CHAPTER 13 Simple Linear Regression

CHAPTER 13 Simple Linear Regression

CHAPTER 13 Simple Linear Regression

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

544 <strong>CHAPTER</strong> THIRTEEN <strong>Simple</strong> <strong>Linear</strong> <strong>Regression</strong><br />

<strong>13</strong>.45 In Problem <strong>13</strong>.7 on page 523, you used<br />

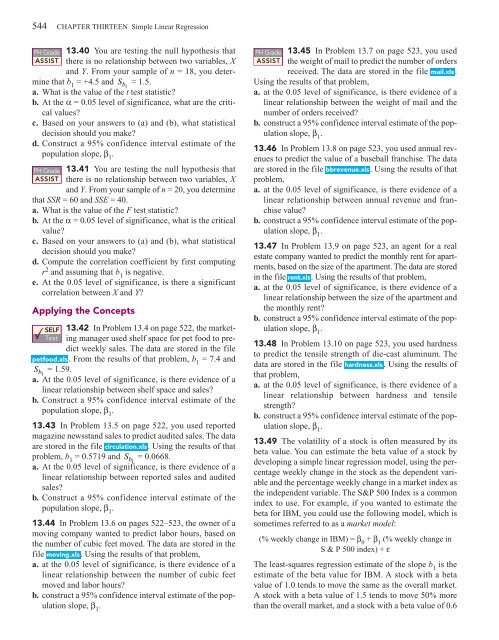

PH Grade <strong>13</strong>.40 You are testing the null hypothesis that PH Grade<br />

Test ing manager used shelf space for pet food to predict<br />

weekly sales. The data are stored in the file<br />

<strong>13</strong>.48 In Problem <strong>13</strong>.10 on page 523, you used hardness<br />

to predict the tensile strength of die-cast aluminum. The<br />

petfood.xls. From the results of that problem, b 1<br />

= 7.4 and<br />

data are stored in the file hardness.xls. Using the results of<br />

S b1<br />

= 1.59.<br />

that problem,<br />

a. At the 0.05 level of significance, is there evidence of a<br />

a. at the 0.05 level of significance, is there evidence of a<br />

linear relationship between shelf space and sales?<br />

linear relationship between hardness and tensile<br />

b. Construct a 95% confidence interval estimate of the<br />

strength?<br />

population slope, β 1<br />

.<br />

b. construct a 95% confidence interval estimate of the population<br />

mine that b 1<br />

= +4.5 and S b1<br />

= 1.5.<br />

Using the results of that problem,<br />

a. What is the value of the t test statistic?<br />

a. at the 0.05 level of significance, is there evidence of a<br />

ASSIST there is no relationship between two variables, X<br />

and Y. From your sample of n = 18, you deter-<br />

ASSIST the weight of mail to predict the number of orders<br />

received. The data are stored in the file mail.xls.<br />

b. At the α = 0.05 level of significance, what are the critical<br />

values?<br />

c. Based on your answers to (a) and (b), what statistical<br />

decision should you make?<br />

linear relationship between the weight of mail and the<br />

number of orders received?<br />

b. construct a 95% confidence interval estimate of the population<br />

slope, β 1<br />

.<br />

d. Construct a 95% confidence interval estimate of the<br />

<strong>13</strong>.46 In Problem <strong>13</strong>.8 on page 523, you used annual revenues<br />

to predict the value of a baseball franchise. The data<br />

population slope, β 1<br />

.<br />

PH Grade<br />

ASSIST<br />

<strong>13</strong>.41 You are testing the null hypothesis that<br />

there is no relationship between two variables, X<br />

and Y. From your sample of n = 20, you determine<br />

are stored in the file bbrevenue.xls. Using the results of that<br />

problem,<br />

a. at the 0.05 level of significance, is there evidence of a<br />

that SSR =60andSSE = 40.<br />

a. What is the value of the F test statistic?<br />

b. At the α = 0.05 level of significance, what is the critical<br />

value?<br />

linear relationship between annual revenue and franchise<br />

value?<br />

b. construct a 95% confidence interval estimate of the population<br />

slope, β 1<br />

.<br />

c. Based on your answers to (a) and (b), what statistical<br />

<strong>13</strong>.47 In Problem <strong>13</strong>.9 on page 523, an agent for a real<br />

decision should you make?<br />

estate company wanted to predict the monthly rent for apartments,<br />

based on the size of the apartment. The data are stored<br />

d. Compute the correlation coefficient by first computing<br />

r 2 and assuming that b 1<br />

is negative.<br />

in the file rent.xls. Using the results of that problem,<br />

e. At the 0.05 level of significance, is there a significant<br />

a. at the 0.05 level of significance, is there evidence of a<br />

correlation between X and Y?<br />

linear relationship between the size of the apartment and<br />

Applying the Concepts<br />

the monthly rent?<br />

b. construct a 95% confidence interval estimate of the population<br />

SELF <strong>13</strong>.42 In Problem <strong>13</strong>.4 on page 522, the market-<br />

slope, β 1<br />

.<br />

slope, β 1<br />

.<br />

<strong>13</strong>.43 In Problem <strong>13</strong>.5 on page 522, you used reported<br />

magazine newsstand sales to predict audited sales. The data<br />

are stored in the file circulation.xls. Using the results of that<br />

problem, b 1<br />

= 0.5719 and S b1<br />

= 0.0668.<br />

a. At the 0.05 level of significance, is there evidence of a<br />

linear relationship between reported sales and audited<br />

sales?<br />

b. Construct a 95% confidence interval estimate of the<br />

population slope, β 1<br />

.<br />

<strong>13</strong>.44 In Problem <strong>13</strong>.6 on pages 522–523, the owner of a<br />

moving company wanted to predict labor hours, based on<br />

the number of cubic feet moved. The data are stored in the<br />

file moving.xls. Using the results of that problem,<br />

a. at the 0.05 level of significance, is there evidence of a<br />

linear relationship between the number of cubic feet<br />

moved and labor hours?<br />

b. construct a 95% confidence interval estimate of the population<br />

slope, β 1<br />

.<br />

<strong>13</strong>.49 The volatility of a stock is often measured by its<br />

beta value. You can estimate the beta value of a stock by<br />

developing a simple linear regression model, using the percentage<br />

weekly change in the stock as the dependent variable<br />

and the percentage weekly change in a market index as<br />

the independent variable. The S&P 500 Index is a common<br />

index to use. For example, if you wanted to estimate the<br />

beta for IBM, you could use the following model, which is<br />

sometimes referred to as a market model:<br />

(% weekly change in IBM) = β 0<br />

+ β 1<br />

(% weekly change in<br />

S & P 500 index) + ε<br />

The least-squares regression estimate of the slope b 1<br />

is the<br />

estimate of the beta value for IBM. A stock with a beta<br />

value of 1.0 tends to move the same as the overall market.<br />

A stock with a beta value of 1.5 tends to move 50% more<br />

than the overall market, and a stock with a beta value of 0.6