Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

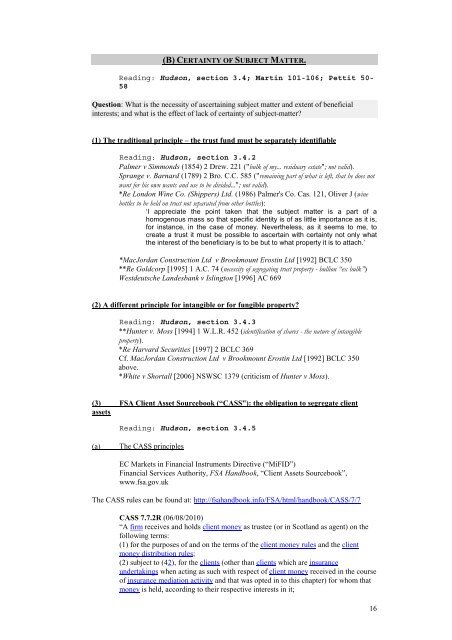

(B) CERTAINTY OF SUBJECT MATTER.<br />

Reading: Hudson, section 3.4; Martin 101-106; Pettit 50-<br />

58<br />

Question: What is the necessity of ascertaining subject matter <strong>and</strong> extent of beneficial<br />

interests; <strong>and</strong> what is the effect of lack of certainty of subject-matter?<br />

(1) The traditional principle – the trust fund must be separately identifiable<br />

Reading: Hudson, section 3.4.2<br />

Palmer v Simmonds (1854) 2 Drew. 221 ("bulk of my... residuary estate"; not valid).<br />

Sprange v. Barnard (1789) 2 Bro. C.C. 585 ("remaining part of what is left, that he does not<br />

want for his own wants <strong>and</strong> use to be divided..."; not valid).<br />

*Re London Wine Co. (Shippers) Ltd. (1986) Palmer's Co. Cas. 121, Oliver J (wine<br />

bottles to be held on trust not separated from other bottles):<br />

‘I appreciate the point taken that the subject matter is a part of a<br />

homogenous mass so that specific identity is of as little importance as it is,<br />

for instance, in the case of money. Nevertheless, as it seems to me, to<br />

create a trust it must be possible to ascertain with certainty not only what<br />

the interest of the beneficiary is to be but to what property it is to attach.’<br />

*MacJordan Construction Ltd v Brookmount Erostin Ltd [1992] BCLC 350<br />

**Re Goldcorp [1995] 1 A.C. 74 (necessity of segregating trust property - bullion “ex bulk”)<br />

Westdeutsche L<strong>and</strong>esbank v Islington [1996] AC 669<br />

(2) A different principle for intangible or for fungible property?<br />

Reading: Hudson, section 3.4.3<br />

**Hunter v. Moss [1994] 1 W.L.R. 452 (identification of shares - the nature of intangible<br />

property).<br />

*Re Harvard Securities [1997] 2 BCLC 369<br />

Cf. MacJordan Construction Ltd v Brookmount Erostin Ltd [1992] BCLC 350<br />

above.<br />

*White v Shortall [2006] NSWSC 1379 (criticism of Hunter v Moss).<br />

(3) FSA Client Asset Sourcebook (“CASS”): the obligation to segregate client<br />

assets<br />

Reading: Hudson, section 3.4.5<br />

(a)<br />

The CASS principles<br />

EC Markets in Financial Instruments Directive (“MiFID”)<br />

Financial Services Authority, FSA H<strong>and</strong>book, “Client Assets Sourcebook”,<br />

www.fsa.gov.uk<br />

The CASS rules can be found at: http://fsah<strong>and</strong>book.info/FSA/html/h<strong>and</strong>book/CASS/7/7<br />

CASS 7.7.2R (06/08/2010)<br />

“A firm receives <strong>and</strong> holds client money as trustee (or in Scotl<strong>and</strong> as agent) on the<br />

following terms:<br />

(1) for the purposes of <strong>and</strong> on the terms of the client money rules <strong>and</strong> the client<br />

money distribution rules;<br />

(2) subject to (42), for the clients (other than clients which are insurance<br />

undertakings when acting as such with respect of client money received in the course<br />

of insurance mediation activity <strong>and</strong> that was opted in to this chapter) for whom that<br />

money is held, according to their respective interests in it;<br />

16