Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

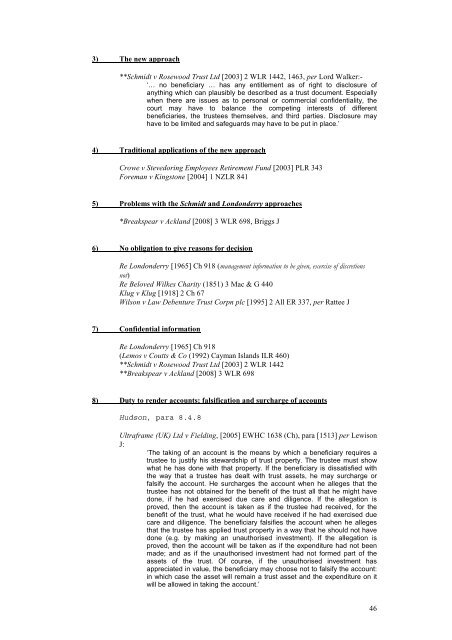

3) The new approach<br />

**Schmidt v Rosewood Trust Ltd [2003] 2 WLR 1442, 1463, per Lord Walker:-<br />

‘… no beneficiary … has any entitlement as of right to disclosure of<br />

anything which can plausibly be described as a trust document. Especially<br />

when there are issues as to personal or <strong>com</strong>mercial confidentiality, the<br />

court may have to balance the <strong>com</strong>peting interests of different<br />

beneficiaries, the trustees themselves, <strong>and</strong> third parties. Disclosure may<br />

have to be limited <strong>and</strong> safeguards may have to be put in place.’<br />

4) Traditional applications of the new approach<br />

Crowe v Stevedoring Employees Retirement Fund [2003] PLR 343<br />

Foreman v Kingstone [2004] 1 NZLR 841<br />

5) Problems with the Schmidt <strong>and</strong> Londonderry approaches<br />

*Breakspear v Ackl<strong>and</strong> [2008] 3 WLR 698, Briggs J<br />

6) No obligation to give reasons for decision<br />

Re Londonderry [1965] Ch 918 (management information to be given, exercise of discretions<br />

not)<br />

Re Beloved Wilkes Charity (1851) 3 Mac & G 440<br />

Klug v Klug [1918] 2 Ch 67<br />

Wilson v Law Debenture Trust Corpn plc [1995] 2 All ER 337, per Rattee J<br />

7) Confidential information<br />

Re Londonderry [1965] Ch 918<br />

(Lemos v Coutts & Co (1992) Cayman Isl<strong>and</strong>s ILR 460)<br />

**Schmidt v Rosewood Trust Ltd [2003] 2 WLR 1442<br />

**Breakspear v Ackl<strong>and</strong> [2008] 3 WLR 698<br />

8) Duty to render accounts; falsification <strong>and</strong> surcharge of accounts<br />

Hudson, para 8.4.8<br />

Ultraframe (UK) Ltd v Fielding, [2005] EWHC 1638 (Ch), para [1513] per Lewison<br />

J:<br />

‘The taking of an account is the means by which a beneficiary requires a<br />

trustee to justify his stewardship of trust property. The trustee must show<br />

what he has done with that property. If the beneficiary is dissatisfied with<br />

the way that a trustee has dealt with trust assets, he may surcharge or<br />

falsify the account. He surcharges the account when he alleges that the<br />

trustee has not obtained for the benefit of the trust all that he might have<br />

done, if he had exercised due care <strong>and</strong> diligence. If the allegation is<br />

proved, then the account is taken as if the trustee had received, for the<br />

benefit of the trust, what he would have received if he had exercised due<br />

care <strong>and</strong> diligence. The beneficiary falsifies the account when he alleges<br />

that the trustee has applied trust property in a way that he should not have<br />

done (e.g. by making an unauthorised investment). If the allegation is<br />

proved, then the account will be taken as if the expenditure had not been<br />

made; <strong>and</strong> as if the unauthorised investment had not formed part of the<br />

assets of the trust. Of course, if the unauthorised investment has<br />

appreciated in value, the beneficiary may choose not to falsify the account:<br />

in which case the asset will remain a trust asset <strong>and</strong> the expenditure on it<br />

will be allowed in taking the account.’<br />

46