Scope - Clearstream

Scope - Clearstream

Scope - Clearstream

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MARKET PRACTICE BOOK - ANNEXES<br />

82<br />

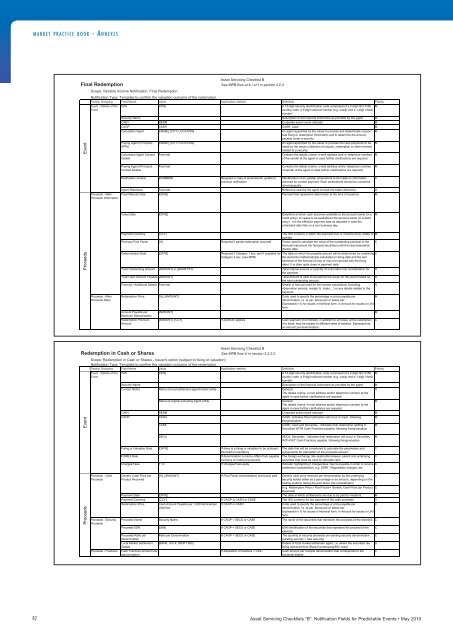

Asset Servicing Checklist B<br />

Final Redemption See MPB flow a+b / e+f in section 4.2.3<br />

<strong>Scope</strong>: Variable Income Notification: Final Redemption<br />

Event<br />

Proceeds<br />

Asset Servicing Checklist B<br />

Redemption in Cash or Shares See MPB flow b' in section 3.2.2.2<br />

Event<br />

Proceeds<br />

Notification Type: Template to confirm the valuation outcome of the redemption.<br />

Family/ Grouping Field Name Value Application method Definition Priority<br />

Event - Details of the<br />

Event<br />

<strong>Scope</strong>: Redemption in Cash or Shares - Issuer's option (subject to fixing or valuation)<br />

Notification Type: Template to confirm the valuation outcome of the redemption.<br />

Family/ Grouping Field Name Value Application method Definition Priority<br />

Event - Details of the<br />

Event<br />

Proceeds - Cash<br />

Proceeds<br />

ISIN [ISIN] (blank) A 12-digit security identification code comprised of a 2-digit ISO 3166<br />

country code, a 9-digit national number (e.g. cusip) and a 1-digit 'check<br />

number'.<br />

M<br />

Security Name (blank) (blank) Description of the financial instrument as provided by the agent. M<br />

CAEV REDM (blank) Corporate action event indicator M<br />

CAOP CASH (blank) CASH: Cash M<br />

Calculation Agent [NAME], [CITY LOCATION] (blank) An agent appointed by the issuer to process and disseminate coupon<br />

rate fixing or redemption information and to determine the amount<br />

payable under a security.<br />

M<br />

Paying Agent (Principal)<br />

(PPA)<br />

Calculation Agent Contact<br />

Details<br />

Paying Agent (Principal)<br />

Contact Details<br />

ISIN [ISIN] (blank) A 12-digit security identification code comprised of a 2-digit ISO 3166<br />

country code, a 9-digit national number (e.g. cusip) and a 1-digit 'check<br />

number'.<br />

M<br />

Security Name (blank) (blank) Description of the financial instrument as provided by the agent. M<br />

Contact Name Name at local settlement agent/market entity (blank) General:<br />

The details (name, e-mail address and/or telephone number) at the<br />

agent in case further clarifications are required.<br />

O<br />

Name at original executing Agent entity (blank) General:<br />

The details (name, e-mail address and/or telephone number) at the<br />

agent in case further clarifications are required.<br />

M<br />

CAEV REDM (blank) Corporate action event indicator M<br />

CAOP CASH (blank) CASH: Indicates final redemption will occur in Cash, following<br />

fixing/valuation<br />

M<br />

CASE (blank) CASE: Cash and Securities - Indicates final redemption settling in<br />

Securities WITH Cash Fractions payable, following fixing/valuation<br />

M<br />

SECU (blank) SECU: Securities - Indicates final redemption will occur in Securities,<br />

WITHOUT Cash Fractions payable, following fixing/valuation<br />

Fixing or Valuation Date [DATE] If there is a fixing or valuation to be actioned,<br />

this field is mandatory<br />

FOREX Rate (blank) If denomination currency differs from payable<br />

currency of underlying security<br />

The date that will be considered to calculate the parameters and<br />

components for calculation of the proceeds amount.<br />

The foreign exchange rate applicable between parent and underlying<br />

securities that must be used to calculate ratio.<br />

Charges/Fees Y, N If Charges/Fees apply Indicator highlighting if charges/fees may be payable in order to receive C<br />

settlement consideration, e.g. SDRT, Registration charges, etc.<br />

Generic Cash Price per<br />

Product Received<br />

[NAME], [CITY LOCATION] (blank) An agent appointed by the issuer to process the cash payments to be M<br />

made by the issuer (collection of coupon, redemption or other monies)<br />

related to a security.<br />

Free text (blank) Contains the details (name, e-mail address and/ or telephone number) M<br />

of the sender at the agent in case further clarifications are required.<br />

Free text (blank) Contains the details (name, e-mail address and/or telephone number)<br />

of sender at the agent in case further clarifications are required.<br />

Notification Version [NUMBER] Required in case of amendment/ update to<br />

previous notification<br />

Identification of an update/ amendment to be made on information<br />

received for current payment. Each amendment should be numbered<br />

chronologically.<br />

Agent Reference Free text (blank) Reference used by the agent to track the trade referred to. O<br />

Proceeds - Main<br />

Proceeds Information<br />

Final Maturity Date [DATE] (blank) Planned final repayment date known at the time of issuance. M<br />

Proceeds - Main<br />

Proceeds Ratio<br />

Value Date [DATE] (blank) Date/time at which cash becomes available to the account owner (in a<br />

credit entry), or cease to be available to the account owner (in a debit<br />

entry). It is the effective payment date as adjusted in case the<br />

scheduled date falls on a non business day.<br />

Payment Currency [CCY] (blank) The ISO currency in which the payment may or must be done, totally or M<br />

partially<br />

Previous Pool Factor [%] Required if partial redemption occurred Factor used to calculate the value of the outstanding principal of the<br />

financial instrument (for factored securities) until the next redemption<br />

(factor) date.<br />

C<br />

Determination Date [DATE] Required if Category 1 sec. and if available for The date on which the payable amount will be determined by combining C<br />

Category 2 sec. (see MPB)<br />

the elements mathematically calculated on fixing date and the last<br />

elements of the formula (it may or may not coincide with the fixing<br />

date). It is often quite close to payment date.<br />

Total Outstanding Amount [AMOUNT] or [QUANTITY] (blank) Total original amount or quantity of units taken into consideration for<br />

the payment<br />

O<br />

Total Cash Amount Payable [AMOUNT] (blank) Total amount of cash to be paid by the issuer for this event based on<br />

the total outstanding amount.<br />

O<br />

Formula / Additional Details Free text (blank) Details of formula used for the income calculations (including<br />

observation periods, margin %, index,…) or any details related to the<br />

payment.<br />

O<br />

Redemption Price [%], [AMOUNT] (blank) Code used to specify the percentage or price payable per<br />

denomination, i.e. at par, above par or below par.<br />

Expressed in % for issues in Nominal form, in Amount for issues in Unit<br />

form.<br />

M<br />

Amount Payable per<br />

Minimum Denomination<br />

[AMOUNT] (blank) (blank) M<br />

Redemption Premium [AMOUNT], [CCY] If premium applies Cash payment (not interest), in addition to principal, at the redemption C<br />

Amount<br />

of a bond; may be subject to different rates of taxation. Expressed as<br />

an amount per denomination.<br />

[%], [AMOUNT] If Pool Factor (Amortisation) previously paid Generic cash price received per denomination by the underlying<br />

security holder either as a percentage or an amount, depending on the<br />

trading method, taking the pool factor into consideration.<br />

C<br />

(e.g. Redemption Price x Pool Factor= Generic Cash Price per Product C<br />

Received)<br />

Payment Date [DATE] (blank) The date at which entitlements are due to be paid to investors. M<br />

Payment Currency [CCY] If CAOP is CASH or CASE The ISO currency for the payment of the cash proceeds. C<br />

Redemption Price Cash Amount Payable per 1,000 Nominal/per If CAOP is CASH Code used to specify the percentage or price payable per<br />

C<br />

Unit/Cert.<br />

denomination, i.e. at par, above par or below par.<br />

Expressed in % for issues in Nominal form, in Amount for issues in Unit<br />

form.<br />

Proceeds - Security<br />

Proceeds<br />

Proceeds Name Security Name If CAOP = SECU or CASE The name of the securities that represent the proceeds of the exercise. C<br />

Proceeds ISIN [ISIN] If CAOP = SECU or CASE ISIN identification of the securities that represent the proceed of the<br />

exercise.<br />

C<br />

Proceeds Ratio per Ratio per Denomination If CAOP = SECU or CASE The quantity of security proceeds per existing security denomination C<br />

Denomination<br />

(existing security > new security)<br />

Local Market Settlement [BANK, A/C #, SWIFT BIC] (blank) Details of local market settlement agent, i.e. where the securities are O<br />

Details<br />

being delivered from (Bank/Counterparty/BIC code)<br />

Proceeds - Fractions Cash Fractions Amount (per (blank) If disposition of fractions = CINL Cash amount per multiple denomination that corresponds to the C<br />

denomination)<br />

fractional shares<br />

Asset Servicing Checklists “B”: Notification Fields for Predictable Events • May 2010<br />

M<br />

C<br />

M<br />

M<br />

C<br />

C