russian software developing industry and software exports

russian software developing industry and software exports

russian software developing industry and software exports

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 2.<br />

Volume <strong>and</strong> Structure of Russian Software Export<br />

According to the Gartner poll, over 70% company<br />

executives in Western Europe responsible for IT<br />

services indicated budget restraints <strong>and</strong> costs<br />

reduction as the main priority for 2009, which is 17.5%<br />

more against 2008. Many of these executives rely on<br />

outsourcing as a real way of business optimization.<br />

Moreover, a big proportion of respondents (36%) are<br />

only learning to use outsourcing.<br />

Simultaneously, the crisis forces clients to require<br />

discounts, which may lead to price wars. Gartner<br />

expects that by 2010 the cost of IT outsourcing<br />

services would drop by 5-20%.<br />

Apparently, Russian companies have higher costs<br />

on developer salaries than their competitors in South-<br />

East Asia (mainly China <strong>and</strong> India). But they have<br />

certain advantages – higher qualifications of staff,<br />

geographical <strong>and</strong> cultural proximity to key markets<br />

(Europe <strong>and</strong> USA), which results into lower total costs<br />

of projects.<br />

Additionally, the fall in the ruble led to the<br />

decrease in salaries expressed in dollars while major<br />

Russia’s competitors have not faced the devaluation<br />

of national currencies. In the course of price wars the<br />

changes taking place in the money market are still in<br />

favor of Russia developers. The reduction of lease<br />

costs on premises also improves the competitiveness<br />

of Russian <strong>software</strong> companies. Another plus is the<br />

increase in the number of programmers on the labor<br />

market due to the reduction of IT services by Russian<br />

enterprises.<br />

The attractiveness of internal markets of IT<br />

services is growing for Chinese <strong>and</strong> Indian companies,<br />

since unlike the Russian market these markets are<br />

continuously growing (or there are big hopes for<br />

their growth).<br />

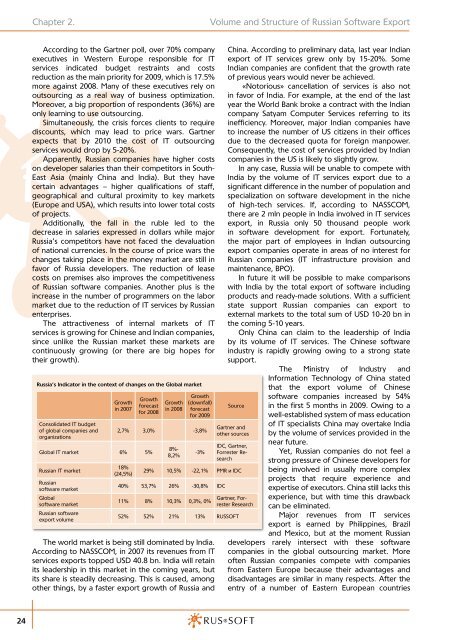

Russia’s Indicator in the context of changes on the Global market<br />

Consolidated IT budget<br />

of global companies <strong>and</strong><br />

organizations<br />

Growth<br />

in 2007<br />

Growth<br />

forecast<br />

for 2008<br />

Global IT market 6% 5%<br />

Russian IT market<br />

Russian<br />

<strong>software</strong> market<br />

Global<br />

<strong>software</strong> market<br />

Russian <strong>software</strong><br />

export volume<br />

Growth<br />

in 2008<br />

Growth<br />

(downfall)<br />

forecast<br />

for 2009<br />

2,7% 3,0% -3,8%<br />

18%<br />

(24,5%)<br />

8%-<br />

8,2%<br />

The world market is being still dominated by India.<br />

According to NASSCOM, in 2007 its revenues from IT<br />

services <strong>exports</strong> topped USD 40.8 bn. India will retain<br />

its leadership in this market in the coming years, but<br />

its share is steadily decreasing. This is caused, among<br />

other things, by a faster export growth of Russia <strong>and</strong><br />

-3%<br />

China. According to preliminary data, last year Indian<br />

export of IT services grew only by 15-20%. Some<br />

Indian companies are confident that the growth rate<br />

of previous years would never be achieved.<br />

«Notorious» cancellation of services is also not<br />

in favor of India. For example, at the end of the last<br />

year the World Bank broke a contract with the Indian<br />

company Satyam Computer Services referring to its<br />

inefficiency. Moreover, major Indian companies have<br />

to increase the number of US citizens in their offices<br />

due to the decreased quota for foreign manpower.<br />

Consequently, the cost of services provided by Indian<br />

companies in the US is likely to slightly grow.<br />

In any case, Russia will be unable to compete with<br />

India by the volume of IT services export due to a<br />

significant difference in the number of population <strong>and</strong><br />

specialization on <strong>software</strong> development in the niche<br />

of high-tech services. If, according to NASSCOM,<br />

there are 2 mln people in India involved in IT services<br />

export, in Russia only 50 thous<strong>and</strong> people work<br />

in <strong>software</strong> development for export. Fortunately,<br />

the major part of employees in Indian outsourcing<br />

export companies operate in areas of no interest for<br />

Russian companies (IT infrastructure provision <strong>and</strong><br />

maintenance, ВРО).<br />

In future it will be possible to make comparisons<br />

with India by the total export of <strong>software</strong> including<br />

products <strong>and</strong> ready-made solutions. With a sufficient<br />

state support Russian companies can export to<br />

external markets to the total sum of USD 10-20 bn in<br />

the coming 5-10 years.<br />

Only China can claim to the leadership of India<br />

by its volume of IT services. The Chinese <strong>software</strong><br />

<strong>industry</strong> is rapidly growing owing to a strong state<br />

support.<br />

The Ministry of Industry <strong>and</strong><br />

Information Technology of China stated<br />

that the export volume of Chinese<br />

<strong>software</strong> companies increased by 54%<br />

Source<br />

Gartner <strong>and</strong><br />

other sources<br />

IDC, Gartner,<br />

Forrester Research<br />

29% 10,5% -22,1% PMR и IDC<br />

40% 53,7% 26% -30,8% IDC<br />

11% 8% 10,3% 0,3%, 0%<br />

Gartner, Forrester<br />

Research<br />

52% 52% 21% 13% RUSSOFT<br />

in the first 5 months in 2009. Owing to a<br />

well-established system of mass education<br />

of IT specialists China may overtake India<br />

by the volume of services provided in the<br />

near future.<br />

Yet, Russian companies do not feel a<br />

strong pressure of Chinese developers for<br />

being involved in usually more complex<br />

projects that require experience <strong>and</strong><br />

expertise of executors. China still lacks this<br />

experience, but with time this drawback<br />

can be eliminated.<br />

Major revenues from IT services<br />

export is earned by Philippines, Brazil<br />

<strong>and</strong> Mexico, but at the moment Russian<br />

developers rarely intersect with these <strong>software</strong><br />

companies in the global outsourcing market. More<br />

often Russian companies compete with companies<br />

from Eastern Europe because their advantages <strong>and</strong><br />

disadvantages are similar in many respects. After the<br />

entry of a number of Eastern European countries<br />

24