Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

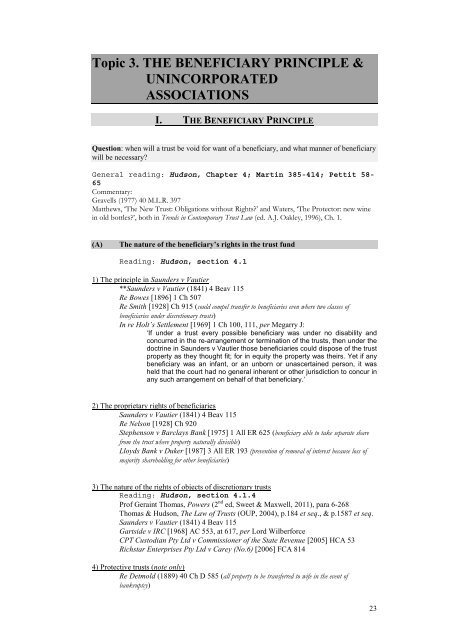

Topic 3. THE BENEFICIARY PRINCIPLE &<br />

UNINCORPORATED<br />

ASSOCIATIONS<br />

I. THE BENEFICIARY PRINCIPLE<br />

Question: when will a trust be void for want of a beneficiary, <strong>and</strong> what manner of beneficiary<br />

will be necessary?<br />

General reading: Hudson, Chapter 4; Martin 385-414; Pettit 58-<br />

65<br />

Commentary:<br />

Gravells (1977) 40 M.L.R. 397<br />

Matthews, ‘The New Trust: Obligations without Rights?’ <strong>and</strong> Waters, ‘The Protector: new wine<br />

in old bottles?’, both in Trends in Contemporary Trust Law (ed. A.J. Oakley, 1996), Ch. 1.<br />

(A)<br />

The nature of the beneficiary’s rights in the trust fund<br />

Reading: Hudson, section 4.1<br />

1) The principle in Saunders v Vautier<br />

**Saunders v Vautier (1841) 4 Beav 115<br />

Re Bowes [1896] 1 Ch 507<br />

Re Smith [1928] Ch 915 (could <strong>com</strong>pel transfer to beneficiaries even where two classes of<br />

beneficiaries under discretionary trusts)<br />

In re Holt’s Settlement [1969] 1 Ch 100, 111, per Megarry J:<br />

‘If under a trust every possible beneficiary was under no disability <strong>and</strong><br />

concurred in the re-arrangement or termination of the trusts, then under the<br />

doctrine in Saunders v Vautier those beneficiaries could dispose of the trust<br />

property as they thought fit; for in equity the property was theirs. Yet if any<br />

beneficiary was an infant, or an unborn or unascertained person, it was<br />

held that the court had no general inherent or other jurisdiction to concur in<br />

any such arrangement on behalf of that beneficiary.’<br />

2) The proprietary rights of beneficiaries<br />

Saunders v Vautier (1841) 4 Beav 115<br />

Re Nelson [1928] Ch 920<br />

Stephenson v Barclays Bank [1975] 1 All ER 625 (beneficiary able to take separate share<br />

from the trust where property naturally divisible)<br />

Lloyds Bank v Duker [1987] 3 All ER 193 (prevention of removal of interest because loss of<br />

majority shareholding for other beneficiaries)<br />

3) The nature of the rights of objects of discretionary trusts<br />

Reading: Hudson, section 4.1.4<br />

Prof Geraint Thomas, Powers (2 nd ed, Sweet & Maxwell, 2011), para 6-268<br />

Thomas & Hudson, The Law of <strong>Trusts</strong> (OUP, 2004), p.184 et seq., & p.1587 et seq.<br />

Saunders v Vautier (1841) 4 Beav 115<br />

Gartside v IRC [1968] AC 553, at 617, per Lord Wilberforce<br />

CPT Custodian Pty Ltd v Commissioner of the State Revenue [2005] HCA 53<br />

Richstar Enterprises Pty Ltd v Carey (No.6) [2006] FCA 814<br />

4) Protective trusts (note only)<br />

Re Detmold (1889) 40 Ch D 585 (all property to be transferred to wife in the event of<br />

bankruptcy)<br />

23