sparse grid method in the libor market model. option valuation and the

sparse grid method in the libor market model. option valuation and the

sparse grid method in the libor market model. option valuation and the

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

0.035<br />

0.03<br />

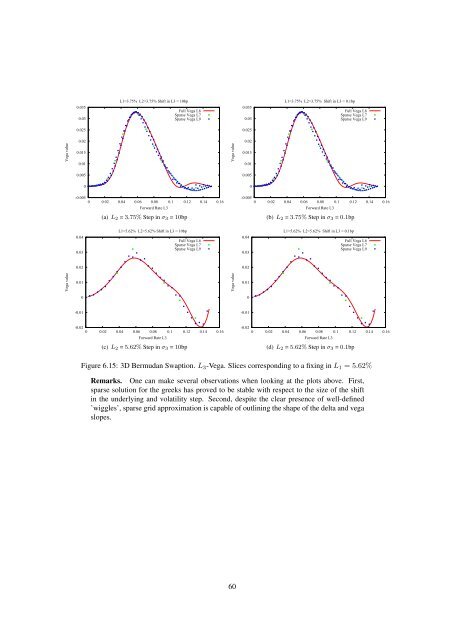

L1=3.75% L2=3.75% Shift <strong>in</strong> L3 = 10bp<br />

Full Vega L6<br />

Sparse Vega L7<br />

Sparse Vega L9<br />

0.035<br />

0.03<br />

L1=3.75% L2=3.75% Shift <strong>in</strong> L3 = 0.1bp<br />

Full Vega L6<br />

Sparse Vega L7<br />

Sparse Vega L9<br />

0.025<br />

0.025<br />

Vega value<br />

0.02<br />

0.015<br />

0.01<br />

Vega value<br />

0.02<br />

0.015<br />

0.01<br />

0.005<br />

0.005<br />

0<br />

0<br />

-0.005<br />

0 0.02 0.04 0.06 0.08 0.1 0.12 0.14 0.16<br />

Forward Rate L3<br />

-0.005<br />

0 0.02 0.04 0.06 0.08 0.1 0.12 0.14 0.16<br />

Forward Rate L3<br />

(a) L 2 = 3.75% Step <strong>in</strong> σ 3 = 10bp<br />

(b) L 2 = 3.75% Step <strong>in</strong> σ 3 = 0.1bp<br />

0.04<br />

0.03<br />

L1=5.62% L2=5.62% Shift <strong>in</strong> L3 = 10bp<br />

Full Vega L6<br />

Sparse Vega L7<br />

Sparse Vega L9<br />

0.04<br />

0.03<br />

L1=5.62% L2=5.62% Shift <strong>in</strong> L3 = 0.1bp<br />

Full Vega L6<br />

Sparse Vega L7<br />

Sparse Vega L9<br />

0.02<br />

0.02<br />

Vega value<br />

0.01<br />

Vega value<br />

0.01<br />

0<br />

0<br />

-0.01<br />

-0.01<br />

-0.02<br />

0 0.02 0.04 0.06 0.08 0.1 0.12 0.14 0.16<br />

Forward Rate L3<br />

-0.02<br />

0 0.02 0.04 0.06 0.08 0.1 0.12 0.14 0.16<br />

Forward Rate L3<br />

(c) L 2 = 5.62% Step <strong>in</strong> σ 3 = 10bp<br />

(d) L 2 = 5.62% Step <strong>in</strong> σ 3 = 0.1bp<br />

Figure 6.15: 3D Bermudan Swaption. L 3 -Vega. Slices correspond<strong>in</strong>g to a fix<strong>in</strong>g <strong>in</strong> L 1 = 5.62%<br />

Remarks. One can make several observations when look<strong>in</strong>g at <strong>the</strong> plots above. First,<br />

<strong>sparse</strong> solution for <strong>the</strong> greeks has proved to be stable with respect to <strong>the</strong> size of <strong>the</strong> shift<br />

<strong>in</strong> <strong>the</strong> underly<strong>in</strong>g <strong>and</strong> volatility step. Second, despite <strong>the</strong> clear presence of well-def<strong>in</strong>ed<br />

’wiggles’, <strong>sparse</strong> <strong>grid</strong> approximation is capable of outl<strong>in</strong><strong>in</strong>g <strong>the</strong> shape of <strong>the</strong> delta <strong>and</strong> vega<br />

slopes.<br />

60