THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

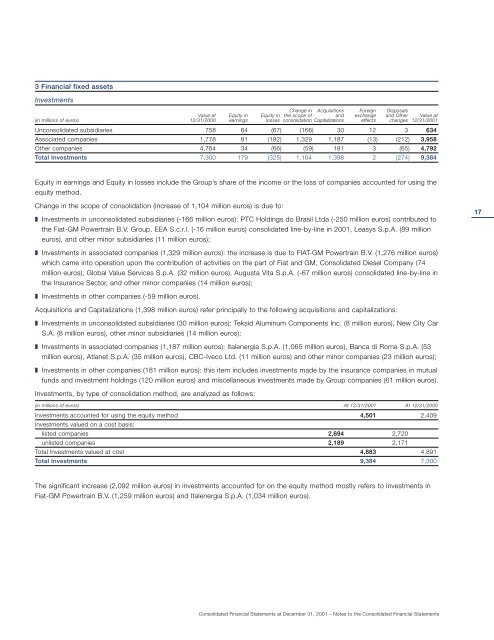

3 Financial fixed assets<br />

Investments<br />

Change in Acquisitions Foreign Disposals<br />

Value at Equity in Equity in the scope of and exchange and Other Value at<br />

(in millions of euros) 12/31/2000 earnings losses consolidation Capitalizations effects changes 12/31/2001<br />

Unconsolidated subsidiaries 758 64 (67) (166) 30 12 3 634<br />

Associated companies 1,778 81 (192) 1,329 1,187 (13) (212) 3,958<br />

Other companies 4,764 34 (66) (59) 181 3 (65) 4,792<br />

Total Investments 7,300 179 (325) 1,104 1,398 2 (274) 9,384<br />

Equity in earnings and Equity in losses include the Group’s share of the income or the loss of companies accounted for using the<br />

equity method.<br />

Change in the scope of consolidation (increase of 1,104 million euros) is due to:<br />

❚ Investments in unconsolidated subsidiaries (-166 million euros): PTC Holdings do Brasil Ltda (-250 million euros) contributed to<br />

the <strong>Fiat</strong>-GM Powertrain B.V. Group, EEA S.c.r.l. (-16 million euros) consolidated line-by-line in 2001, Leasys S.p.A. (89 million<br />

euros), and other minor subsidiaries (11 million euros);<br />

❚ Investments in associated companies (1,329 million euros): the increase is due to <strong>FIAT</strong>-GM Powertrain B.V. (1,276 million euros)<br />

which came into operation upon the contribution of activities on the part of <strong>Fiat</strong> and GM, Consolidated Diesel Company (74<br />

million euros), Global Value Services S.p.A. (32 million euros), Augusta Vita S.p.A. (-67 million euros) consolidated line-by-line in<br />

the Insurance Sector, and other minor companies (14 million euros);<br />

❚ Investments in other companies (-59 million euros).<br />

Acquisitions and Capitalizations (1,398 million euros) refer principally to the following acquisitions and capitalizations:<br />

❚ Investments in unconsolidated subsidiaries (30 million euros): Teksid Aluminum Components Inc. (8 million euros), New City Car<br />

S.A. (8 million euros), other minor subsidiaries (14 million euros);<br />

❚ Investments in associated companies (1,187 million euros): Italenergia S.p.A. (1,065 million euros), Banca di Roma S.p.A. (53<br />

million euros), Atlanet S.p.A. (35 million euros), CBC-Iveco Ltd. (11 million euros) and other minor companies (23 million euros);<br />

❚ Investments in other companies (181 million euros): this item includes investments made by the insurance companies in mutual<br />

funds and investment holdings (120 million euros) and miscellaneous investments made by Group companies (61 million euros).<br />

Investments, by type of consolidation method, are analyzed as follows:<br />

(in millions of euros) At 12/31/2001 At 12/31/2000<br />

Investments accounted for using the equity method 4,501 2,409<br />

Investments valued on a cost basis:<br />

listed companies 2,694 2,720<br />

unlisted companies 2,189 2,171<br />

Total Investments valued at cost 4,883 4,891<br />

Total Investments 9,384 7,300<br />

The significant increase (2,092 million euros) in investments accounted for on the equity method mostly refers to investments in<br />

<strong>Fiat</strong>-GM Powertrain B.V. (1,259 million euros) and Italenergia S.p.A. (1,034 million euros).<br />

Consolidated Financial Statements at December 31, 2001 – Notes to the Consolidated Financial Statements 17<br />

17