Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

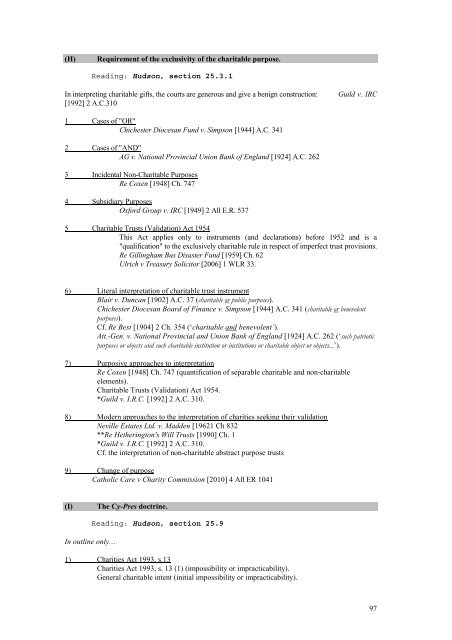

(H)<br />

Requirement of the exclusivity of the charitable purpose.<br />

Reading: Hudson, section 25.3.1<br />

In interpreting charitable gifts, the courts are generous <strong>and</strong> give a benign construction:<br />

[1992] 2 A.C.310<br />

Guild v. IRC<br />

1 Cases of "OR"<br />

Chichester Diocesan Fund v. Simpson [1944] A.C. 341<br />

2 Cases of "AND"<br />

AG v. National Provincial Union Bank of Engl<strong>and</strong> [1924] A.C. 262<br />

3 Incidental Non-Charitable Purposes<br />

Re Coxen [1948] Ch. 747<br />

4 Subsidiary Purposes<br />

Oxford Group v. IRC [1949] 2 All E.R. 537<br />

5 Charitable <strong>Trusts</strong> (Validation) Act 1954<br />

This Act applies only to instruments (<strong>and</strong> declarations) before 1952 <strong>and</strong> is a<br />

"qualification" to the exclusively charitable rule in respect of imperfect trust provisions.<br />

Re Gillingham Bus Disaster Fund [1959] Ch. 62<br />

Ulrich v Treasury Solicitor [2006] 1 WLR 33.<br />

6) Literal interpretation of charitable trust instrument<br />

Blair v. Duncan [1902] A.C. 37 (charitable or public purposes).<br />

Chichester Diocesan Board of Finance v. Simpson [1944] A.C. 341 (charitable or benevolent<br />

purposes).<br />

Cf. Re Best [1904] 2 Ch. 354 (‘charitable <strong>and</strong> benevolent’).<br />

Att.-Gen. v. National Provincial <strong>and</strong> Union Bank of Engl<strong>and</strong> [1924] A.C. 262 (‘such patriotic<br />

purposes or objects <strong>and</strong> such charitable institution or institutions or charitable object or objects...’).<br />

7) Purposive approaches to interpretation<br />

Re Coxen [1948] Ch. 747 (quantification of separable charitable <strong>and</strong> non-charitable<br />

elements).<br />

Charitable <strong>Trusts</strong> (Validation) Act 1954.<br />

*Guild v. I.R.C. [1992] 2 A.C. 310.<br />

8) Modern approaches to the interpretation of charities seeking their validation<br />

Neville Estates Ltd. v. Madden [19621 Ch 832<br />

**Re Hetherington's Will <strong>Trusts</strong> [1990] Ch. 1<br />

*Guild v. I.R.C. [1992] 2 A.C. 310.<br />

Cf. the interpretation of non-charitable abstract purpose trusts<br />

9) Change of purpose<br />

Catholic Care v Charity Commission [2010] 4 All ER 1041<br />

(I)<br />

The Cy-Pres doctrine.<br />

In outline only…<br />

Reading: Hudson, section 25.9<br />

1) Charities Act 1993, s.13<br />

Charities Act 1993, s. 13 (1) (impossibility or impracticability).<br />

General charitable intent (initial impossibility or impracticability).<br />

97