sparse grid method in the libor market model. option valuation and the

sparse grid method in the libor market model. option valuation and the

sparse grid method in the libor market model. option valuation and the

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

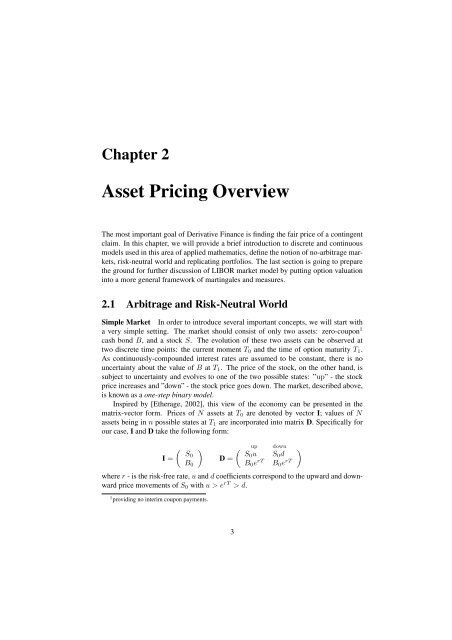

Chapter 2<br />

Asset Pric<strong>in</strong>g Overview<br />

The most important goal of Derivative F<strong>in</strong>ance is f<strong>in</strong>d<strong>in</strong>g <strong>the</strong> fair price of a cont<strong>in</strong>gent<br />

claim. In this chapter, we will provide a brief <strong>in</strong>troduction to discrete <strong>and</strong> cont<strong>in</strong>uous<br />

<strong>model</strong>s used <strong>in</strong> this area of applied ma<strong>the</strong>matics, def<strong>in</strong>e <strong>the</strong> notion of no-arbitrage <strong>market</strong>s,<br />

risk-neutral world <strong>and</strong> replicat<strong>in</strong>g portfolios. The last section is go<strong>in</strong>g to prepare<br />

<strong>the</strong> ground for fur<strong>the</strong>r discussion of LIBOR <strong>market</strong> <strong>model</strong> by putt<strong>in</strong>g <strong>option</strong> <strong>valuation</strong><br />

<strong>in</strong>to a more general framework of mart<strong>in</strong>gales <strong>and</strong> measures.<br />

2.1 Arbitrage <strong>and</strong> Risk-Neutral World<br />

Simple Market In order to <strong>in</strong>troduce several important concepts, we will start with<br />

a very simple sett<strong>in</strong>g. The <strong>market</strong> should consist of only two assets: zero-coupon 1<br />

cash bond B, <strong>and</strong> a stock S. The evolution of <strong>the</strong>se two assets can be observed at<br />

two discrete time po<strong>in</strong>ts: <strong>the</strong> current moment T 0 <strong>and</strong> <strong>the</strong> time of <strong>option</strong> maturity T 1 .<br />

As cont<strong>in</strong>uously-compounded <strong>in</strong>terest rates are assumed to be constant, <strong>the</strong>re is no<br />

uncerta<strong>in</strong>ty about <strong>the</strong> value of B at T 1 . The price of <strong>the</strong> stock, on <strong>the</strong> o<strong>the</strong>r h<strong>and</strong>, is<br />

subject to uncerta<strong>in</strong>ty <strong>and</strong> evolves to one of <strong>the</strong> two possible states: ”up” - <strong>the</strong> stock<br />

price <strong>in</strong>creases <strong>and</strong> ”down” - <strong>the</strong> stock price goes down. The <strong>market</strong>, described above,<br />

is known as a one-step b<strong>in</strong>ary <strong>model</strong>.<br />

Inspired by [E<strong>the</strong>rage, 2002], this view of <strong>the</strong> economy can be presented <strong>in</strong> <strong>the</strong><br />

matrix-vector form. Prices of N assets at T 0 are denoted by vector I; values of N<br />

assets be<strong>in</strong>g <strong>in</strong> n possible states at T 1 are <strong>in</strong>corporated <strong>in</strong>to matrix D. Specifically for<br />

our case, I <strong>and</strong> D take <strong>the</strong> follow<strong>in</strong>g form:<br />

I =<br />

(<br />

S0<br />

B 0<br />

)<br />

(<br />

up down<br />

)<br />

S0 u S<br />

D =<br />

0 d<br />

B 0 e rT B 0 e rT<br />

where r - is <strong>the</strong> risk-free rate, u <strong>and</strong> d coefficients correspond to <strong>the</strong> upward <strong>and</strong> downward<br />

price movements of S 0 with u > e rT > d.<br />

1 provid<strong>in</strong>g no <strong>in</strong>terim coupon payments.<br />

3