Scope - Clearstream

Scope - Clearstream

Scope - Clearstream

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

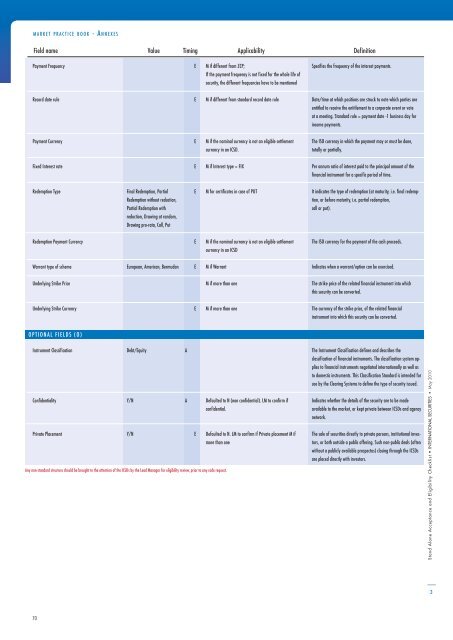

MARKET PRACTICE BOOK - ANNEXES<br />

Field name Value Timing Applicability Definition<br />

Payment Frequency<br />

Record date rule<br />

Payment Currency<br />

Fixed Interest rate<br />

Redemption Type<br />

Redemption Payment Currency<br />

Warrant type of scheme<br />

Underlying Strike Price<br />

Underlying Strike Currency<br />

OPTIONAL FIELDS (O)<br />

Instrument Classifi cation<br />

Confi dentiality<br />

Private Placement<br />

70<br />

Final Redemption, Partial<br />

Redemption without reduction,<br />

Partial Redemption with<br />

reduction, Drawing at random,<br />

Drawing pro-rata, Call, Put<br />

European, American, Bermudan<br />

Debt/Equity<br />

Y/N<br />

Y/N<br />

M if different from ZCP;<br />

If the payment frequency is not fi xed for the whole life of<br />

security, the different frequencies have to be mentioned<br />

M if different from standard record date rule<br />

M if the nominal currency is not an eligible settlement<br />

currency in an ICSD.<br />

M if Interest type = FIX<br />

M for certifi cates in case of PUT<br />

M if the nominal currency is not an eligible settlement<br />

currency in an ICSD<br />

.<br />

M if Warrant<br />

M if more than one<br />

M if more than one<br />

Any non-standard structure should be brought to the attention of the ICSDs by the Lead Manager for eligibility review, prior to any code request.<br />

A<br />

A<br />

E<br />

E<br />

E<br />

E<br />

E<br />

E<br />

E<br />

E<br />

E<br />

Defaulted to N (non confi dential). LM to confi rm if<br />

confi dential.<br />

Defaulted to N. LM to confi rm if Private placement M if<br />

more than one<br />

Specifi es the frequency of the interest payments.<br />

Date/time at which positions are struck to note which parties are<br />

entitled to receive the entitlement to a corporate event or vote<br />

at a meeting. Standard rule = payment date -1 business day for<br />

income payments.<br />

The ISO currency in which the payment may or must be done,<br />

totally or partially.<br />

Per annum ratio of interest paid to the principal amount of the<br />

fi nancial instrument for a specifi c period of time.<br />

It indicates the type of redemption (at maturity, i.e. fi nal redemption,<br />

or before maturity, i.e. partial redemption,<br />

call or put).<br />

The ISO currency for the payment of the cash proceeds.<br />

Indicates when a warrant/option can be exercised.<br />

The strike price of the related fi nancial instrument into which<br />

this security can be converted.<br />

The currency of the strike price, of the related fi nancial<br />

instrument into which this security can be converted.<br />

The Instrument Classifi cation defi nes and describes the<br />

classifi cation of fi nancial instruments. The classifi cation system applies<br />

to fi nancial instruments negotiated internationally as well as<br />

to domestic instruments. This Classifi cation Standard is intended for<br />

use by the Clearing Systems to defi ne the type of security issued.<br />

Indicates whether the details of the security are to be made<br />

available to the market, or kept private between ICSDs and agency<br />

network.<br />

The sale of securities directly to private persons, institutional investors,<br />

or both outside a public offering. Such non-public deals (often<br />

without a publicly available prospectus) closing through the ICSDs<br />

are placed directly with investors.<br />

Stand Alone Acceptance and Eligibility Checklist • INTERNATIONAL SECURITIES • May 2010<br />

3