BA II PLUS™ PROFESSIONAL Calculator

BA II PLUS™ PROFESSIONAL Calculator

BA II PLUS™ PROFESSIONAL Calculator

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5<br />

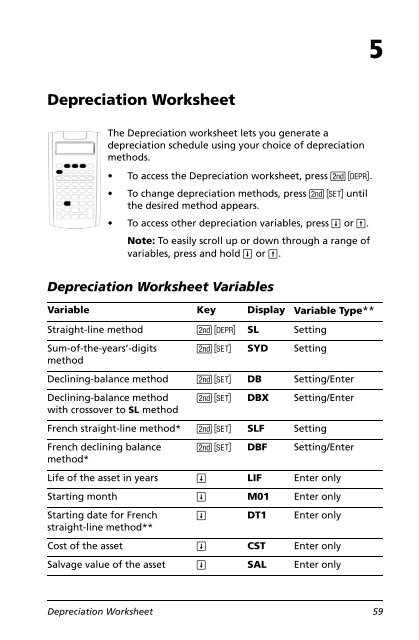

Depreciation Worksheet<br />

The Depreciation worksheet lets you generate a<br />

depreciation schedule using your choice of depreciation<br />

methods.<br />

• To access the Depreciation worksheet, press & p.<br />

• To change depreciation methods, press & V until<br />

the desired method appears.<br />

• To access other depreciation variables, press # or ".<br />

Note: To easily scroll up or down through a range of<br />

variables, press and hold # or ".<br />

Depreciation Worksheet Variables<br />

Variable Key Display Variable Type**<br />

Straight-line method & p SL Setting<br />

Sum-of-the-years’-digits<br />

method<br />

& V SYD Setting<br />

Declining-balance method & V DB Setting/Enter<br />

Declining-balance method<br />

with crossover to SL method<br />

& V DBX Setting/Enter<br />

French straight-line method* & V SLF Setting<br />

French declining balance<br />

method*<br />

& V DBF Setting/Enter<br />

Life of the asset in years # LIF Enter only<br />

Starting month # M01 Enter only<br />

Starting date for French<br />

straight-line method**<br />

# DT1 Enter only<br />

Cost of the asset # CST Enter only<br />

Salvage value of the asset # SAL Enter only<br />

Depreciation Worksheet 59