THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

40<br />

40<br />

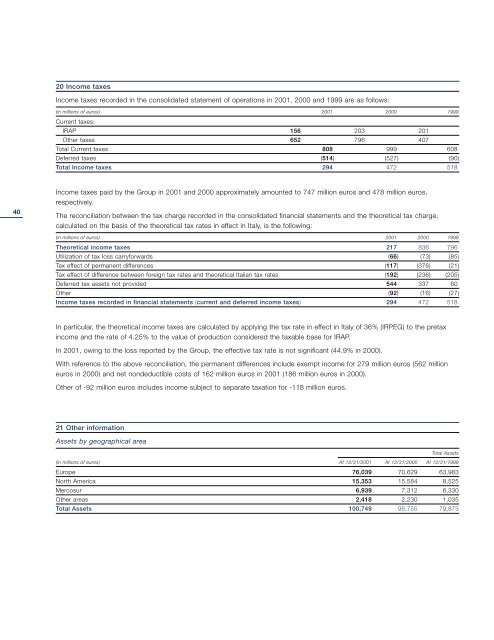

20 Income taxes<br />

Income taxes recorded in the consolidated statement of operations in 2001, 2000 and 1999 are as follows:<br />

(in millions of euros) 2001 2000 1999<br />

Current taxes:<br />

IRAP 156 203 201<br />

Other taxes 652 796 407<br />

Total Current taxes 808 999 608<br />

Deferred taxes (514) (527) (90)<br />

Total Income taxes 294 472 518<br />

Income taxes paid by the Group in 2001 and 2000 approximately amounted to 747 million euros and 478 million euros,<br />

respectively.<br />

The reconciliation between the tax charge recorded in the consolidated financial statements and the theoretical tax charge,<br />

calculated on the basis of the theoretical tax rates in effect in Italy, is the following:<br />

(in millions of euros) 2001 2000 1999<br />

Theoretical income taxes 217 836 796<br />

Utilization of tax loss carryforwards (66) (73) (85)<br />

Tax effect of permanent differences (117) (376) (21)<br />

Tax effect of difference between foreign tax rates and theoretical Italian tax rates (192) (236) (205)<br />

Deferred tax assets not provided 544 337 60<br />

Other (92) (16) (27)<br />

Income taxes recorded in financial statements (current and deferred income taxes) 294 472 518<br />

In particular, the theoretical income taxes are calculated by applying the tax rate in effect in Italy of 36% (IRPEG) to the pretax<br />

income and the rate of 4.25% to the value of production considered the taxable base for IRAP.<br />

In 2001, owing to the loss reported by the Group, the effective tax rate is not significant (44.9% in 2000).<br />

With reference to the above reconciliation, the permanent differences include exempt income for 279 million euros (562 million<br />

euros in 2000) and net nondeductible costs of 162 million euros in 2001 (186 million euros in 2000).<br />

Other of -92 million euros includes income subject to separate taxation for -118 million euros.<br />

21 Other information<br />

Assets by geographical area<br />

(in millions of euros) At 12/31/2001 At 12/31/2000<br />

Total Assets<br />

At 12/31/1999<br />

Europe 76,039 70,629 63,983<br />

North America 15,353 15,584 8,525<br />

Mercosur 6,939 7,312 6,330<br />

Other areas 2,418 2,230 1,035<br />

Total Assets 100,749 95,755 79,873