Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

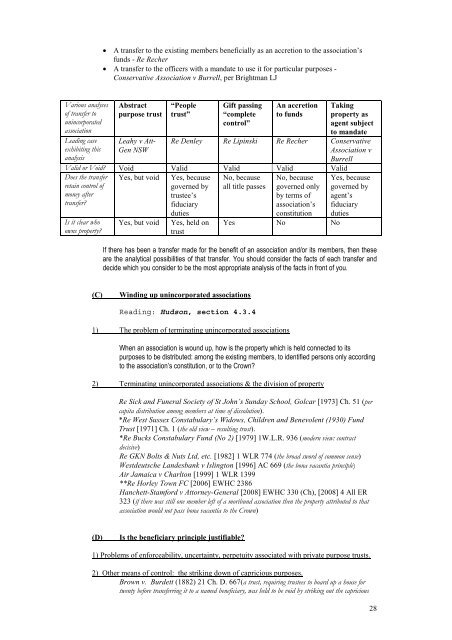

A transfer to the existing members beneficially as an accretion to the association’s<br />

funds - Re Recher<br />

A transfer to the officers with a m<strong>and</strong>ate to use it for particular purposes -<br />

Conservative Association v Burrell, per Brightman LJ<br />

Various analyses<br />

of transfer to<br />

unincorporated<br />

association<br />

Leading case<br />

exhibiting this<br />

analysis<br />

Abstract<br />

purpose trust<br />

“People<br />

trust”<br />

Gift passing<br />

“<strong>com</strong>plete<br />

control”<br />

An accretion<br />

to funds<br />

Taking<br />

property as<br />

agent subject<br />

to m<strong>and</strong>ate<br />

Leahy v Att-<br />

Gen NSW<br />

Re Denley Re Lipinski Re Recher Conservative<br />

Association v<br />

Burrell<br />

Valid or Void? Void Valid Valid Valid Valid<br />

Does the transfer<br />

retain control of<br />

money after<br />

transfer?<br />

Is it clear who<br />

owns property?<br />

Yes, but void<br />

Yes, but void<br />

Yes, because<br />

governed by<br />

trustee’s<br />

fiduciary<br />

duties<br />

Yes, held on<br />

trust<br />

No, because<br />

all title passes<br />

No, because<br />

governed only<br />

by terms of<br />

association’s<br />

constitution<br />

Yes No No<br />

Yes, because<br />

governed by<br />

agent’s<br />

fiduciary<br />

duties<br />

If there has been a transfer made for the benefit of an association <strong>and</strong>/or its members, then these<br />

are the analytical possibilities of that transfer. You should consider the facts of each transfer <strong>and</strong><br />

decide which you consider to be the most appropriate analysis of the facts in front of you.<br />

(C)<br />

Winding up unincorporated associations<br />

Reading: Hudson, section 4.3.4<br />

1) The problem of terminating unincorporated associations<br />

When an association is wound up, how is the property which is held connected to its<br />

purposes to be distributed: among the existing members, to identified persons only according<br />

to the association’s constitution, or to the Crown?<br />

2) Terminating unincorporated associations & the division of property<br />

Re Sick <strong>and</strong> Funeral Society of St John’s Sunday School, Golcar [1973] Ch. 51 (per<br />

capita distribution among members at time of dissolution).<br />

*Re West Sussex Constabulary’s Widows, Children <strong>and</strong> Benevolent (1930) Fund<br />

Trust [1971] Ch. 1 (the old view – resulting trust).<br />

*Re Bucks Constabulary Fund (No 2) [1979] 1W.L.R. 936 (modern view: contract<br />

decisive)<br />

Re GKN Bolts & Nuts Ltd, etc. [1982] 1 WLR 774 (the broad sword of <strong>com</strong>mon sense)<br />

Westdeutsche L<strong>and</strong>esbank v Islington [1996] AC 669 (the bona vacantia principle)<br />

Air Jamaica v Charlton [1999] 1 WLR 1399<br />

**Re Horley Town FC [2006] EWHC 2386<br />

Hanchett-Stamford v Attorney-General [2008] EWHC 330 (Ch), [2008] 4 All ER<br />

323 (if there was still one member left of a moribund association then the property attributed to that<br />

association would not pass bona vacantia to the Crown)<br />

(D)<br />

Is the beneficiary principle justifiable?<br />

1) Problems of enforceability, uncertainty, perpetuity associated with private purpose trusts.<br />

2) Other means of control: the striking down of capricious purposes.<br />

Brown v. Burdett (1882) 21 Ch. D. 667(a trust, requiring trustees to board up a house for<br />

twenty before transferring it to a named beneficiary, was held to be void by striking out the capricious<br />

28