Scope - Clearstream

Scope - Clearstream

Scope - Clearstream

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

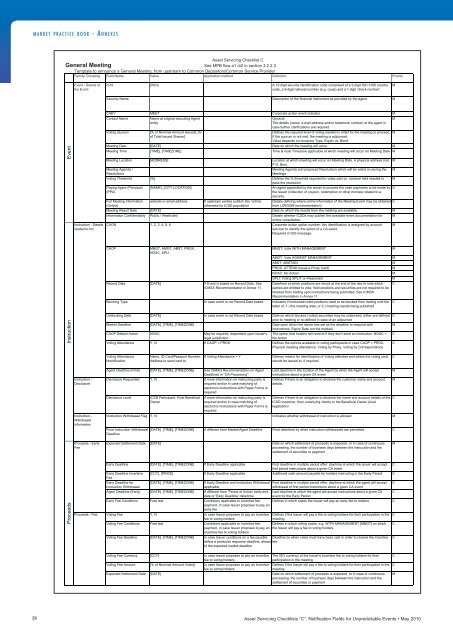

MARKET PRACTICE BOOK - ANNEXES<br />

84<br />

Asset Servicing Checklist C<br />

General Meeting See MPB flow a1 /a2 in section 3.2.2.3<br />

Template to announce a General Meeting, from upstream to Common Depository/Common Service Provider<br />

Family/ Grouping Field Name Value Application method Definition Priority<br />

Instruction Event<br />

Proceeds<br />

Event - Details of<br />

the Event<br />

Instruction - Details<br />

related to Inx<br />

Instruction -<br />

Disclosure<br />

Instruction -<br />

Withdrawal<br />

information<br />

Proceeds - Early<br />

Fee<br />

ISIN [ISIN] (blank) A 12-digit security identification code comprised of a 2-digit ISO 3166 country<br />

code, a 9-digit national number (e.g. cusip) and a 1-digit 'check number'.<br />

Security Name (blank) (blank) Description of the financial instrument as provided by the agent. M<br />

CAEV MEET (blank) Corporate action event indicator M<br />

Contact Name Name at original executing Agent (blank) General:<br />

M<br />

entity<br />

The details (name, e-mail address and/or telephone number) at the agent in<br />

case further clarifications are required.<br />

Voting Quorum [% of Nominal Amount Issued], [% (blank) Defines the required level of voting needed in order for the meeting to proceed. M<br />

of Total Issued Shares]<br />

If the quorum is not met, the meeting is adjourned.<br />

Value depends on Issuance Type, Equity vs. Bond.<br />

Meeting Date [DATE] (blank) Date on which the meeting will occur M<br />

Meeting Time [TIME], [TIMEZONE] (blank) Time & local Timezone applicable at which meeting will occur on Meeting Date M<br />

Meeting Location [ADDRESS] (blank) Location at which meeting will occur on Meeting Date. A physical address (not<br />

P.O. Box).<br />

Meeting Agenda /<br />

Resolutions<br />

(blank) (blank) Meeting Agenda and proposed Resolutions which will be voted on during the<br />

Meetings<br />

Voting Threshold [%] (blank) Defines the % threshold required for votes cast vs. nominal held needed to<br />

pass the resolution<br />

Paying Agent (Principal)<br />

(PPA)<br />

Full Meeting Information<br />

(Online)<br />

[NAME], [CITY LOCATION] (blank) An agent appointed by the issuer to process the cash payments to be made by<br />

the issuer (collection of coupon, redemption or other monies) related to a<br />

security.<br />

website or email address If upstream parties publish this 'online',<br />

otherwise for ICSD population<br />

Details defining where online information of the Meeting Event may be obtained C<br />

from (JWGGM recommendation)<br />

Meeting Result Date [DATE] (blank) Date on which the results from the meeting are available. M<br />

Information Confidentiality Public / Restricted (blank) Details whether ICSDs may publish the available event documentation for<br />

online consultation.<br />

M<br />

CAON 1, 2, 3, 4, 5, 6 (blank) Corporate action option number: this identification is assigned by account<br />

servicer to identify the option of a CA event.<br />

Required in ISO message.<br />

M<br />

CAOP MNGT, AMGT, ABST, PROX,<br />

NOAC, SPLI<br />

(blank) MNGT: Vote WITH MANAGEMENT M<br />

AMGT: Vote AGAINST MANAGEMENT M<br />

ABST: ABSTAIN M<br />

PROX: ATTEND (Issue a Proxy Card) M<br />

NOAC: No Action M<br />

SPLI: Voting SPLIT on Resolution M<br />

Record Date [DATE] If Event is based on Record Date. See Date/time at which positions are struck at the end of the day to note which C<br />

ICMSA Recommendation in Annex 11. parties are entitled to vote, held positions and securities are not required to be<br />

blocked from trading upon instructions being submitted. See ICMSA<br />

Recommendation in Annex 11.<br />

Blocking Type (blank) In case event is not Record Date based Indicates if instructed/voted positions need to be blocked from trading until the C<br />

latter of, 1.) the meeting date, or 2.) meeting results being published<br />

Unblocking Date [DATE] In case event is not Record Date based Date on which blocked (voted) securities may be unblocked, either pre-defined<br />

prior to meeting or re-defined in case of an adjourned<br />

Market Deadline [DATE], [TIME], [TIMEZONE] (blank) Date upon which the issuer has set as the deadline to respond with<br />

instructions. Expiry Date (on the market).<br />

CAOP Default Action NOAC May be required, dependent upon Issuer's<br />

legal jurisdiction.<br />

The option that holders will receive if they don't send an instruction: NOAC =<br />

No Action<br />

Voting Attendance Y, N If CAOP = PROX Defines the options available to voting participants in case CAOP = PROX.<br />

Physical meeting attendance, Voting by Proxy, Voting by Correspondence<br />

Voting Attendance<br />

Identification<br />

Name, ID Card/Passport Number,<br />

Address to send card to<br />

Agent Deadline (Final) [DATE], [TIME], [TIMEZONE] See ISMAG Recommendation on Agent<br />

Deadlines in "CA Processing".<br />

Disclosure Requested Y, N If more information on instructing party is<br />

required and/or in case matching of<br />

electronic instructions with Paper Forms is<br />

required<br />

Disclosure Level ICSD Participant, Final Beneficial<br />

Owner<br />

If Voting Attendance = Y Defines means for identification of Voting attendee and where the voting card<br />

should be issued to, if required.<br />

If more information on instructing party is<br />

required and/or in case matching of<br />

electronic instructions with Paper Forms is<br />

required<br />

Last day/time in the location of the Agent by when the Agent will accept<br />

instructions about a given CA event<br />

Defines if there is an obligation to disclose the customer name and account<br />

details.<br />

Defines if there is an obligation to disclose the name and account details of the<br />

ICSD customer, their underlying clients or the Beneficial Owner (local<br />

legislation)<br />

Instruction Withdrawal Flag Y, N (blank) Indicates whether withdrawal of instruction is allowed M<br />

Final Instruction Withdrawal<br />

Deadline<br />

[DATE], [TIME], [TIMEZONE] If different from Market/Agent Deadline Final date/time by when instruction withdrawals are permitted C<br />

Expected Settlement Date [DATE] (blank) Date on which settlement of proceeds is expected, or in case of continuous<br />

processing, the number of business days between the instruction and the<br />

settlement of securities or payment<br />

Early Deadline [DATE], [TIME], [TIMEZONE] If Early Deadline applicable First deadline in multiple period offer: day/time at which the issuer will accept<br />

first period instructions about a given CA event<br />

C<br />

Early Deadline Incentive<br />

Fee<br />

[CCY], [PRICE] If Early Deadline applicable Additional cash amount payable for holders instructing in the Early Period C<br />

Early Deadline for<br />

Instruction Withdrawal<br />

[DATE], [TIME], [TIMEZONE] If Early Deadline and Instruction Withdrawal<br />

applicable<br />

Agent Deadline (Early) [DATE], [TIME], [TIMEZONE] If different from 'Period of Action' early-end<br />

date or 'Early Deadline' date/time<br />

First deadline in multiple period offer: day/time at which the agent will accept<br />

withdrawal of first period instructions about a given CA event<br />

Last day/time at which the agent will accept instructions about a given CA<br />

event for the Early Period<br />

Early Fee Conditions Free text Conditions applicable to incentive fee<br />

payment, in case Issuer proposes to pay an<br />

early fee<br />

Defines in which cases the Issuer will pay an early fee to holders C<br />

Proceeds - Fee Voting Fee Y, N In case Issuer proposes to pay an incentive<br />

fee to voting holders<br />

Defines if the Issuer will pay a fee to voting holders for their participation in the<br />

meeting<br />

Voting Fee Conditions Free text Conditions applicable to incentive fee Defines in which voting cases, e.g. WITH MANAGEMENT [MNGT] on which<br />

payment, in case Issuer proposes to pay an the Issuer will pay a fee to voting holders<br />

incentive fee to voting holders<br />

Voting Fee Deadline [DATE], [TIME], [TIMEZONE] In case Issuer conditions on a fee payable Deadline by when votes must have been cast in order to receive the incentive<br />

define a particular response deadline, ahead fee<br />

of the expected market deadline<br />

Voting Fee Currency [CCY] In case Issuer proposes to pay an incentive<br />

fee to voting holders<br />

Voting Fee Amount [% of Nominal Amount Voted] In case Issuer proposes to pay an incentive<br />

fee to voting holders<br />

The ISO currency of the Issuer's incentive fee to voting holders for their<br />

participation in the meeting<br />

Defines if the Issuer will pay a fee to voting holders for their participation in the<br />

meeting<br />

Expected Settlement Date [DATE] (blank) Date on which settlement of proceeds is expected, or in case of continuous<br />

processing, the number of business days between the instruction and the<br />

settlement of securities or payment<br />

Asset Servicing Checklists “C”: Notification Fields for Unpredictable Events • May 2010<br />

M<br />

M<br />

M<br />

M<br />

O<br />

C<br />

M<br />

C<br />

C<br />

C<br />

M<br />

M<br />

C<br />

M<br />

C<br />

C<br />

C<br />

C<br />

C<br />

C<br />

C<br />

M