Scope - Clearstream

Scope - Clearstream

Scope - Clearstream

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MARKET PRACTICE BOOK - NEW ISSUES<br />

22<br />

2.2.2.<br />

2.2.2.1.<br />

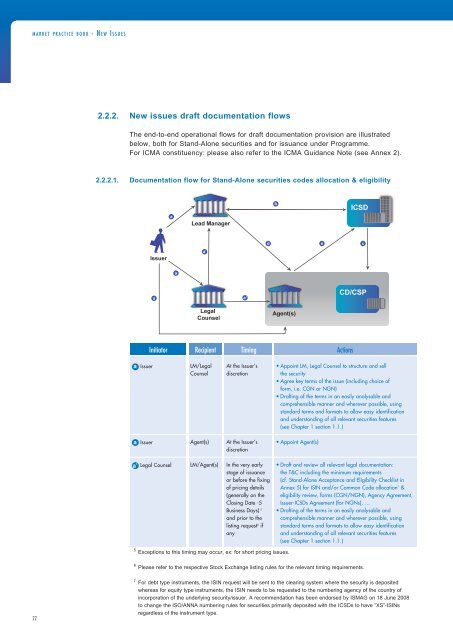

New issues draft documentation flows<br />

The end-to-end operational flows for draft documentation provision are illustrated<br />

below, both for Stand-Alone securities and for issuance under Programme.<br />

For ICMA constituency: please also refer to the ICMA Guidance Note (see Annex 2).<br />

Documentation flow for Stand-Alone securities codes allocation & eligibility<br />

a<br />

a<br />

Issuer<br />

Issuer<br />

Issuer<br />

a<br />

a<br />

a<br />

Lead Manager<br />

a’<br />

Legal L l<br />

Counsel<br />

Initiator Recipient Timing<br />

a’ Legal Counsel<br />

LM/Legal<br />

Counsel<br />

Agent(s)<br />

LM/Agent(s)<br />

a’<br />

At the Issuer’s<br />

discretion<br />

At the Issuer’s<br />

discretion<br />

In the very early<br />

stage of issuance<br />

or before the fixing<br />

of pricing details<br />

(generally on the<br />

Closing Date -5<br />

Business Days) 5<br />

and prior to the<br />

listing request 6 if<br />

any<br />

b<br />

Agent(s)<br />

5 Exceptions to this timing may occur, ex: for short pricing issues.<br />

ICSD SD<br />

d e c<br />

CD/CSP<br />

Actions<br />

• Appoint LM, Legal Counsel to structure and sell<br />

the security<br />

• Agree key terms of the issue (including choice of<br />

form, i.e. CGN or NGN)<br />

• Drafting of the terms in an easily analysable and<br />

comprehensible manner and wherever possible, using<br />

standard terms and formats to allow easy identification<br />

and understanding of all relevant securities features<br />

(see Chapter 1 section 1.1.)<br />

• Appoint Agent(s)<br />

• Draft and review all relevant legal documentation:<br />

the T&C including the minimum requirements<br />

(cf. Stand-Alone Acceptance and Eligibility Checklist in<br />

Annex 5) for ISIN and/or Common Code allocation 7 &<br />

eligibility review, forms (CGN/NGN), Agency Agreement,<br />

Issuer-ICSDs Agreement (for NGNs), …<br />

• Drafting of the terms in an easily analysable and<br />

comprehensible manner and wherever possible, using<br />

standard terms and formats to allow easy identification<br />

and understanding of all relevant securities features<br />

(see Chapter 1 section 1.1.)<br />

6 Please refer to the respective Stock Exchange listing rules for the relevant timing requirements.<br />

7 For debt type instruments, the ISIN request will be sent to the clearing system where the security is deposited<br />

whereas for equity type instruments, the ISIN needs to be requested to the numbering agency of the country of<br />

incorporation of the underlying security/issuer. A recommendation has been endorsed by ISMAG on 18 June 2008<br />

to change the ISO/ANNA numbering rules for securities primarily deposited with the ICSDs to have “XS”-ISINs<br />

regardless of the instrument type.