THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

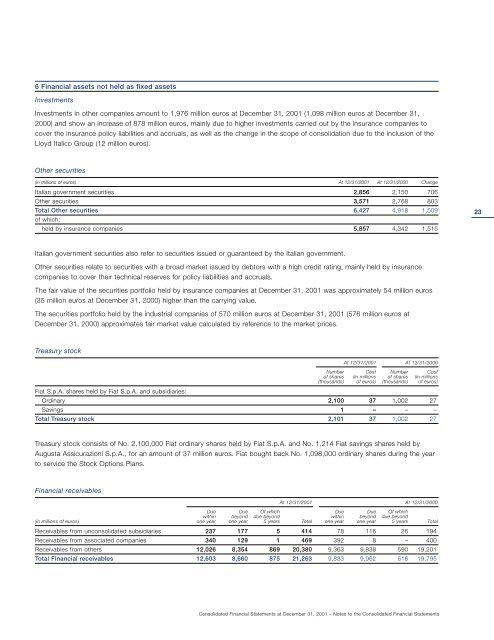

6 Financial assets not held as fixed assets<br />

Investments<br />

Investments in other companies amount to 1,976 million euros at December 31, 2001 (1,098 million euros at December 31,<br />

2000) and show an increase of 878 million euros, mainly due to higher investments carried out by the insurance companies to<br />

cover the insurance policy liabilities and accruals, as well as the change in the scope of consolidation due to the inclusion of the<br />

Lloyd Italico Group (12 million euros).<br />

Other securities<br />

(in millions of euros) At 12/31/2001 At 12/31/2000 Change<br />

Italian government securities 2,856 2,150 706<br />

Other securities 3,571 2,768 803<br />

Total Other securities 6,427 4,918 1,509<br />

of which:<br />

held by insurance companies 5,857 4,342 1,515<br />

Italian government securities also refer to securities issued or guaranteed by the Italian government.<br />

Other securities relate to securities with a broad market issued by debtors with a high credit rating, mainly held by insurance<br />

companies to cover their technical reserves for policy liabilities and accruals.<br />

The fair value of the securities portfolio held by insurance companies at December 31, 2001 was approximately 54 million euros<br />

(35 million euros at December 31, 2000) higher than the carrying value.<br />

The securities portfolio held by the industrial companies of 570 million euros at December 31, 2001 (576 million euros at<br />

December 31, 2000) approximates fair market value calculated by reference to the market prices.<br />

Treasury stock<br />

At 12/31/2001 At 12/31/2000<br />

Number Cost Number Cost<br />

of shares<br />

(thousands)<br />

(in millions<br />

of euros)<br />

of shares<br />

(thousands)<br />

(in millions<br />

of euros)<br />

<strong>Fiat</strong> S.p.A. shares held by <strong>Fiat</strong> S.p.A. and subsidiaries:<br />

Ordinary 2,100 37 1,002 27<br />

Savings 1 – – –<br />

Total Treasury stock 2,101 37 1,002 27<br />

Treasury stock consists of No. 2,100,000 <strong>Fiat</strong> ordinary shares held by <strong>Fiat</strong> S.p.A. and No. 1,214 <strong>Fiat</strong> savings shares held by<br />

Augusta Assicurazioni S.p.A., for an amount of 37 million euros. <strong>Fiat</strong> bought back No. 1,098,000 ordinary shares during the year<br />

to service the Stock Options Plans.<br />

Financial receivables<br />

At 12/31/2001 At 12/31/2000<br />

Due Due Of which Due Due Of which<br />

(in millions of euros)<br />

within<br />

one year<br />

beyond<br />

one year<br />

due beyond<br />

5 years Total<br />

within<br />

one year<br />

beyond<br />

one year<br />

due beyond<br />

5 years Total<br />

Receivables from unconsolidated subsidiaries 237 177 5 414 78 116 26 194<br />

Receivables from associated companies 340 129 1 469 392 8 – 400<br />

Receivables from others 12,026 8,354 869 20,380 9,363 9,838 590 19,201<br />

Total Financial receivables 12,603 8,660 875 21,263 9,833 9,962 616 19,795<br />

Consolidated Financial Statements at December 31, 2001 – Notes to the Consolidated Financial Statements 23<br />

23