Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

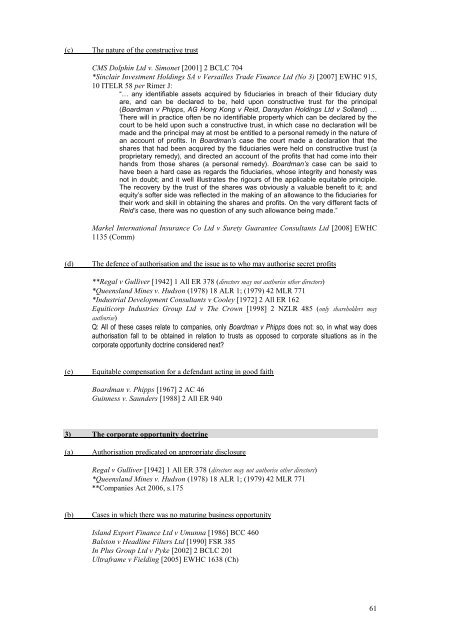

(c)<br />

The nature of the constructive trust<br />

CMS Dolphin Ltd v. Simonet [2001] 2 BCLC 704<br />

*Sinclair Investment Holdings SA v Versailles Trade Finance Ltd (No 3) [2007] EWHC 915,<br />

10 ITELR 58 per Rimer J:<br />

“… any identifiable assets acquired by fiduciaries in breach of their fiduciary duty<br />

are, <strong>and</strong> can be declared to be, held upon constructive trust for the principal<br />

(Boardman v Phipps, AG Hong Kong v Reid, Daraydan Holdings Ltd v Soll<strong>and</strong>) …<br />

There will in practice often be no identifiable property which can be declared by the<br />

court to be held upon such a constructive trust, in which case no declaration will be<br />

made <strong>and</strong> the principal may at most be entitled to a personal remedy in the nature of<br />

an account of profits. In Boardman’s case the court made a declaration that the<br />

shares that had been acquired by the fiduciaries were held on constructive trust (a<br />

proprietary remedy), <strong>and</strong> directed an account of the profits that had <strong>com</strong>e into their<br />

h<strong>and</strong>s from those shares (a personal remedy). Boardman’s case can be said to<br />

have been a hard case as regards the fiduciaries, whose integrity <strong>and</strong> honesty was<br />

not in doubt; <strong>and</strong> it well illustrates the rigours of the applicable equitable principle.<br />

The recovery by the trust of the shares was obviously a valuable benefit to it; <strong>and</strong><br />

equity’s softer side was reflected in the making of an allowance to the fiduciaries for<br />

their work <strong>and</strong> skill in obtaining the shares <strong>and</strong> profits. On the very different facts of<br />

Reid’s case, there was no question of any such allowance being made.”<br />

Markel International Insurance Co Ltd v Surety Guarantee Consultants Ltd [2008] EWHC<br />

1135 (Comm)<br />

(d)<br />

The defence of authorisation <strong>and</strong> the issue as to who may authorise secret profits<br />

**Regal v Gulliver [1942] 1 All ER 378 (directors may not authorise other directors)<br />

*Queensl<strong>and</strong> Mines v. Hudson (1978) 18 ALR 1; (1979) 42 MLR 771<br />

*Industrial Development Consultants v Cooley [1972] 2 All ER 162<br />

Equiticorp Industries Group Ltd v The Crown [1998] 2 NZLR 485 (only shareholders may<br />

authorise)<br />

Q: All of these cases relate to <strong>com</strong>panies, only Boardman v Phipps does not: so, in what way does<br />

authorisation fall to be obtained in relation to trusts as opposed to corporate situations as in the<br />

corporate opportunity doctrine considered next?<br />

(e)<br />

Equitable <strong>com</strong>pensation for a defendant acting in good faith<br />

Boardman v. Phipps [1967] 2 AC 46<br />

Guinness v. Saunders [1988] 2 All ER 940<br />

3) The corporate opportunity doctrine<br />

(a)<br />

Authorisation predicated on appropriate disclosure<br />

Regal v Gulliver [1942] 1 All ER 378 (directors may not authorise other directors)<br />

*Queensl<strong>and</strong> Mines v. Hudson (1978) 18 ALR 1; (1979) 42 MLR 771<br />

**Companies Act 2006, s.175<br />

(b)<br />

Cases in which there was no maturing business opportunity<br />

Isl<strong>and</strong> Export Finance Ltd v Umunna [1986] BCC 460<br />

Balston v Headline Filters Ltd [1990] FSR 385<br />

In Plus Group Ltd v Pyke [2002] 2 BCLC 201<br />

Ultraframe v Fielding [2005] EWHC 1638 (Ch)<br />

61