Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Group results<br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

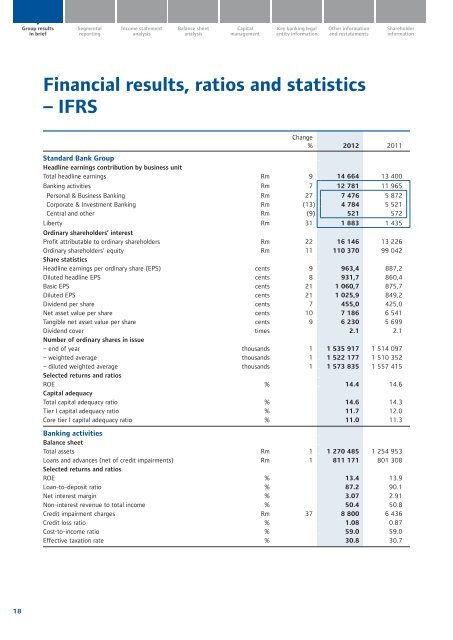

Financial results, ratios and statistics<br />

– IFRS<br />

Change<br />

% 2012 2011<br />

<strong>Standard</strong> <strong>Bank</strong> Group<br />

Headline earnings contribution by business unit<br />

Total headline earnings Rm 9 14 664 13 400<br />

<strong>Bank</strong>ing activities Rm 7 12 781 11 965<br />

Personal & Business <strong>Bank</strong>ing Rm 27 7 476 5 872<br />

Corporate & Investment <strong>Bank</strong>ing Rm (13) 4 784 5 521<br />

Central and other Rm (9) 521 572<br />

Liberty Rm 31 1 883 1 435<br />

Ordinary shareholders’ interest<br />

Profit attributable to ordinary shareholders Rm 22 16 146 13 226<br />

Ordinary shareholders’ equity Rm 11 110 370 99 042<br />

Share statistics<br />

Headline earnings per ordinary share (EPS) cents 9 963,4 887,2<br />

Diluted headline EPS cents 8 931,7 860,4<br />

Basic EPS cents 21 1 060,7 875,7<br />

Diluted EPS cents 21 1 025,9 849,2<br />

Dividend per share cents 7 455,0 425,0<br />

Net asset value per share cents 10 7 186 6 541<br />

Tangible net asset value per share cents 9 6 230 5 699<br />

Dividend cover times 2.1 2.1<br />

Number of ordinary shares in issue<br />

– end of year thousands 1 1 535 917 1 514 097<br />

– weighted average thousands 1 1 522 177 1 510 352<br />

– diluted weighted average thousands 1 1 573 835 1 557 415<br />

Selected returns and ratios<br />

ROE % 14.4 14.6<br />

Capital adequacy<br />

Total capital adequacy ratio % 14.6 14.3<br />

Tier I capital adequacy ratio % 11.7 12.0<br />

Core tier I capital adequacy ratio % 11.0 11.3<br />

<strong>Bank</strong>ing activities<br />

Balance sheet<br />

Total assets Rm 1 1 270 485 1 254 953<br />

Loans and advances (net of credit impairments) Rm 1 811 171 801 308<br />

Selected returns and ratios<br />

ROE % 13.4 13.9<br />

Loan-to-deposit ratio % 87.2 90.1<br />

Net interest margin % 3.07 2.91<br />

Non-interest revenue to total income % 50.4 50.8<br />

Credit impairment charges Rm 37 8 800 6 436<br />

Credit loss ratio % 1.08 0.87<br />

Cost-to-income ratio % 59.0 59.0<br />

Effective taxation rate % 30.8 30.7<br />

18