sparse grid method in the libor market model. option valuation and the

sparse grid method in the libor market model. option valuation and the

sparse grid method in the libor market model. option valuation and the

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

S 0 u<br />

d<br />

u S 0<br />

S u 2<br />

0<br />

Su<br />

3<br />

0<br />

S du 2<br />

0<br />

4<br />

S0u<br />

S<br />

du 3<br />

0<br />

S0<br />

S0<br />

ud S 0<br />

2<br />

S0ud<br />

S u d<br />

2<br />

0<br />

2<br />

T 0<br />

T<br />

1<br />

S 0<br />

d S 0<br />

2<br />

S0d<br />

S ud 3<br />

0<br />

T<br />

0<br />

T<br />

1<br />

T<br />

2<br />

3<br />

S0d<br />

T3<br />

T4<br />

S d 4<br />

0<br />

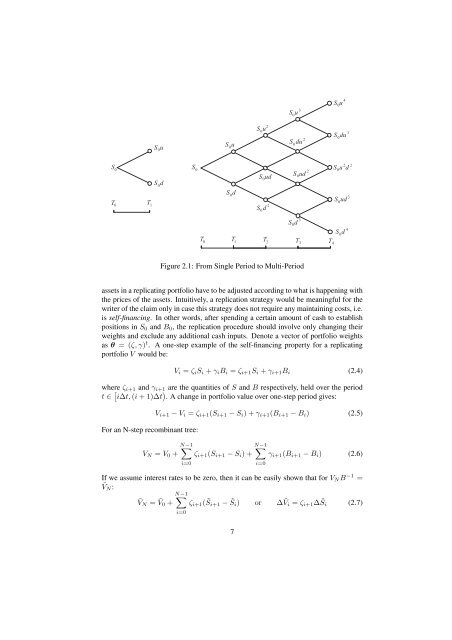

Figure 2.1: From S<strong>in</strong>gle Period to Multi-Period<br />

assets <strong>in</strong> a replicat<strong>in</strong>g portfolio have to be adjusted accord<strong>in</strong>g to what is happen<strong>in</strong>g with<br />

<strong>the</strong> prices of <strong>the</strong> assets. Intuitively, a replication strategy would be mean<strong>in</strong>gful for <strong>the</strong><br />

writer of <strong>the</strong> claim only <strong>in</strong> case this strategy does not require any ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g costs, i.e.<br />

is self-f<strong>in</strong>anc<strong>in</strong>g. In o<strong>the</strong>r words, after spend<strong>in</strong>g a certa<strong>in</strong> amount of cash to establish<br />

positions <strong>in</strong> S 0 <strong>and</strong> B 0 , <strong>the</strong> replication procedure should <strong>in</strong>volve only chang<strong>in</strong>g <strong>the</strong>ir<br />

weights <strong>and</strong> exclude any additional cash <strong>in</strong>puts. Denote a vector of portfolio weights<br />

as θ = (ζ, γ) t . A one-step example of <strong>the</strong> self-f<strong>in</strong>anc<strong>in</strong>g property for a replicat<strong>in</strong>g<br />

portfolio V would be:<br />

V i = ζ i S i + γ i B i = ζ i+1 S i + γ i+1 B i (2.4)<br />

where ζ i+1 <strong>and</strong> γ i+1 are <strong>the</strong> quantities of S <strong>and</strong> B respectively, held over <strong>the</strong> period<br />

t ∈ [ i∆t, (i + 1)∆t ) . A change <strong>in</strong> portfolio value over one-step period gives:<br />

For an N-step recomb<strong>in</strong>ant tree:<br />

V i+1 − V i = ζ i+1 (S i+1 − S i ) + γ i+1 (B i+1 − B i ) (2.5)<br />

N−1<br />

∑<br />

N−1<br />

∑<br />

V N = V 0 + ζ i+1 (S i+1 − S i ) + γ i+1 (B i+1 − B i ) (2.6)<br />

i=0<br />

If we assume <strong>in</strong>terest rates to be zero, <strong>the</strong>n it can be easily shown that for V N B −1 =<br />

Ṽ N :<br />

N−1<br />

∑<br />

Ṽ N = Ṽ0 + ζ i+1 ( ˜S i+1 − ˜S i ) or ∆Ṽi = ζ i+1 ∆ ˜S i (2.7)<br />

i=0<br />

7<br />

i=0