russian software developing industry and software exports

russian software developing industry and software exports

russian software developing industry and software exports

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Chapter 5.<br />

Geographical Distribution <strong>and</strong> Key Vertical Markets<br />

of respondents have been working in this market for<br />

a long time already, <strong>and</strong> 5–10% more companies are<br />

trying to strengthen their positions there, but as a rule<br />

their attempts fail.<br />

Companies with export revenues less than 50% of<br />

total revenue are more than other exporters oriented<br />

at the markets of Ukraine (51%), Belarus (40%) <strong>and</strong><br />

«Other countries of the former USSR» (35%). The<br />

number of records of far-abroad markets by these<br />

companies is below average (only few of them view<br />

developed countries as key markets).<br />

Naturally, the situation is reverse for companies<br />

with export revenues over 51%. It will be logical<br />

to conclude that small companies are more often<br />

present in the markets close to Russia. Almost half<br />

of the largest companies with the turnover over<br />

20 MUSD operate in all markets, but they focus on the<br />

advanced markets of America <strong>and</strong> Europe <strong>and</strong> do not<br />

regard as their top priorities the markets of Ukraine,<br />

Belarus, South-East Asia <strong>and</strong> the region «Australia,<br />

Africa <strong>and</strong> South America».<br />

St. Petersburg companies are to a greater extent<br />

than other respondents oriented at European<br />

markets. Around one third of St. Petersburg<br />

companies are present in the neighboring market of<br />

Northern Europe (primarily in Finl<strong>and</strong>).<br />

Moscow companies (mainly small <strong>and</strong> mediumsized)<br />

most frequently named as their key markets<br />

Ukraine, Belarus <strong>and</strong> «Other countries of the former<br />

USSR».<br />

In 2009, the significance of markets for <strong>software</strong><br />

developers should not drastically change. A small<br />

part of respondents expects the decline in dem<strong>and</strong><br />

in the markets of Russia <strong>and</strong> other countries of the<br />

former USSR caused by consequences of the crisis for<br />

their economies dependent on the production of raw<br />

materials. Therefore, they are planning to switch to<br />

markets more distant from Russia. It does not make<br />

sense to make any conclusions about the year 2010<br />

since many of the respondents were not ready to<br />

answer this question due to the growing crisis.<br />

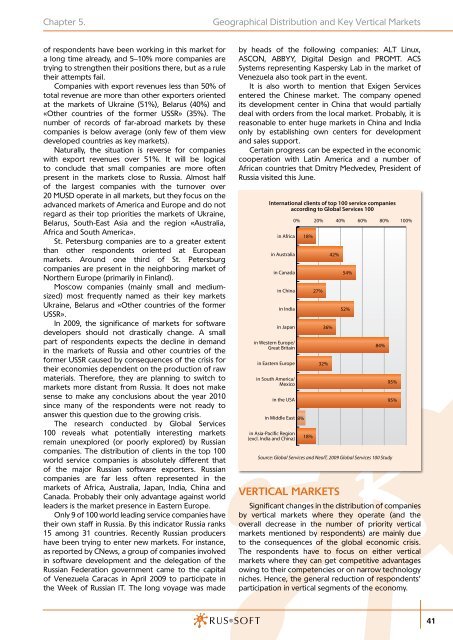

The research conducted by Global Services<br />

100 reveals what potentially interesting markets<br />

remain unexplored (or poorly explored) by Russian<br />

companies. The distribution of clients in the top 100<br />

world service companies is absolutely different that<br />

of the major Russian <strong>software</strong> exporters. Russian<br />

companies are far less often represented in the<br />

markets of Africa, Australia, Japan, India, China <strong>and</strong><br />

Canada. Probably their only advantage against world<br />

leaders is the market presence in Eastern Europe.<br />

Only 9 of 100 world leading service companies have<br />

their own staff in Russia. By this indicator Russia ranks<br />

15 among 31 countries. Recently Russian producers<br />

have been trying to enter new markets. For instance,<br />

as reported by CNews, a group of companies involved<br />

in <strong>software</strong> development <strong>and</strong> the delegation of the<br />

Russian Federation government came to the capital<br />

of Venezuela Caracas in April 2009 to participate in<br />

the Week of Russian IT. The long voyage was made<br />

by heads of the following companies: ALT Linux,<br />

ASCON, ABBYY, Digital Design <strong>and</strong> PROMT. ACS<br />

Systems representing Kaspersky Lab in the market of<br />

Venezuela also took part in the event.<br />

It is also worth to mention that Exigen Services<br />

entered the Chinese market. The company opened<br />

its development center in China that would partially<br />

deal with orders from the local market. Probably, it is<br />

reasonable to enter huge markets in China <strong>and</strong> India<br />

only by establishing own centers for development<br />

<strong>and</strong> sales support.<br />

Certain progress can be expected in the economic<br />

cooperation with Latin America <strong>and</strong> a number of<br />

African countries that Dmitry Medvedev, President of<br />

Russia visited this June.<br />

International clients of top 100 service companies<br />

according to Global Services 100<br />

in Africa<br />

in Australia<br />

in Canada<br />

in China<br />

in India<br />

in Japan<br />

in Western Europe/<br />

Great Britain<br />

in Eastern Europe<br />

in South America/<br />

Mexico<br />

in the USA<br />

in Middle East 8%<br />

in Asia-Pacific Region<br />

(excl. India <strong>and</strong> China)<br />

18%<br />

18%<br />

27%<br />

36%<br />

32%<br />

42%<br />

VERTICAL MARKETS<br />

0% 20% 40% 60% 80% 100%<br />

54%<br />

52%<br />

84%<br />

Source: Global Services <strong>and</strong> NeoIT, 2009 Global Services 100 Study<br />

95%<br />

95%<br />

Significant changes in the distribution of companies<br />

by vertical markets where they operate (<strong>and</strong> the<br />

overall decrease in the number of priority vertical<br />

markets mentioned by respondents) are mainly due<br />

to the consequences of the global economic crisis.<br />

The respondents have to focus on either vertical<br />

markets where they can get competitive advantages<br />

owing to their competencies or on narrow technology<br />

niches. Hence, the general reduction of respondents’<br />

participation in vertical segments of the economy.<br />

41