russian software developing industry and software exports

russian software developing industry and software exports

russian software developing industry and software exports

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 3.<br />

Major Trends in the Russian Software Development Industry<br />

The consequences of the global financial crisis have<br />

overshadowed almost all trends that were previously<br />

characteristic of the Russian <strong>software</strong> <strong>industry</strong>. It can<br />

be said that during the survey respondents named<br />

the crisis the major cause of all changes taking place<br />

in the sector. All other observed factors have become<br />

less significant.<br />

Indeed, the majority of companies cannot single<br />

out any other important trends in the situation of<br />

uncertainty (when the forecast of analysts change<br />

every month). During the crisis it is much more difficult<br />

to answer the question about what is going on in the<br />

market <strong>and</strong> describe its general trends.<br />

In this connection, comparisons with the results of<br />

the last year’s poll are not always justified. However,<br />

comparisons of 2009 answers related to every trend<br />

can give food for thought. For instance, it should be<br />

noted that respondents still view sales in the home<br />

market more promising than export operations (44%<br />

against 19%). And this is despite the fact that the IT<br />

market in Russia reduced due to the crisis to a greater<br />

extent than in the USA<br />

<strong>and</strong> Western Europe, <strong>and</strong> Russian exporters are<br />

primarily oriented at Western countries.<br />

In previous years priority levels of sales in the home<br />

market <strong>and</strong> export operations were comparable.<br />

These two trends were named as key by around<br />

60-70% of respondents. But in 2 recent years the<br />

difference in favor of the home market has been<br />

growing. Last year it was referred to by 71% of<br />

respondents, while export growth was mentioned by<br />

56%. Therefore, the crisis has accelerated the increase<br />

in significance of the Russian market for exporters. Its<br />

enormous potential is recognized by almost half of<br />

respondents in spite of its temporarily big reduction.<br />

Even export-oriented companies name the<br />

internal market growth as an important trend more<br />

often than the export growth. But for this category<br />

the difference is less big than for exporters mainly<br />

oriented at the home market. 39% of companies with<br />

the export share of 51% of their revenue consider the<br />

home market growth the major trend. Export growth<br />

was mentioned by 36% of companies mainly focused<br />

on foreign markets.<br />

The number of records for such trend as “Growth<br />

in the Field of IT Outsourcing” increased year-onyear<br />

(from 30% to 34%). Gartner experts expect<br />

that as a result of the crisis the world market of IT<br />

outsourcing would grow, though after a certain<br />

short-term decline.<br />

In Russia this market is in its early stage of<br />

development, therefore its potential is especially big.<br />

Anyway, the majority of respondents (about 80% of<br />

those who chose this trend) do not correlate it with<br />

the growth of sales in the internal market.<br />

Outsourcing growth was more often named by<br />

companies with 51% of revenue falling at export.<br />

Consolidation in the <strong>industry</strong> as trend has become<br />

less evident (21% against 61% last year). The reason is<br />

that this process has slightly slowed down. Moreover,<br />

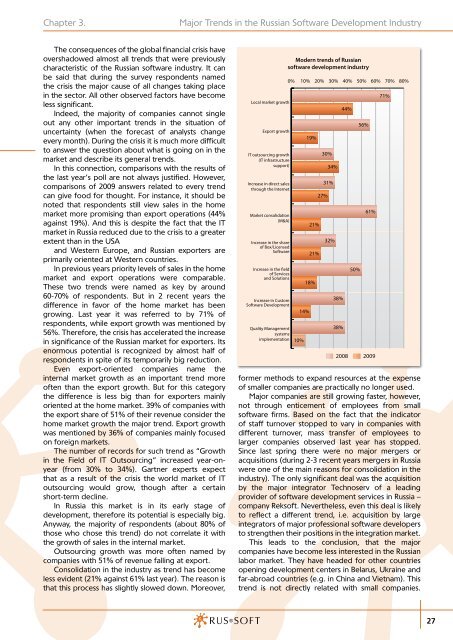

Local market growth<br />

Export growth<br />

IT outsourcing growth<br />

(IT infrastructure<br />

support)<br />

Increase in direct sales<br />

through the Internet<br />

Market consolidation<br />

(M&A)<br />

Increase in the share<br />

of Box/Licensed<br />

Software<br />

Increase in the field<br />

of Services<br />

<strong>and</strong> Solutions<br />

Increase in Custom<br />

Software Development<br />

Quality Management<br />

systems<br />

implementation<br />

Modern trends of Russian<br />

<strong>software</strong> development <strong>industry</strong><br />

0% 10% 20% 30% 40% 50% 60% 70% 80%<br />

10%<br />

14%<br />

19%<br />

21%<br />

21%<br />

18%<br />

30%<br />

27%<br />

34%<br />

31%<br />

32%<br />

38%<br />

38%<br />

44%<br />

2008<br />

50%<br />

56%<br />

61%<br />

2009<br />

71%<br />

former methods to exp<strong>and</strong> resources at the expense<br />

of smaller companies are practically no longer used.<br />

Major companies are still growing faster, however,<br />

not through enticement of employees from small<br />

<strong>software</strong> firms. Based on the fact that the indicator<br />

of staff turnover stopped to vary in companies with<br />

different turnover, mass transfer of employees to<br />

larger companies observed last year has stopped.<br />

Since last spring there were no major mergers or<br />

acquisitions (during 2-3 recent years mergers in Russia<br />

were one of the main reasons for consolidation in the<br />

<strong>industry</strong>). The only significant deal was the acquisition<br />

by the major integrator Technoserv of a leading<br />

provider of <strong>software</strong> development services in Russia –<br />

company Reksoft. Nevertheless, even this deal is likely<br />

to reflect a different trend, i.e. acquisition by large<br />

integrators of major professional <strong>software</strong> developers<br />

to strengthen their positions in the integration market.<br />

This leads to the conclusion, that the major<br />

companies have become less interested in the Russian<br />

labor market. They have headed for other countries<br />

opening development centers in Belarus, Ukraine <strong>and</strong><br />

far-abroad countries (e.g. in China <strong>and</strong> Vietnam). This<br />

trend is not directly related with small companies.<br />

27