Scope - Clearstream

Scope - Clearstream

Scope - Clearstream

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MARKET PRACTICE BOOK - ANNEXES<br />

72<br />

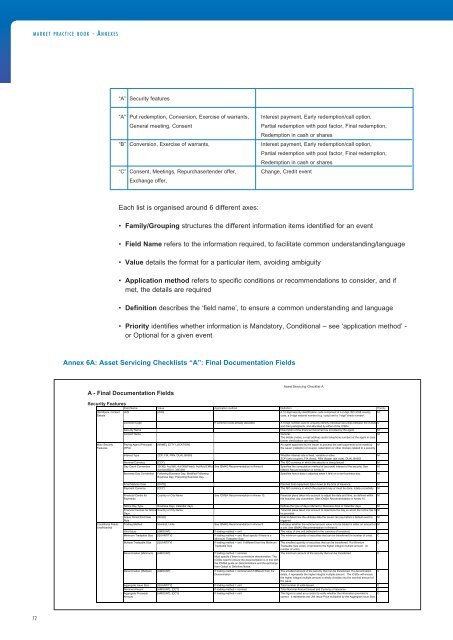

Annex 6A: Asset Servicing Checklists “A”: Final Documentation Fields<br />

A - Final Documentation Fields<br />

Asset Servicing Checklist A<br />

Security Features Field Name Value Application method Definition Priority<br />

Identifyers, Contact<br />

Details<br />

Main Security<br />

Features<br />

Conditional Fields:<br />

Unit/Nominal<br />

“A” Security features<br />

“A” Put redemption, Conversion, Exercise of warrants, Interest payment, Early redemption/call option,<br />

General meeting, Consent Partial redemption with pool factor, Final redemption,<br />

Redemption in cash or shares<br />

“B” Conversion, Exercise of warrants, Interest payment, Early redemption/call option,<br />

Partial redemption with pool factor, Final redemption,<br />

Redemption in cash or shares<br />

“C” Consent, Meetings, Repurchase/tender offer, Change, Credit event<br />

Exchange offer,<br />

Each list is organised around 6 different axes:<br />

• Family/Grouping structures the different information items identified for an event<br />

• Field Name refers to the information required, to facilitate common understanding/language<br />

• Value details the format for a particular item, avoiding ambiguity<br />

• Application method refers to specific conditions or recommendations to consider, and if<br />

met, the details are required<br />

• Definition describes the ‘field name’, to ensure a common understanding and language<br />

• Priority identifies whether information is Mandatory, Conditional – see ‘application method’ -<br />

or Optional for a given event<br />

ISIN [ISIN] (blank) A 12-digit security identification code comprised of a 2-digit ISO 3166 country<br />

code, a 9-digit national number (e.g. cusip) and a 1-digit 'check number'.<br />

Common Code (blank) If Common code already allocated A 9-digit number used to uniquely identify individual securities between the ICSDs C<br />

and their participants, and allocated by either of the ICSDs.<br />

Security Name (blank) (blank) Description of the financial instrument as provided by the agent. M<br />

Contact Name (blank) (blank) General:<br />

The details (name, e-mail address and/or telephone number) at the agent in case<br />

further clarifications are required.<br />

M<br />

Paying Agent (Principal)<br />

(PPA)<br />

[NAME], [CITY LOCATION] (blank) An agent appointed by the issuer to process the cash payments to be made by<br />

the issuer (collection of coupon, redemption or other monies) related to a security.<br />

M<br />

Interest Type ZCP, FIX, FRN, DUAL BASIS (blank) Whether interest rate is fixed, variable or other.<br />

ZCP (zero coupon), FIX (fixed), FRN (floater rate note), DUAL BASIS<br />

M<br />

Nominal Currency [CCY] (blank) The ISO currency in which the security is being Issued M<br />

Day Count Convention 30/360, Act/360, Act/365(Fixed), Act/Act(ICMA), See ISMAG Recommendation in Annex 8 Specifies the computation method of (accrued) interest of the security. See M<br />

Act/Act(ISDA), 30E/360, …<br />

ISMAG Recommendation in Annex 8<br />

Business Day Convention Following Business Day, Modified Following<br />

Business Day, Preceding Business Day, …<br />

(blank) Specifies how a date is adjusted when it falls on a non-business day. M<br />

Final Maturity Date [DATE] (blank) Planned final repayment date known at the time of issuance. M<br />

Payment Currency [CCY] (blank) The ISO currency in which the payment may or must be done, totally or partially M<br />

Financial Centre for<br />

Payments<br />

Country or City Name See ICMSA Recommendation in Annex 10. Financial place taken into account to adjust the date and time, as defined within<br />

the business day convention. See ICMSA Recommendation in Annex 10.<br />

Notice Day Type Business days, Calendar days (blank) Defines the type of days referred to: Business days or Calendar days M<br />

Financial Centres for Notice<br />

Days<br />

Grace Period End Date<br />

Rule<br />

Country or City Name (blank) Financial place taken into account to determine the day on which the notice has to M<br />

be provided.<br />

[RULE] (blank) Rule to determine the ultimate date the issuer can pay before a default event is<br />

triggered<br />

Trading Method Nominal, Units See ISMAG Recommendation in Annex 9. Indicates whether the notional amount value is to be traded in either an amount or M<br />

a unit. See ISMAG Recommendation in Annex 9.<br />

Unit Value [AMOUNT] If trading method = unit The value of one unit (reflected in the currency of issuance) C<br />

Minimum Tradeable Size [QUANTITY] If trading method = unit. Must specify if there is a<br />

Minimum Tradeable Size.<br />

The minimum quantity of securities that can be transferred (in number of units). C<br />

Multiple Tradeable Size [QUANTITY] If trading method = unit. If different from the Minimum<br />

Tradeable Size<br />

The smallest quantity of securities that can be transferred. If a Minimum<br />

Tradeable Size exists, it represents the higher integral multiple amount. (in<br />

number of units).<br />

Denomination (Minimum) [AMOUNT] If trading method = nominal.<br />

Must specify if there is a minimum denomination. The<br />

ICSDs need to ensure the documentation is in line with<br />

the ICMSA guide on Denominations and the exchange<br />

from Global to Definitive Notes.<br />

The minimum amount of the security that can be transferred. C<br />

Denomination (Multiple) [AMOUNT] If trading method = nominal and if different from the<br />

Denomination<br />

The smallest amount of the security that can be transferred. If a denomination<br />

exists, it represents the higher integral multiple amount. The ICSDs will ensure<br />

the higher integral multiple amount is wholly divisible into the nominal amount of<br />

the issue.<br />

Aggregate Issue Size [QUANTITY] If trading method = unit Total number of units issued. C<br />

Nominal Amount [AMOUNT], [CCY] If trading method = nominal Total Nominal Amount issued and Currency of issuance. C<br />

Aggregate Proceeds<br />

Amount<br />

[AMOUNT], [CCY] If trading method = unit This figure is used as a control to verify whether the information provided is<br />

correct. It represents the Unit Issue Price multiplied by the Aggregate Issue Size.<br />

C<br />

M<br />

M<br />

M<br />

C<br />

C