Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

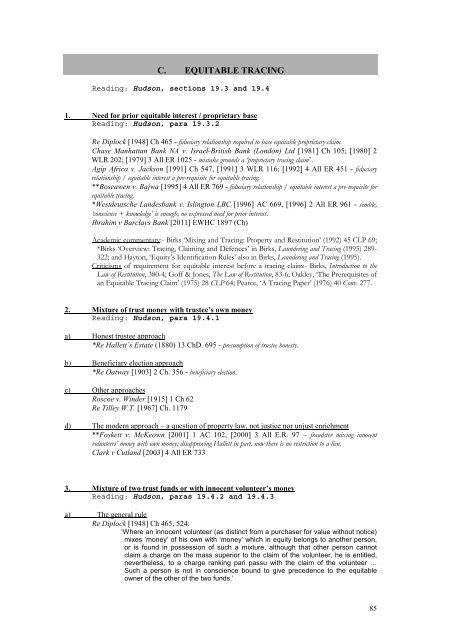

C. EQUITABLE TRACING<br />

Reading: Hudson, sections 19.3 <strong>and</strong> 19.4<br />

1. Need for prior equitable interest / proprietary base<br />

Reading: Hudson, para 19.3.2<br />

Re Diplock [1948] Ch 465 - fiduciary relationship required to base equitable proprietary claim.<br />

Chase Manhattan Bank NA v. Israel-British Bank (London) Ltd [1981] Ch 105; [1980] 2<br />

WLR 202; [1979] 3 All ER 1025 - mistake grounds a ‘proprietary tracing claim’.<br />

Agip Africa v. Jackson [1991] Ch 547, [1991] 3 WLR 116; [1992] 4 All ER 451 - fiduciary<br />

relationship / equitable interest a pre-requisite for equitable tracing.<br />

**Boscawen v. Bajwa [1995] 4 All ER 769 - fiduciary relationship / equitable interest a pre-requisite for<br />

equitable tracing.<br />

*Westdeutsche L<strong>and</strong>esbank v. Islington LBC [1996] AC 669, [1996] 2 All ER 961 - semble,<br />

‘conscience + knowledge’ is enough, no expressed need for prior interest.<br />

Ibrahim v Barclays Bank [2011] EWHC 1897 (Ch)<br />

Academic <strong>com</strong>mentary:- Birks ‘Mixing <strong>and</strong> Tracing: Property <strong>and</strong> Restitution’ (1992) 45 CLP 69;<br />

*Birks ‘Overview: Tracing, Claiming <strong>and</strong> Defences’ in Birks, Laundering <strong>and</strong> Tracing (1995) 289-<br />

322; <strong>and</strong> Hayton, ‘<strong>Equity</strong>’s Identification Rules’ also in Birks, Laundering <strong>and</strong> Tracing (1995).<br />

Criticisms of requirement for equitable interest before a tracing claim:- Birks, Introduction to the<br />

Law of Restitution, 380-4; Goff & Jones, The Law of Restitution, 83-6; Oakley, ‘The Prerequisites of<br />

an Equitable Tracing Claim’ (1975) 28 CLP 64; Pearce, ‘A Tracing Paper’ (1976) 40 Conv. 277.<br />

2. Mixture of trust money with trustee’s own money<br />

Reading: Hudson, para 19.4.1<br />

a) Honest trustee approach<br />

*Re Hallett’s Estate (1880) 13 ChD. 695 - presumption of trustee honesty.<br />

b) Beneficiary election approach<br />

*Re Oatway [1903] 2 Ch. 356 - beneficiary election.<br />

c) Other approaches<br />

Roscoe v. Winder [1915] 1 Ch 62<br />

Re Tilley W.T. [1967] Ch. 1179<br />

d) The modern approach – a question of property law, not justice nor unjust enrichment<br />

**Foskett v. McKeown [2001] 1 AC 102, [2000] 3 All E.R. 97 – fraudster mixing innocent<br />

volunteers’ money with own money; disapproving Hallett in part, now there is no restriction to a lien.<br />

Clark v Cutl<strong>and</strong> [2003] 4 All ER 733<br />

3. Mixture of two trust funds or with innocent volunteer’s money<br />

Reading: Hudson, paras 19.4.2 <strong>and</strong> 19.4.3<br />

a) The general rule<br />

Re Diplock [1948] Ch 465, 524:<br />

‘Where an innocent volunteer (as distinct from a purchaser for value without notice)<br />

mixes ‘money’ of his own with ‘money’ which in equity belongs to another person,<br />

or is found in possession of such a mixture, although that other person cannot<br />

claim a charge on the mass superior to the claim of the volunteer, he is entitled,<br />

nevertheless, to a charge ranking pari passu with the claim of the volunteer …<br />

Such a person is not in conscience bound to give precedence to the equitable<br />

owner of the other of the two funds.’<br />

85