Tally.ERP 9 Series A Release 3.6 Stat.900 Version 174 Release Notes

Tally.ERP 9 Series A Release 3.6 Stat.900 Version 174 Release Notes

Tally.ERP 9 Series A Release 3.6 Stat.900 Version 174 Release Notes

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

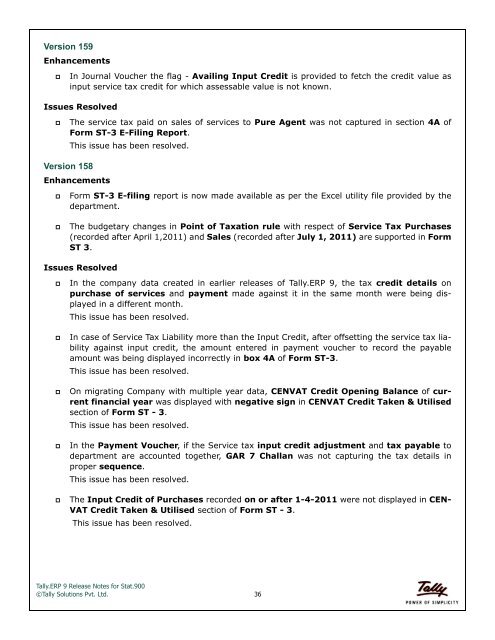

<strong>Version</strong> 159<br />

Enhancements<br />

<br />

In Journal Voucher the flag - Availing Input Credit is provided to fetch the credit value as<br />

input service tax credit for which assessable value is not known.<br />

Issues Resolved<br />

<br />

The service tax paid on sales of services to Pure Agent was not captured in section 4A of<br />

Form ST-3 E-Filing Report.<br />

This issue has been resolved.<br />

<strong>Version</strong> 158<br />

Enhancements<br />

<br />

Form ST-3 E-filing report is now made available as per the Excel utility file provided by the<br />

department.<br />

<br />

The budgetary changes in Point of Taxation rule with respect of Service Tax Purchases<br />

(recorded after April 1,2011) and Sales (recorded after July 1, 2011) are supported in Form<br />

ST 3.<br />

Issues Resolved<br />

<br />

<br />

<br />

<br />

<br />

In the company data created in earlier releases of <strong>Tally</strong>.<strong>ERP</strong> 9, the tax credit details on<br />

purchase of services and payment made against it in the same month were being displayed<br />

in a different month.<br />

This issue has been resolved.<br />

In case of Service Tax Liability more than the Input Credit, after offsetting the service tax liability<br />

against input credit, the amount entered in payment voucher to record the payable<br />

amount was being displayed incorrectly in box 4A of Form ST-3.<br />

This issue has been resolved.<br />

On migrating Company with multiple year data, CENVAT Credit Opening Balance of current<br />

financial year was displayed with negative sign in CENVAT Credit Taken & Utilised<br />

section of Form ST - 3.<br />

This issue has been resolved.<br />

In the Payment Voucher, if the Service tax input credit adjustment and tax payable to<br />

department are accounted together, GAR 7 Challan was not capturing the tax details in<br />

proper sequence.<br />

This issue has been resolved.<br />

The Input Credit of Purchases recorded on or after 1-4-2011 were not displayed in CEN-<br />

VAT Credit Taken & Utilised section of Form ST - 3.<br />

This issue has been resolved.<br />

<strong>Tally</strong>.<strong>ERP</strong> 9 <strong>Release</strong> <strong>Notes</strong> for <strong>Stat.900</strong><br />

©<strong>Tally</strong> Solutions Pvt. Ltd. 36