock<br />

At December 31, 2001, the fully paid-in capital stock totaled 2,753,025 thousand euros, and consists of 550,605,000 shares,<br />

broken down as follows:<br />

❚ 367,399,890 ordinary shares, totaling 1,836,999 thousand euros<br />

❚ 103,292,310 preference shares, totaling 516,462 thousand euros, and<br />

❚ 79,912,800 savings shares, totaling 399,564 thousand euros.<br />

All classes of shares have a par value of 5 euros each.<br />

It should be noted that, in accordance with the provisions of Articles 2420 ter and 2443 of the Italian Civil Code, the Stockholders’<br />

Meeting of June 22, 1998 authorized the Board of Directors to increase the capital stock, on a contributory or on a noncontributory<br />

basis, in a single transaction, or repeatedly over a maximum period of 5 years, up to a maximum of 10,000 billion<br />

lire, redefined in the amount of 5,000 million euros by the Stockholders’ Meeting of June 23, 1999, and either in a single<br />

transaction or on repeated occasions, to issue bonds or convertible bonds up to the same maximum amount, but without<br />

exceeding in any one transaction the limits set forth by law.<br />

Capital increases authorized by the Board of Directors as of today total 438,909 thousand euros, and consist of 411,379<br />

thousand euros for the capital increase approved on December 10, 2001 and 27,530 thousand euros for capital increases<br />

to service stock option plans.<br />

Treasury stock valuation reserve<br />

The treasury stock valuation reserve totaled 37,542 thousand euros at December 31, 2001, with a net increase of 10,308<br />

thousand euros from the prior year. The change comes from the difference between the increase of 26,261 thousand euros<br />

for the transfer from the reserve for purchases of treasury stock of the equivalent amount of the stock purchased during 2001<br />

and a decrease of 15,953 thousand euros for the writedown of the stock to market value during the last month of the year.