module 6 Submanifests - Cargo Support

module 6 Submanifests - Cargo Support

module 6 Submanifests - Cargo Support

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SUBMANIFESTS<br />

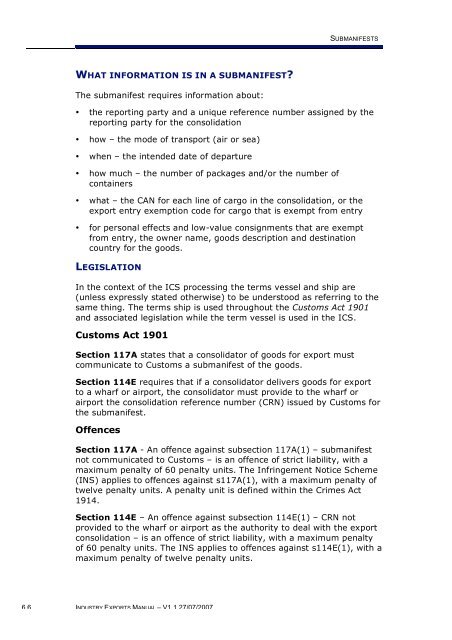

WHAT INFORMATION IS IN A SUBMANIFEST?<br />

The submanifest requires information about:<br />

• the reporting party and a unique reference number assigned by the<br />

reporting party for the consolidation<br />

• how – the mode of transport (air or sea)<br />

• when – the intended date of departure<br />

• how much – the number of packages and/or the number of<br />

containers<br />

• what – the CAN for each line of cargo in the consolidation, or the<br />

export entry exemption code for cargo that is exempt from entry<br />

• for personal effects and low-value consignments that are exempt<br />

from entry, the owner name, goods description and destination<br />

country for the goods.<br />

LEGISLATION<br />

In the context of the ICS processing the terms vessel and ship are<br />

(unless expressly stated otherwise) to be understood as referring to the<br />

same thing. The terms ship is used throughout the Customs Act 1901<br />

and associated legislation while the term vessel is used in the ICS.<br />

Customs Act 1901<br />

Section 117A states that a consolidator of goods for export must<br />

communicate to Customs a submanifest of the goods.<br />

Section 114E requires that if a consolidator delivers goods for export<br />

to a wharf or airport, the consolidator must provide to the wharf or<br />

airport the consolidation reference number (CRN) issued by Customs for<br />

the submanifest.<br />

Offences<br />

Section 117A - An offence against subsection 117A(1) – submanifest<br />

not communicated to Customs – is an offence of strict liability, with a<br />

maximum penalty of 60 penalty units. The Infringement Notice Scheme<br />

(INS) applies to offences against s117A(1), with a maximum penalty of<br />

twelve penalty units. A penalty unit is defined within the Crimes Act<br />

1914.<br />

Section 114E – An offence against subsection 114E(1) – CRN not<br />

provided to the wharf or airport as the authority to deal with the export<br />

consolidation – is an offence of strict liability, with a maximum penalty<br />

of 60 penalty units. The INS applies to offences against s114E(1), with a<br />

maximum penalty of twelve penalty units.<br />

6.6 INDUSTRY EXPORTS MANUAL – V1.1 27/07/2007