Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

Soton Equity and Trusts - alastairhudson.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The maximum period (under the case law) for the vesting of interests under trusts: a<br />

life or lives in being + 21 years.<br />

2) <strong>Trusts</strong> created after 16 July 1964<br />

*ss. 1, 3 <strong>and</strong> 4 of the Perpetuities <strong>and</strong> Accumulations Act 1964.<br />

The parties “wait <strong>and</strong> see” for a statutory limitation period whether or not the<br />

trust <strong>com</strong>es to an end, further to s.3.<br />

If it does not, then the class closing rules in s.4 apply so as to close the<br />

beneficial class to any future members.<br />

3) <strong>Trusts</strong> created after 6 April 2010<br />

Perpetuities <strong>and</strong> Accumulations Act 2009<br />

(a)<br />

The ambit of the Act<br />

Section 1 describes the ambit of the PAA 2009, subject to the notion in s.1(1) that<br />

“The rule against perpetuities applies (<strong>and</strong> applies only) as provided by this<br />

section”<br />

(b)<br />

(c)<br />

(d)<br />

<br />

<br />

<br />

<br />

<br />

<br />

Hence, the Act applies to<br />

trusts with successive interests;<br />

trusts subject to some condition precedent (such as “the beneficiary must<br />

reach the age of 21”);<br />

trusts subject to some condition subsequent (such as “provided that the<br />

beneficiary does not marry”);<br />

wills with successive interests; <strong>and</strong><br />

powers of appointment.<br />

The statutory perpetuity period<br />

s.5(1): ‘The perpetuity period is 125 years (<strong>and</strong> no other period).’<br />

Section 5(2): s.5(1) applies “whether or not the instrument … specifies a perpetuity<br />

period; <strong>and</strong> a specification of a perpetuity period in that instrument is ineffective”.<br />

Section 6: the starting point for measuring the period of 125 years is the time at<br />

which the relevant instrument takes effect.<br />

<strong>Trusts</strong> which would otherwise be invalid<br />

Section 7: “wait <strong>and</strong> see” until the statutory period has expired <strong>and</strong> then any unused<br />

parts of the trust <strong>com</strong>e to an end.<br />

Section 8 then introduces a “class closing” rule to eliminate beneficiaries once the<br />

statutory perpetuity period has been reached.<br />

Non-charitable purpose trusts<br />

Section 18 provides that nothing in the Act affects the rule that “limits the duration<br />

of non-charitable purpose trusts”<br />

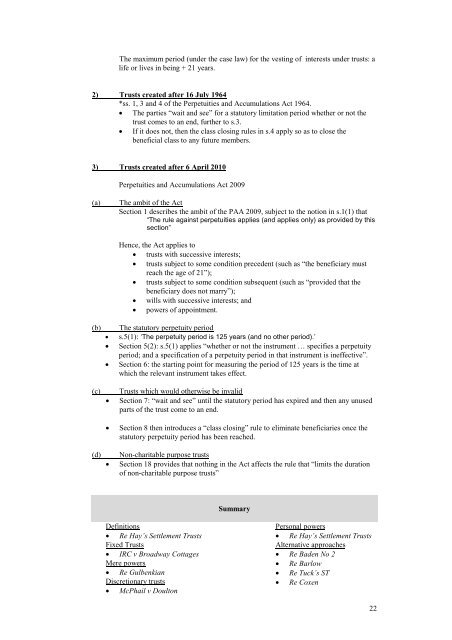

Summary<br />

Definitions<br />

Re Hay’s Settlement <strong>Trusts</strong><br />

Fixed <strong>Trusts</strong><br />

IRC v Broadway Cottages<br />

Mere powers<br />

Re Gulbenkian<br />

Discretionary trusts<br />

McPhail v Doulton<br />

Personal powers<br />

Re Hay’s Settlement <strong>Trusts</strong><br />

Alternative approaches<br />

Re Baden No 2<br />

Re Barlow<br />

Re Tuck’s ST<br />

Re Coxen<br />

22