BA II PLUS™ PROFESSIONAL Calculator

BA II PLUS™ PROFESSIONAL Calculator

BA II PLUS™ PROFESSIONAL Calculator

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

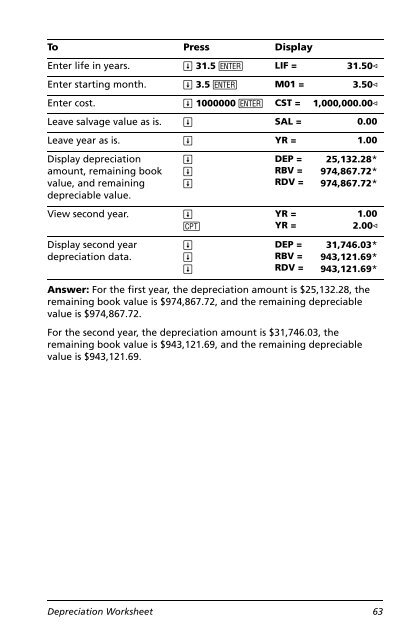

To Press Display<br />

Enter life in years. # 31.5 ! LIF = 31.50<br />

Enter starting month. # 3.5 ! M01 = 3.50<br />

Enter cost. # 1000000 ! CST = 1,000,000.00<br />

Leave salvage value as is. # SAL = 0.00<br />

Leave year as is. # YR = 1.00<br />

Display depreciation<br />

amount, remaining book<br />

value, and remaining<br />

depreciable value.<br />

#<br />

#<br />

#<br />

DEP =<br />

RBV =<br />

RDV =<br />

25,132.28*<br />

974,867.72*<br />

974,867.72*<br />

View second year. #<br />

%<br />

YR =<br />

YR =<br />

1.00<br />

2.00<br />

Display second year<br />

depreciation data.<br />

#<br />

#<br />

#<br />

DEP =<br />

RBV =<br />

RDV =<br />

31,746.03*<br />

943,121.69*<br />

943,121.69*<br />

Answer: For the first year, the depreciation amount is $25,132.28, the<br />

remaining book value is $974,867.72, and the remaining depreciable<br />

value is $974,867.72.<br />

For the second year, the depreciation amount is $31,746.03, the<br />

remaining book value is $943,121.69, and the remaining depreciable<br />

value is $943,121.69.<br />

Depreciation Worksheet 63