Pennsylvania grant & resource directory - pa house

Pennsylvania grant & resource directory - pa house

Pennsylvania grant & resource directory - pa house

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

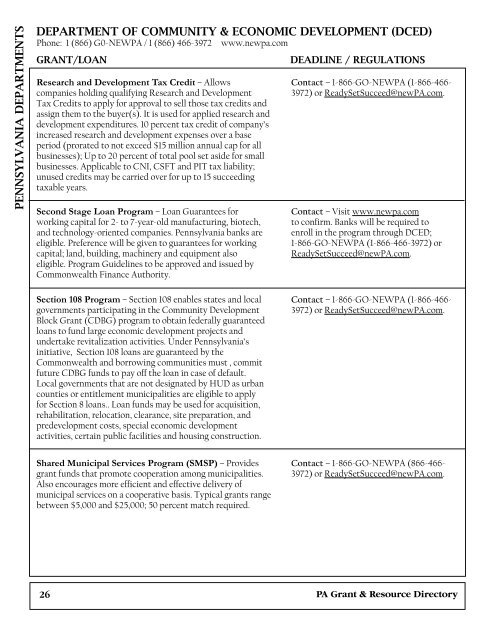

PENNSYLVANIA DEPARTMENTS<br />

DEPARTMENT OF COMMUNITY & ECONOMIC DEVELOPMENT (DCED)<br />

Phone: 1 (866) G0-NEWPA / 1 (866) 466-3972 www.new<strong>pa</strong>.com<br />

GRANT/LOAN<br />

Research and Development Tax Credit – Allows<br />

com<strong>pa</strong>nies holding qualifying Research and Development<br />

Tax Credits to apply for approval to sell those tax credits and<br />

assign them to the buyer(s). It is used for applied research and<br />

development expenditures. 10 percent tax credit of com<strong>pa</strong>ny’s<br />

increased research and development expenses over a base<br />

period (prorated to not exceed $15 million annual cap for all<br />

businesses); Up to 20 percent of total pool set aside for small<br />

businesses. Applicable to CNI, CSFT and PIT tax liability;<br />

unused credits may be carried over for up to 15 succeeding<br />

taxable years.<br />

Second Stage Loan Program – Loan Guarantees for<br />

working capital for 2- to 7-year-old manufacturing, biotech,<br />

and technology-oriented com<strong>pa</strong>nies. <strong>Pennsylvania</strong> banks are<br />

eligible. Preference will be given to guarantees for working<br />

capital; land, building, machinery and equipment also<br />

eligible. Program Guidelines to be approved and issued by<br />

Commonwealth Finance Authority.<br />

DEADLINE / REGULATIONS<br />

Contact – 1-866-GO-NEWPA (1-866-466-<br />

3972) or ReadySetSucceed@newPA.com.<br />

Contact – Visit www.new<strong>pa</strong>.com<br />

to confirm. Banks will be required to<br />

enroll in the program through DCED;<br />

1-866-GO-NEWPA (1-866-466-3972) or<br />

ReadySetSucceed@newPA.com.<br />

Section 108 Program – Section 108 enables states and local<br />

governments <strong>pa</strong>rtici<strong>pa</strong>ting in the Community Development<br />

Block Grant (CDBG) program to obtain federally guaranteed<br />

loans to fund large economic development projects and<br />

undertake revitalization activities. Under <strong>Pennsylvania</strong>’s<br />

initiative, Section 108 loans are guaranteed by the<br />

Commonwealth and borrowing communities must , commit<br />

future CDBG funds to <strong>pa</strong>y off the loan in case of default.<br />

Local governments that are not designated by HUD as urban<br />

counties or entitlement munici<strong>pa</strong>lities are eligible to apply<br />

for Section 8 loans.. Loan funds may be used for acquisition,<br />

rehabilitation, relocation, clearance, site pre<strong>pa</strong>ration, and<br />

predevelopment costs, special economic development<br />

activities, certain public facilities and housing construction.<br />

Contact – 1-866-GO-NEWPA (1-866-466-<br />

3972) or ReadySetSucceed@newPA.com.<br />

Shared Munici<strong>pa</strong>l Services Program (SMSP) – Provides<br />

<strong>grant</strong> funds that promote cooperation among munici<strong>pa</strong>lities.<br />

Also encourages more efficient and effective delivery of<br />

munici<strong>pa</strong>l services on a cooperative basis. Typical <strong>grant</strong>s range<br />

between $5,000 and $25,000; 50 percent match required.<br />

Contact – 1-866-GO-NEWPA (866-466-<br />

3972) or ReadySetSucceed@newPA.com.<br />

26<br />

PA Grant & Resource Directory