sparse grid method in the libor market model. option valuation and the

sparse grid method in the libor market model. option valuation and the

sparse grid method in the libor market model. option valuation and the

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>grid</strong>s with <strong>the</strong> largest multi-<strong>in</strong>dex value.<br />

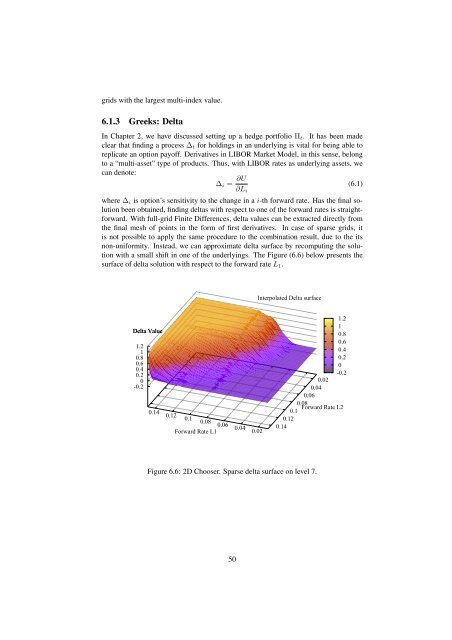

6.1.3 Greeks: Delta<br />

In Chapter 2, we have discussed sett<strong>in</strong>g up a hedge portfolio Π t . It has been made<br />

clear that f<strong>in</strong>d<strong>in</strong>g a process ∆ t for hold<strong>in</strong>gs <strong>in</strong> an underly<strong>in</strong>g is vital for be<strong>in</strong>g able to<br />

replicate an <strong>option</strong> payoff. Derivatives <strong>in</strong> LIBOR Market Model, <strong>in</strong> this sense, belong<br />

to a “multi-asset” type of products. Thus, with LIBOR rates as underly<strong>in</strong>g assets, we<br />

can denote:<br />

∆ i = ∂U<br />

∂L i<br />

(6.1)<br />

where ∆ i is <strong>option</strong>’s sensitivity to <strong>the</strong> change <strong>in</strong> a i-th forward rate. Has <strong>the</strong> f<strong>in</strong>al solution<br />

been obta<strong>in</strong>ed, f<strong>in</strong>d<strong>in</strong>g deltas with respect to one of <strong>the</strong> forward rates is straightforward.<br />

With full-<strong>grid</strong> F<strong>in</strong>ite Differences, delta values can be extracted directly from<br />

<strong>the</strong> f<strong>in</strong>al mesh of po<strong>in</strong>ts <strong>in</strong> <strong>the</strong> form of first derivatives. In case of <strong>sparse</strong> <strong>grid</strong>s, it<br />

is not possible to apply <strong>the</strong> same procedure to <strong>the</strong> comb<strong>in</strong>ation result, due to <strong>the</strong> its<br />

non-uniformity. Instead, we can approximate delta surface by recomput<strong>in</strong>g <strong>the</strong> solution<br />

with a small shift <strong>in</strong> one of <strong>the</strong> underly<strong>in</strong>gs. The Figure (6.6) below presents <strong>the</strong><br />

surface of delta solution with respect to <strong>the</strong> forward rate L 1 .<br />

Interpolated Delta surface<br />

Delta Value<br />

1.2<br />

0.8 1<br />

0.6<br />

0.4<br />

0.2<br />

-0.2 0<br />

0.14<br />

0.12<br />

0.1<br />

0.08<br />

0.06<br />

Forward Rate L1<br />

0.04<br />

0.02<br />

0.02<br />

0.04<br />

0.06<br />

0.08<br />

0.1<br />

0.12<br />

0.14<br />

1.2<br />

1<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

0<br />

-0.2<br />

Forward Rate L2<br />

Figure 6.6: 2D Chooser. Sparse delta surface on level 7.<br />

50