Scope - Clearstream

Scope - Clearstream

Scope - Clearstream

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

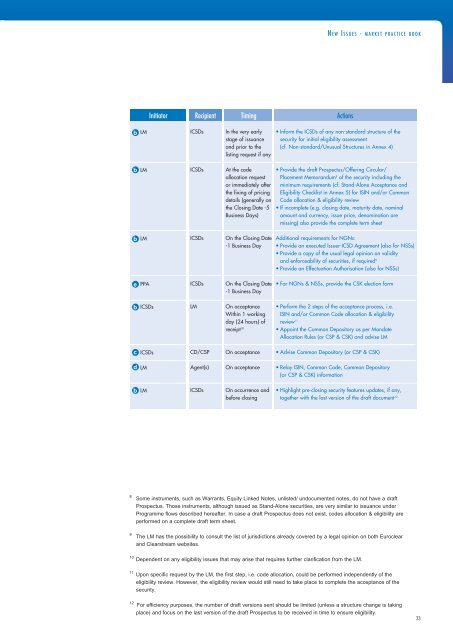

LM<br />

b LM<br />

b LM<br />

e PPA<br />

b ICSDs<br />

c ICSDs<br />

d<br />

LM<br />

b LM<br />

Initiator Recipient Timing<br />

ICSDs<br />

ICSDs<br />

ICSDs<br />

ICSDs<br />

LM<br />

CD/CSP<br />

Agent(s)<br />

ICSDs<br />

In the very early<br />

stage of issuance<br />

and prior to the<br />

listing request if any<br />

At the code<br />

allocation request<br />

or immediately after<br />

the fixing of pricing<br />

details (generally on<br />

the Closing Date -5<br />

Business Days)<br />

On the Closing Date<br />

-1 Business Day<br />

On the Closing Date<br />

-1 Business Day<br />

On acceptance<br />

Within 1 working<br />

day (24 hours) of<br />

receipt 10<br />

On acceptance<br />

On acceptance<br />

On occurrence and<br />

before closing<br />

N EW ISSUES - MARKET PRACTICE BOOK<br />

Actions<br />

• Inform the ICSDs of any non-standard structure of the<br />

security for initial eligibility assessment<br />

(cf. Non-standard/Unusual Structures in Annex 4)<br />

• Provide the draft Prospectus/Offering Circular/<br />

Placement Memorandum 8 of the security including the<br />

minimum requirements (cf. Stand-Alone Acceptance and<br />

Eligibility Checklist in Annex 5) for ISIN and/or Common<br />

Code allocation & eligibility review<br />

• If incomplete (e.g. closing date, maturity date, nominal<br />

amount and currency, issue price, denomination are<br />

missing) also provide the complete term sheet<br />

Additional requirements for NGNs:<br />

• Provide an executed Issuer-ICSD Agreement (also for NSSs)<br />

• Provide a copy of the usual legal opinion on validity<br />

and enforceability of securities, if required 9<br />

• Provide an Effectuation Authorisation (also for NSSs)<br />

• For NGNs & NSSs, provide the CSK election form<br />

• Perform the 2 steps of the acceptance process, i.e.<br />

ISIN and/or Common Code allocation & eligibility<br />

review 11<br />

• Appoint the Common Depository as per Mandate<br />

Allocation Rules (or CSP & CSK) and advise LM<br />

• Advise Common Depository (or CSP & CSK)<br />

• Relay ISIN, Common Code, Common Depository<br />

(or CSP & CSK) information<br />

• Highlight pre-closing security features updates, if any,<br />

together with the last version of the draft document 12<br />

8 Some instruments, such as Warrants, Equity Linked Notes, unlisted/ undocumented notes, do not have a draft<br />

Prospectus. Those instruments, although issued as Stand-Alone securities, are very similar to issuance under<br />

Programme flows described hereafter. In case a draft Prospectus does not exist, codes allocation & eligibility are<br />

performed on a complete draft term sheet.<br />

9<br />

The LM has the possibility to consult the list of jurisdictions already covered by a legal opinion on both Euroclear<br />

and <strong>Clearstream</strong> websites.<br />

10 Dependent on any eligibility issues that may arise that requires further clarification from the LM.<br />

11 Upon specific request by the LM, the first step, i.e. code allocation, could be performed independently of the<br />

eligibility review. However, the eligibility review would still need to take place to complete the acceptance of the<br />

security.<br />

12<br />

For efficiency purposes, the number of draft versions sent should be limited (unless a structure change is taking<br />

place) and focus on the last version of the draft Prospectus to be received in time to ensure eligibility.<br />

23