Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

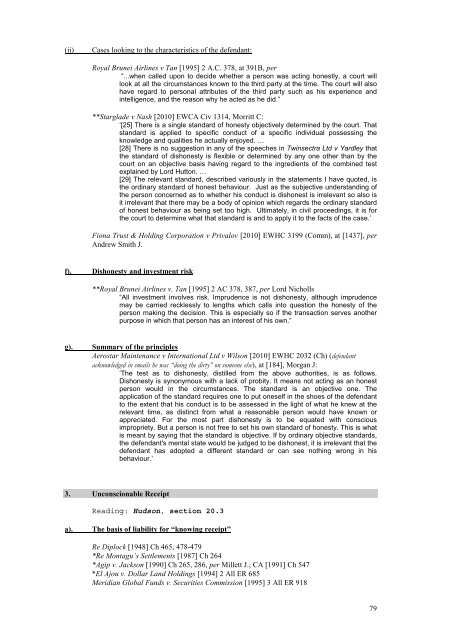

(ii)<br />

Cases looking to the characteristics of the defendant:<br />

Royal Brunei Airlines v Tan [1995] 2 A.C. 378, at 391B, per<br />

“...when called upon to decide whether a person was acting honestly, a court will<br />

look at all the circumstances known to the third party at the time. The court will also<br />

have regard to personal attributes of the third party such as his experience <strong>and</strong><br />

intelligence, <strong>and</strong> the reason why he acted as he did.”<br />

**Starglade v Nash [2010] EWCA Civ 1314, Morritt C:<br />

‘[25] There is a single st<strong>and</strong>ard of honesty objectively determined by the court. That<br />

st<strong>and</strong>ard is applied to specific conduct of a specific individual possessing the<br />

knowledge <strong>and</strong> qualities he actually enjoyed. …<br />

[28] There is no suggestion in any of the speeches in Twinsectra Ltd v Yardley that<br />

the st<strong>and</strong>ard of dishonesty is flexible or determined by any one other than by the<br />

court on an objective basis having regard to the ingredients of the <strong>com</strong>bined test<br />

explained by Lord Hutton. …<br />

[29] The relevant st<strong>and</strong>ard, described variously in the statements I have quoted, is<br />

the ordinary st<strong>and</strong>ard of honest behaviour. Just as the subjective underst<strong>and</strong>ing of<br />

the person concerned as to whether his conduct is dishonest is irrelevant so also is<br />

it irrelevant that there may be a body of opinion which regards the ordinary st<strong>and</strong>ard<br />

of honest behaviour as being set too high. Ultimately, in civil proceedings, it is for<br />

the court to determine what that st<strong>and</strong>ard is <strong>and</strong> to apply it to the facts of the case.’<br />

Fiona Trust & Holding Corporation v Privalov [2010] EWHC 3199 (Comm), at [1437], per<br />

Andrew Smith J.<br />

f).<br />

Dishonesty <strong>and</strong> investment risk<br />

**Royal Brunei Airlines v. Tan [1995] 2 AC 378, 387, per Lord Nicholls<br />

“All investment involves risk. Imprudence is not dishonesty, although imprudence<br />

may be carried recklessly to lengths which calls into question the honesty of the<br />

person making the decision. This is especially so if the transaction serves another<br />

purpose in which that person has an interest of his own.”<br />

g).<br />

Summary of the principles<br />

Aerostar Maintenance v International Ltd v Wilson [2010] EWHC 2032 (Ch) (defendant<br />

acknowledged in emails he was “doing the dirty” on someone else), at [184], Morgan J:<br />

‘The test as to dishonesty, distilled from the above authorities, is as follows.<br />

Dishonesty is synonymous with a lack of probity. It means not acting as an honest<br />

person would in the circumstances. The st<strong>and</strong>ard is an objective one. The<br />

application of the st<strong>and</strong>ard requires one to put oneself in the shoes of the defendant<br />

to the extent that his conduct is to be assessed in the light of what he knew at the<br />

relevant time, as distinct from what a reasonable person would have known or<br />

appreciated. For the most part dishonesty is to be equated with conscious<br />

impropriety. But a person is not free to set his own st<strong>and</strong>ard of honesty. This is what<br />

is meant by saying that the st<strong>and</strong>ard is objective. If by ordinary objective st<strong>and</strong>ards,<br />

the defendant's mental state would be judged to be dishonest, it is irrelevant that the<br />

defendant has adopted a different st<strong>and</strong>ard or can see nothing wrong in his<br />

behaviour.’<br />

3. Unconscionable Receipt<br />

Reading: Hudson, section 20.3<br />

a).<br />

The basis of liability for “knowing receipt”<br />

Re Diplock [1948] Ch 465, 478-479<br />

*Re Montagu’s Settlements [1987] Ch 264<br />

*Agip v. Jackson [1990] Ch 265, 286, per Millett J.; CA [1991] Ch 547<br />

*El Ajou v. Dollar L<strong>and</strong> Holdings [1994] 2 All ER 685<br />

Meridian Global Funds v. Securities Commission [1995] 3 All ER 918<br />

79