russian software developing industry and software exports

russian software developing industry and software exports

russian software developing industry and software exports

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 4.<br />

Overview of Business Environment<br />

for Software Development in Russia<br />

Based on the results of the poll, the business environment for <strong>software</strong> developers has generally slightly<br />

improved in the past year. This statement somewhat differs from the data of the same poll related to the<br />

evaluation of the state policy in the field of support for the IT <strong>industry</strong> in 2 recent years (according to these<br />

data, evaluations of the state policy have worsened).<br />

At the same time, respondents give higher evaluations of the state of infrastructure, supply of staff,<br />

resolution of problems with taxation <strong>and</strong> bureaucratic barriers.<br />

HUMAN RESOURCES<br />

AND THE EDUCATION SYSTEM<br />

The supply of labor has slightly improved mainly<br />

owing to the inflow to the market of quite big<br />

numbers of specialists with high or good qualifications<br />

that were left jobless after massive dismissals<br />

in IT departments of many Russian companies.<br />

Consequently, this was a partial compensation for the<br />

insufficient supply of staff.<br />

Apart from this, due to the decrease in dem<strong>and</strong><br />

in the global market the growth of dem<strong>and</strong> of<br />

service <strong>and</strong> product companies for human resources<br />

has reduced a bit. Only around a third of 15 major<br />

<strong>software</strong> development exporters stated their plans<br />

to exp<strong>and</strong> their staff in 2009. As a rule, the projected<br />

increase in the level of staff does not exceed 10-15%.<br />

In previous years practically all of these companies<br />

planned to actively recruit new employees (30%-50%)<br />

<strong>and</strong> many of them even managed to do so.<br />

At the same time, given a possible growth in<br />

dem<strong>and</strong> for the services of Russian developers owing<br />

to a certain economic stabilization in the world,<br />

the situation in the labor market again will start to<br />

aggravate. Therefore, it may be said, that certain<br />

improvements are likely to be short-term, if only the<br />

crisis in the IT market does not last too long.<br />

Moreover, despite this improvement around half<br />

of the companies evaluate the supply of staff as<br />

«unsatisfactory» (44% gave a mark «poor», in 2007<br />

this figure was much less – 40%). It can be concluded<br />

that nothing has essentially changed in the labor<br />

market except for a temporary increase in dem<strong>and</strong>. As<br />

a year ago, the lowest level of dissatisfaction with the<br />

staff issue was registered in Moscow (33%). Outside<br />

the capital this indicator grows: in St. Petersburg –<br />

39%, in all other cities – 50%. Moreover, respondents<br />

representing Moscow most frequently evaluated<br />

the supply of staff as «good» (21% against 13% for<br />

all other companies).<br />

In recent years major Russian companies<br />

established in the regions their development centers<br />

<strong>and</strong> increased their staff. Having more financial<br />

opportunities than other companies, they successfully<br />

attracted staff from local companies, <strong>and</strong> respondents<br />

representing numerous small local firms turned out to<br />

be less satisfied with the situation in the labor market.<br />

It should be noted, that companies oriented<br />

mainly at export are more dissatisfied with the marker<br />

situation than companies earning the bigger part<br />

of revenue in the domestic market (the difference<br />

between them is rather big, however around half of<br />

respondents in both groups are not satisfied with the<br />

overall situation ).<br />

Working for international markets sets higher<br />

requirements for specialists at least due to the fact<br />

that participation in projects of foreign partners<br />

presupposes, as a rule, knowledge of a foreign<br />

language (English). Apparently, general dissatisfaction<br />

with the quality of staff reflects the shortage of<br />

specialists proficient in English <strong>and</strong> other foreign<br />

languages. This is proved by answers concerning<br />

the number of such specialists working for our<br />

respondents (for more details on this issue <strong>and</strong> the<br />

situation in the labor market see Chapter 6).<br />

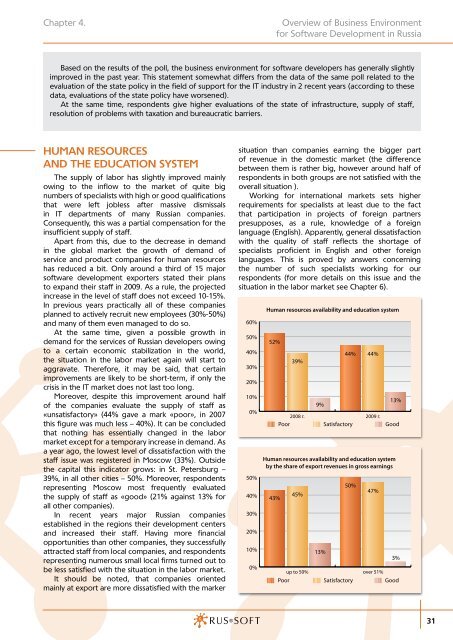

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Human resources availability <strong>and</strong> education system<br />

52%<br />

43%<br />

39%<br />

2008 г.<br />

Poor<br />

45%<br />

up to 50%<br />

Poor<br />

9%<br />

13%<br />

44%<br />

Satisfactory<br />

50%<br />

Satisfactory<br />

44%<br />

2009 г.<br />

47%<br />

13%<br />

Good<br />

Human resources availability <strong>and</strong> education system<br />

by the share of export revenues in gross earnings<br />

3%<br />

over 51%<br />

Good<br />

31