sparse grid method in the libor market model. option valuation and the

sparse grid method in the libor market model. option valuation and the

sparse grid method in the libor market model. option valuation and the

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

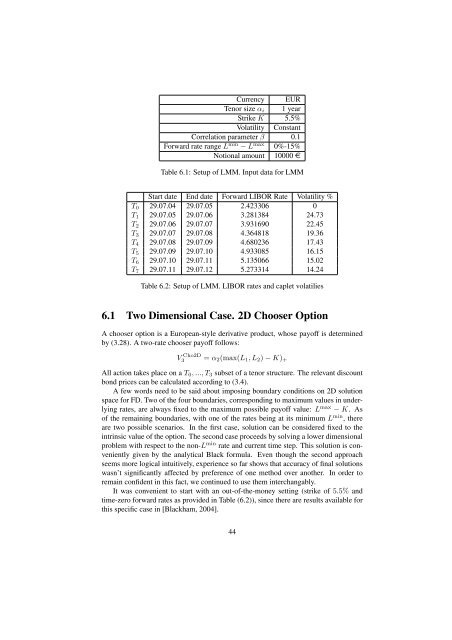

Currency EUR<br />

Tenor size α i 1 year<br />

Strike K 5.5%<br />

Volatility Constant<br />

Correlation parameter β 0.1<br />

Forward rate range L m<strong>in</strong> − L max 0%-15%<br />

Notional amount 10000 e<br />

Table 6.1: Setup of LMM. Input data for LMM<br />

Start date End date Forward LIBOR Rate Volatility %<br />

T 0 29.07.04 29.07.05 2.423306 0<br />

T 1 29.07.05 29.07.06 3.281384 24.73<br />

T 2 29.07.06 29.07.07 3.931690 22.45<br />

T 3 29.07.07 29.07.08 4.364818 19.36<br />

T 4 29.07.08 29.07.09 4.680236 17.43<br />

T 5 29.07.09 29.07.10 4.933085 16.15<br />

T 6 29.07.10 29.07.11 5.135066 15.02<br />

T 7 29.07.11 29.07.12 5.273314 14.24<br />

Table 6.2: Setup of LMM. LIBOR rates <strong>and</strong> caplet volatilies<br />

6.1 Two Dimensional Case. 2D Chooser Option<br />

A chooser <strong>option</strong> is a European-style derivative product, whose payoff is determ<strong>in</strong>ed<br />

by (3.28). A two-rate chooser payoff follows:<br />

V Cho2D<br />

3 = α 2 (max(L 1 , L 2 ) − K) +<br />

All action takes place on a T 0 , ..., T 3 subset of a tenor structure. The relevant discount<br />

bond prices can be calculated accord<strong>in</strong>g to (3.4).<br />

A few words need to be said about impos<strong>in</strong>g boundary conditions on 2D solution<br />

space for FD. Two of <strong>the</strong> four boundaries, correspond<strong>in</strong>g to maximum values <strong>in</strong> underly<strong>in</strong>g<br />

rates, are always fixed to <strong>the</strong> maximum possible payoff value: L max − K. As<br />

of <strong>the</strong> rema<strong>in</strong><strong>in</strong>g boundaries, with one of <strong>the</strong> rates be<strong>in</strong>g at its m<strong>in</strong>imum L m<strong>in</strong> , <strong>the</strong>re<br />

are two possible scenarios. In <strong>the</strong> first case, solution can be considered fixed to <strong>the</strong><br />

<strong>in</strong>tr<strong>in</strong>sic value of <strong>the</strong> <strong>option</strong>. The second case proceeds by solv<strong>in</strong>g a lower dimensional<br />

problem with respect to <strong>the</strong> non-L m<strong>in</strong> rate <strong>and</strong> current time step. This solution is conveniently<br />

given by <strong>the</strong> analytical Black formula. Even though <strong>the</strong> second approach<br />

seems more logical <strong>in</strong>tuitively, experience so far shows that accuracy of f<strong>in</strong>al solutions<br />

wasn’t significantly affected by preference of one <strong>method</strong> over ano<strong>the</strong>r. In order to<br />

rema<strong>in</strong> confident <strong>in</strong> this fact, we cont<strong>in</strong>ued to use <strong>the</strong>m <strong>in</strong>terchangably.<br />

It was convenient to start with an out-of-<strong>the</strong>-money sett<strong>in</strong>g (strike of 5.5% <strong>and</strong><br />

time-zero forward rates as provided <strong>in</strong> Table (6.2)), s<strong>in</strong>ce <strong>the</strong>re are results available for<br />

this specific case <strong>in</strong> [Blackham, 2004].<br />

44