Scope - Clearstream

Scope - Clearstream

Scope - Clearstream

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MARKET PRACTICE BOOK - CORPORATE ACTIONS<br />

36<br />

3.2.<br />

3.2.1.<br />

3.2.1.1.<br />

In addition to these classifications and in an effort of harmonisation undertaken on local<br />

European markets/Central Securities Depositories, the International Organization for<br />

Normalization (ISO) regrouped all corporate action events under three broad categories.<br />

These are based on what happens to the underlying securities of the holder:<br />

• Distribution: an event when the issuer delivers security proceeds to the holders of the<br />

security. The event does not affect the holdings;<br />

• Reorganisation: an event when the issuer replaces all, or some, of an underlying<br />

security with one or more different resource(s); and<br />

• General: an event where there is typically no movement of proceeds. The event could<br />

be for information purposes only, or may require some action on the part of the holders<br />

of a security<br />

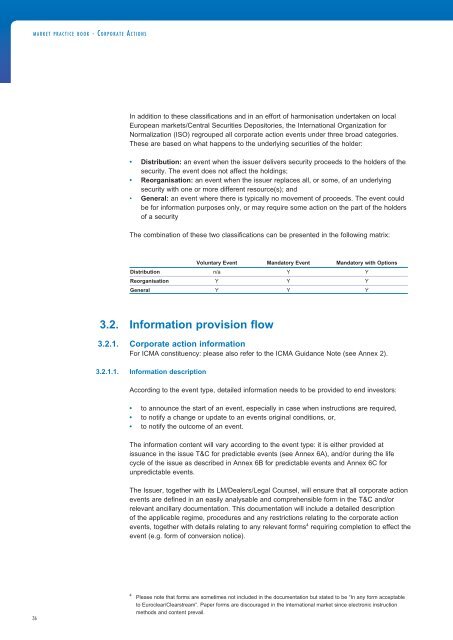

The combination of these two classifications can be presented in the following matrix:<br />

Voluntary Event Mandatory Event Mandatory with Options<br />

Distribution n/a Y Y<br />

Reorganisation Y Y Y<br />

General Y Y Y<br />

Information provision flow<br />

Corporate action information<br />

For ICMA constituency: please also refer to the ICMA Guidance Note (see Annex 2).<br />

Information description<br />

According to the event type, detailed information needs to be provided to end investors:<br />

• to announce the start of an event, especially in case when instructions are required,<br />

• to notify a change or update to an events original conditions, or,<br />

• to notify the outcome of an event.<br />

The information content will vary according to the event type: it is either provided at<br />

issuance in the issue T&C for predictable events (see Annex 6A), and/or during the life<br />

cycle of the issue as described in Annex 6B for predictable events and Annex 6C for<br />

unpredictable events.<br />

The Issuer, together with its LM/Dealers/Legal Counsel, will ensure that all corporate action<br />

events are defined in an easily analysable and comprehensible form in the T&C and/or<br />

relevant ancillary documentation. This documentation will include a detailed description<br />

of the applicable regime, procedures and any restrictions relating to the corporate action<br />

events, together with details relating to any relevant forms 4 requiring completion to effect the<br />

event (e.g. form of conversion notice).<br />

4 Please note that forms are sometimes not included in the documentation but stated to be “In any form acceptable<br />

to Euroclear/<strong>Clearstream</strong>”. Paper forms are discouraged in the international market since electronic instruction<br />

methods and content prevail.