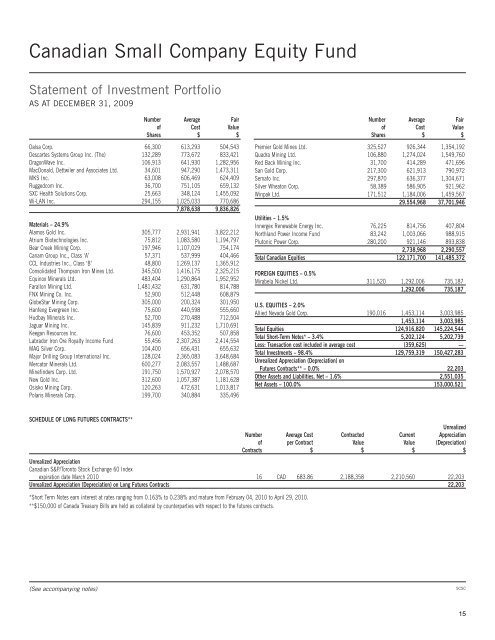

Canadian Small Company Equity Fund Statement of Investment Portfolio AS AT DECEMBER 31, 2009 Number Average Fair of Cost Value Shares $ $ CANADIAN EQUITIES – 92.5% Consumer Discretionary – 8.2% BMTC Group Inc., Class ‘A’ 81,656 1,424,070 2,417,018 Coastal Contacts Inc. 451,416 500,287 636,497 COGECO Inc. 31,372 982,662 899,749 Dorel Industries Inc., Class ‘B’ 21,500 646,939 692,085 Easyhome Ltd. 44,322 671,909 375,407 Fluid Music Canada Inc. 219,000 412,924 367,920 Glacier Media Inc. 532,528 1,510,311 1,065,056 Le Chateau Inc. 76,632 990,325 1,046,027 Leon’s Furniture Ltd. 54,500 522,751 572,250 Linamar Corp. 82,900 926,096 1,139,875 Quebecor Inc., Class ‘B’ 56,800 1,021,051 1,539,848 Uni-Select Inc. 59,800 1,433,045 1,824,498 11,042,370 12,576,230 Consumer Staples – 3.1% Canada Bread Co. Ltd. 26,398 1,309,393 1,366,096 Cineplex Galaxy Income Fund 46,942 747,786 855,283 Lassonde Industries Inc., Class ‘A’ 10,322 395,295 529,209 North West Co. Fund (The) 80,609 1,324,169 1,530,765 Viterra Inc. 43,300 460,501 426,938 4,237,144 4,708,291 Energy – 22.4% AltaGas Income Trust 47,000 929,371 882,190 Antrim Energy Inc. 224,857 502,268 283,320 Birchcliff Energy Ltd. 53,235 344,757 500,409 Cathedral Energy Services Ltd. 141,000 591,832 705,000 Celtic Exploration Ltd. 99,433 1,302,630 2,067,212 Crew Energy Inc. 377,615 3,856,894 5,509,403 Daylight Resources Trust 201,374 1,780,149 2,047,974 Ensign Energy Services Inc. 65,800 754,161 987,000 Fairborne Energy Ltd. 192,500 1,245,223 912,450 Galleon Energy Inc., Class ‘A’ 168,850 1,759,489 886,462 Legacy Oil + Gas Inc., Class ‘A’ 138,617 1,324,987 1,332,109 OPTI Canada Inc. 351,100 750,378 705,711 Paramount Resources Ltd., Class ‘A’ 51,600 636,135 753,360 Parex Resources Inc. 116,025 368,990 471,062 Pason Systems Inc. 63,100 758,145 733,222 Petro Rubiales Energy Corp. 129,695 804,953 1,997,303 PetroBakken Energy Ltd. 63,153 2,197,692 2,040,473 Petrominerales Ltd. 50,400 777,421 945,000 Phoenix Technology Income Fund 156,131 1,217,933 1,280,274 Progress Energy Resources Corp. 177,629 2,243,492 2,504,569 Provident Energy Trust 131,481 761,128 926,941 Rock Energy Inc. 253,540 867,380 816,399 ShawCor Ltd., Class ‘A’ 18,100 306,710 529,968 Storm Exploration Inc. 92,600 1,326,410 1,204,726 TransGlobe Energy Corp. 476,237 1,957,001 1,647,780 Trinidad Drilling Ltd. 144,687 1,162,555 1,014,256 Uranium One Inc. 201,800 504,178 605,400 31,032,262 34,289,973 Number Average Fair of Cost Value Shares $ $ Financial Services – 12.3% Artis REIT 116,338 1,258,613 1,297,169 Canadian Western Bank 61,449 1,021,179 1,345,733 Equitable Group Inc. 42,400 793,707 894,640 First National Financial Income Fund 67,185 848,559 1,266,437 Genworth MI Canada Inc. 35,800 682,847 964,810 GMP Capital Inc. 108,629 1,393,909 1,364,380 Home Capital Group Inc. 58,050 1,719,156 2,420,104 Industrial Alliance Insurance and Financial Services Inc. 69,700 1,705,711 2,238,764 Intact Financial Corp. 61,500 1,980,083 2,268,120 Killam Properties Inc. 60,800 434,437 528,960 Morguard Corp. 31,598 911,711 1,027,251 Morguard REIT 85,399 1,123,184 1,115,311 Morneau Sobeco Income Fund 89,900 805,382 881,919 Sceptre Investment Counsel Ltd. 125,100 718,398 700,560 Western Financial Group Inc. 187,135 744,764 471,580 16,141,640 18,785,738 Health Care – 0.8% CML Healthcare Income Fund 42,906 584,223 592,532 IMRIS Inc. 95,200 528,602 495,040 Response Biomedical Corp. 919,000 256,337 110,280 Response Biomedical Corp., Warrants, 2011/05/21 357,200 — 12,073 Response Biomedical Corp., Warrants, 2011/10/28 65,200 — 1,297 1,369,162 1,211,222 Industrials – 12.9% Aecon Group Inc. 98,132 1,337,820 1,469,036 AG Growth International Inc. 29,588 826,368 1,029,662 Bird Construction Income Fund 30,000 968,591 1,030,200 CanWel Building Materials Income Fund 99,080 389,446 408,210 CanWel Building Materials Income Fund, Subscription Receipts 60,840 231,192 231,192 Cervus Equipment Corp. 68,050 717,320 850,625 Churchill Corp. (The), Class ‘A’ 64,575 1,055,986 1,237,257 Davis + Henderson Income Fund 94,726 1,321,522 1,598,975 FirstService Corp. 27,500 477,307 552,750 Flint Energy Services Ltd. 74,401 1,626,539 715,738 Genivar Income Fund 46,676 1,098,666 1,262,586 GLV Inc., Class ‘A’ 75,498 537,484 660,608 Richelieu Hardware Ltd. 70,732 1,424,038 1,591,470 Stantec Inc. 31,301 675,681 945,290 Toromont Industries Ltd. 39,700 894,495 1,101,278 Transat A.T. Inc., Class ‘B’ 95,675 2,206,145 2,008,218 Vicwest Income Fund 41,272 481,815 775,088 WestJet Airlines Ltd. 77,300 879,865 953,882 WFI Industries Ltd. 65,197 1,026,268 1,662,524 18,176,548 20,084,589 Information Technology – 6.4% Absolute Software Corp. 158,600 875,332 832,650 AXIA NetMedia Corp. 307,000 473,601 472,780 COM DEV International Ltd. 271,300 822,789 927,846 SCSC (See accompanying notes) 14

Canadian Small Company Equity Fund Statement of Investment Portfolio AS AT DECEMBER 31, 2009 Number Average Fair of Cost Value Shares $ $ Dalsa Corp. 66,300 613,293 504,543 Descartes Systems Group Inc. (The) 132,289 773,672 833,421 DragonWave Inc. 106,913 641,930 1,282,956 MacDonald, Dettwiler and Associates Ltd. 34,601 947,290 1,473,311 MKS Inc. 63,008 606,469 624,409 Ruggedcom Inc. 36,700 751,105 659,132 SXC Health Solutions Corp. 25,663 348,124 1,455,092 Wi-LAN Inc. 294,155 1,025,033 770,686 7,878,638 9,836,826 Materials – 24.9% Alamos Gold Inc. 305,777 2,931,941 3,822,212 Atrium Biotechnologies Inc. 75,812 1,083,580 1,194,797 Bear Creek Mining Corp. 197,946 1,107,029 754,174 Canam Group Inc., Class ‘A’ 57,371 537,999 404,466 CCL Industries Inc., Class ‘B’ 48,800 1,269,137 1,365,912 Consolidated Thompson Iron Mines Ltd. 345,500 1,416,175 2,325,215 Equinox Minerals Ltd. 483,404 1,290,864 1,952,952 Farallon Mining Ltd. 1,481,432 631,780 814,788 FNX Mining Co. Inc. 52,900 512,448 608,879 GlobeStar Mining Corp. 305,000 200,324 301,950 Hanfeng Evergreen Inc. 75,600 440,598 555,660 Hudbay Minerals Inc. 52,700 270,488 712,504 Jaguar Mining Inc. 145,839 911,232 1,710,691 Keegan Resources Inc. 76,600 453,352 507,858 Labrador Iron Ore Royalty Income Fund 55,456 2,307,263 2,414,554 MAG Silver Corp. 104,400 656,431 655,632 Major Drilling Group International Inc. 128,024 2,365,083 3,648,684 Mercator Minerals Ltd. 600,277 2,083,557 1,488,687 Minefinders Corp. Ltd. 191,750 1,570,927 2,078,570 New Gold Inc. 312,600 1,057,387 1,181,628 Osisko Mining Corp. 120,263 472,631 1,013,817 Polaris Minerals Corp. 199,700 340,884 335,496 Number Average Fair of Cost Value Shares $ $ Premier Gold Mines Ltd. 325,527 926,344 1,354,192 Quadra Mining Ltd. 106,880 1,274,024 1,549,760 Red Back Mining Inc. 31,700 414,289 471,696 San Gold Corp. 217,300 621,913 790,972 Semafo Inc. 297,870 636,377 1,304,671 Silver Wheaton Corp. 58,389 586,905 921,962 Winpak Ltd. 171,512 1,184,006 1,459,567 29,554,968 37,701,946 Utilities – 1.5% Innergex Renewable Energy Inc. 76,225 814,756 407,804 Northland Power Income Fund 83,242 1,003,066 988,915 Plutonic Power Corp. 280,200 921,146 893,838 2,738,968 2,290,557 Total Canadian Equities 122,171,700 141,485,372 FOREIGN EQUITIES – 0.5% Mirabela Nickel Ltd. 311,520 1,292,006 735,187 1,292,006 735,187 U.S. EQUITIES – 2.0% Allied Nevada Gold Corp. 190,016 1,453,114 3,003,985 1,453,114 3,003,985 Total Equities 124,916,820 145,224,544 Total Short-Term Notes* – 3.4% 5,202,124 5,202,739 Less: Transaction cost included in average cost (359,625) — Total Investments – 98.4% 129,759,319 150,427,283 Unrealized Appreciation (Depreciation) on Futures Contracts** – 0.0% 22,203 Other Assets and Liabilities, Net – 1.6% 2,551,035 Net Assets – 100.0% 153,000,521 SCHEDULE OF LONG FUTURES CONTRACTS** Unrealized Number Average Cost Contracted Current Appreciation of per Contract Value Value (Depreciation) Contracts $ $ $ $ Unrealized Appreciation Canadian S&P/Toronto Stock Exchange 60 Index expiration date March 2010 16 CAD 683.86 2,188,358 2,210,560 22,203 Unrealized Appreciation (Depreciation) on Long Futures Contracts 22,203 *Short Term Notes earn interest at rates ranging from 0.163% to 0.238% and mature from February 04, 2010 to April 29, 2010. **$150,000 of Canada Treasury Bills are held as collateral by counterparties with respect to the futures contracts. (See accompanying notes) SCSC 15