Tally.ERP 9 Series A Release 3.6 Stat.900 Version 174 Release Notes

Tally.ERP 9 Series A Release 3.6 Stat.900 Version 174 Release Notes

Tally.ERP 9 Series A Release 3.6 Stat.900 Version 174 Release Notes

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

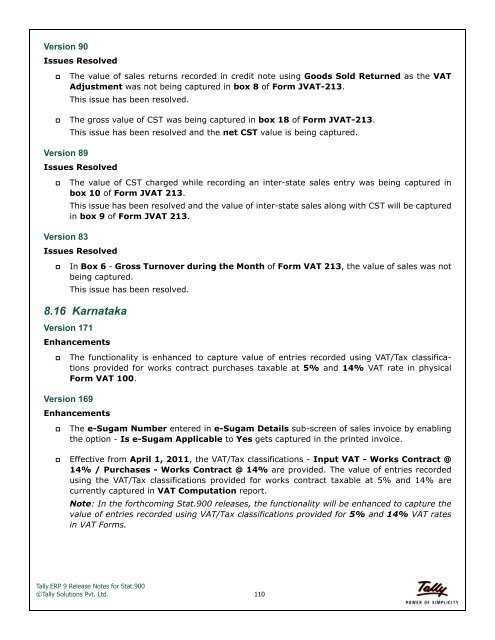

<strong>Version</strong> 90<br />

Issues Resolved<br />

<br />

The value of sales returns recorded in credit note using Goods Sold Returned as the VAT<br />

Adjustment was not being captured in box 8 of Form JVAT-213.<br />

This issue has been resolved.<br />

<br />

The gross value of CST was being captured in box 18 of Form JVAT-213.<br />

This issue has been resolved and the net CST value is being captured.<br />

<strong>Version</strong> 89<br />

Issues Resolved<br />

<br />

<strong>Version</strong> 83<br />

The value of CST charged while recording an inter-state sales entry was being captured in<br />

box 10 of Form JVAT 213.<br />

This issue has been resolved and the value of inter-state sales along with CST will be captured<br />

in box 9 of Form JVAT 213.<br />

Issues Resolved<br />

<br />

In Box 6 - Gross Turnover during the Month of Form VAT 213, the value of sales was not<br />

being captured.<br />

This issue has been resolved.<br />

8.16 Karnataka<br />

<strong>Version</strong> 171<br />

Enhancements<br />

<br />

The functionality is enhanced to capture value of entries recorded using VAT/Tax classifications<br />

provided for works contract purchases taxable at 5% and 14% VAT rate in physical<br />

Form VAT 100.<br />

<strong>Version</strong> 169<br />

Enhancements<br />

<br />

The e-Sugam Number entered in e-Sugam Details sub-screen of sales invoice by enabling<br />

the option - Is e-Sugam Applicable to Yes gets captured in the printed invoice.<br />

<br />

Effective from April 1, 2011, the VAT/Tax classifications - Input VAT - Works Contract @<br />

14% / Purchases - Works Contract @ 14% are provided. The value of entries recorded<br />

using the VAT/Tax classifications provided for works contract taxable at 5% and 14% are<br />

currently captured in VAT Computation report.<br />

Note: In the forthcoming <strong>Stat.900</strong> releases, the functionality will be enhanced to capture the<br />

value of entries recorded using VAT/Tax classifications provided for 5% and 14% VAT rates<br />

in VAT Forms.<br />

<strong>Tally</strong>.<strong>ERP</strong> 9 <strong>Release</strong> <strong>Notes</strong> for <strong>Stat.900</strong><br />

©<strong>Tally</strong> Solutions Pvt. Ltd. 110